DSP Endurance SIF: A Game-Changer in Customized Investment for Sophisticated Investors 2025

In an ever-evolving investment landscape, fund houses are constantly innovating to meet the nuanced needs of experienced investors. DSP Endurance SIF, a cutting-edge initiative by DSP Mutual Fund known for its trust and long-term investment philosophy marks a significant step forward in the Indian investment ecosystem. This Specialized Investment Fund (SIF) introduces a hybrid model that merges the accessibility of mutual funds with the bespoke features of portfolio management services (PMS), offering a more tailored approach for sophisticated investors.

This article unpacks what Endurance SIF is, its strategic value, who it’s for, and how it fits into the larger framework of personalized, disciplined investing all while maintaining the investor-first ethos Nemi Wealth stands for.

What Is DSP’s Endurance SIF?

According to the official press release from DSP Mutual Fund, Endurance SIF is a distinct business vertical under DSP Asset Managers Pvt. Ltd. Built for seasoned investors seeking more than what traditional mutual funds offer, this platform is designed to deliver:

- Customized portfolio strategies

- Absolute returns orientation

- Long-term compounding

- Robust governance and transparency

Endurance as the name suggests aims to apply the first principles of investing and risk management to offer an absolute returns approach and help investors stay invested for the long term to reap the benefits of compounding.

said Kalpen Parekh, Managing Director and CEO, DSP Mutual Fund. In essence, Endurance SIF offers evolved investment products that are personalized, actively managed, and deeply rooted in risk-conscious principles.

The Philosophy Behind Endurance SIF

DSP’s new initiative is grounded in the belief that sophisticated investors require evolved, context-driven solutions not one-size-fits-all funds. The company’s long-standing experience of 28 years in capital markets is now channeled into creating a category that balances innovation with discipline.

“At DSP, we believe investing must be done with the right design, sound principles, and a long-term view. Our SIF products will be a natural extension of this philosophy, offering evolved solutions for more experienced investors.”

How Endurance SIF Bridges the Gap

One of the most noteworthy aspects of Endurance SIF is its position in the investment product spectrum between mutual funds and PMS offerings.

Traditional Mutual Funds:

- Low entry barrier

- Broad-based investment strategy

- Mass retail focus

- Limited customization

Portfolio Management Services (PMS):

- High ticket size (₹50 lakhs and above)

- High customization

- Direct ownership of securities

- Active, concentrated bets

Endurance SIF:

- Moderate entry requirements (likely lower than PMS, though yet to be fully disclosed)

- Bespoke strategies tailored to investor objectives

- Deep research and risk controls

- Regulated under mutual fund framework, ensuring transparency and investor protection

This hybrid model combines the agility of PMS with the discipline and oversight of mutual fund regulation offering the best of both worlds.

Who Should Consider Endurance SIF?

This product is not for everyone. DSP has made it clear that Endurance SIF is aimed at investors who are:

- Comfortable with market cycles and volatility

- Seeking tailored strategies beyond generic index or large-cap exposure

- Looking for absolute return objectives, not just relative outperformance

- Interested in long-term compounding over tactical moves

- Prefer investment products rooted in governance and research discipline

It is ideal for:

- HNIs (High Net-worth Individuals)

- Family offices

- Institutional or semi-institutional investors

- Professionals with sizable portfolios seeking better risk-adjusted returns

Key Features of Endurance SIF

1. Bespoke Portfolio Design

Unlike standardized mutual funds, SIFs are designed with investor-specific objectives in mind. This allows for better alignment with long-term goals and personal risk appetite.

2. Absolute Return Orientation

The fund does not benchmark itself against traditional indices. Instead, it focuses on positive returns regardless of market cycles, drawing on first principles of capital preservation and asymmetry in risk.

3. Backed by 28 Years of Investment Experience

DSP brings a legacy of risk management, equity research, and long-term investing into the new SIF structure ensuring that innovation is tempered with time-tested principles.

4. Robust Risk Management

At its core, the fund’s strategies are likely to use a blend of quantitative frameworks and discretionary inputs allowing flexibility while controlling downside.

5. Regulated Structure

Endurance SIF operates under SEBI oversight, which ensures investor protection, periodic disclosure, and portfolio transparency a clear edge over unregulated AIFs or PMS-lite models.

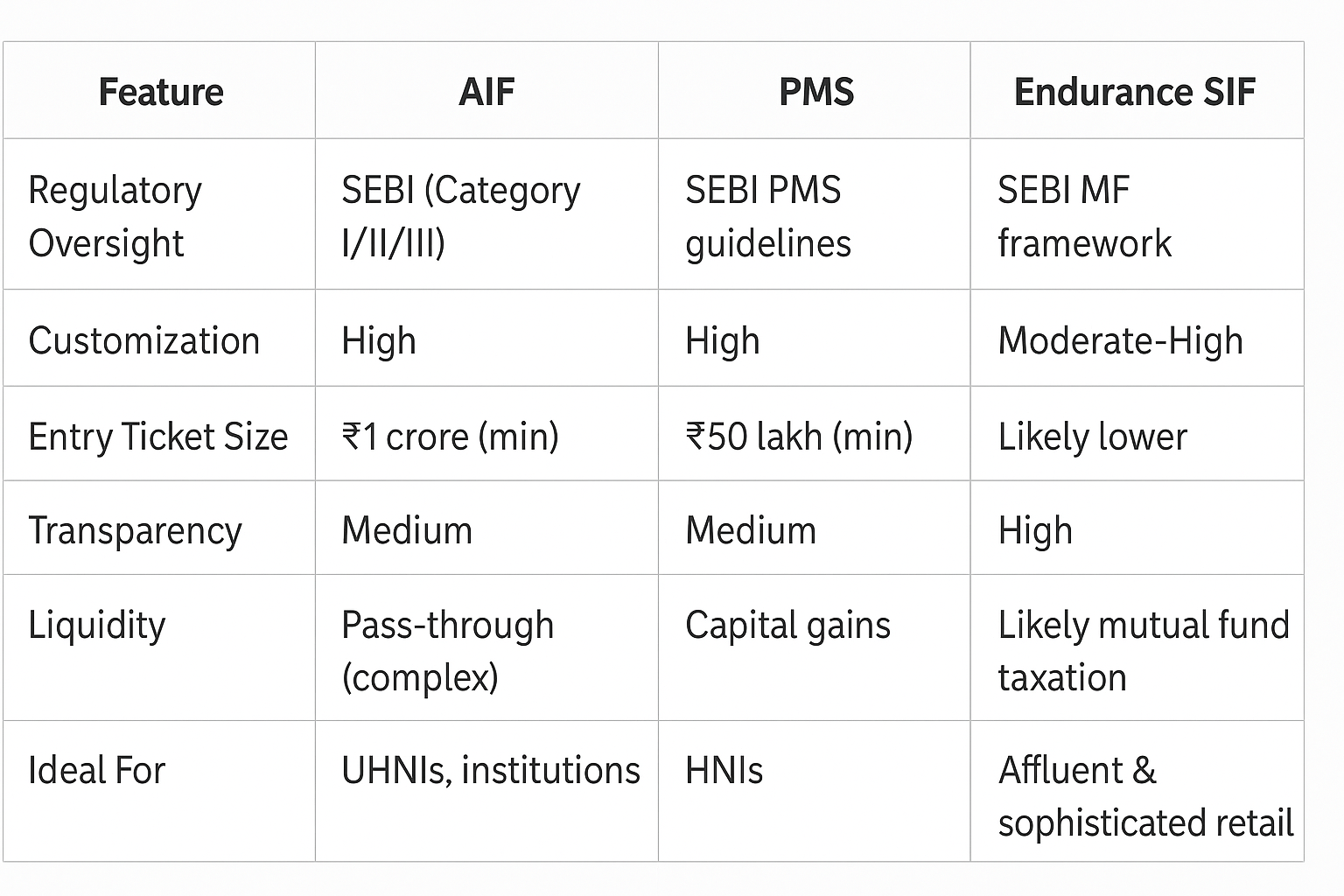

How Endurance SIF Differs from Other Alternative Funds

While the Indian market has seen an emergence of AIFs (Alternative Investment Funds) and multi-asset platforms, Endurance SIF stands apart for three main reasons:

Nemi Wealth’s View: A Smart Addition to a Diversified Portfolio

At Nemi Wealth, At Nemi Wealth, we believe that financial strategy is not about chasing trends it’s about building smart, goal-aligned solutions. Get started with us today and take the first step toward a financially secure future.

Here’s how we see Endurance SIF complementing your investment plan:

- Portfolio Core vs. Satellite: Use traditional equity and debt mutual funds for your core, and position Endurance SIF as a satellite strategy for absolute return potential.

- Diversification by Strategy, Not Just Asset Class: Endurance SIF helps you diversify your portfolio beyond asset classes by introducing a different investment philosophy and process.

- Behavioral Advantage: Products like Endurance SIF may help long-term investors stay invested by reducing volatility and promoting discipline, crucial for compounding.

We take a 360-degree view of your financial life, not just product selection. If you’re an investor looking to explore customized strategies without losing sight of governance and long-term thinking Endurance SIF could be the next chapter in your wealth journey. If you’re ready to begin your SIF journey, click here to get started.

FAQs About DSP Endurance SIF

What is DSP Endurance SIF?

DSP Endurance SIF (Specialized Investment Fund) is a new investment product by DSP Mutual Fund designed for sophisticated investors. It combines the regulatory transparency of mutual funds with the customization and strategy depth of portfolio management services (PMS).

Who should invest in DSP Endurance SIF?

DSP Endurance SIF is ideal for experienced investors looking for personalized portfolio strategies, long-term absolute returns, and better control over risk. It suits those who want more than what traditional mutual funds offer without fully moving to PMS or AIF.

How is DSP Endurance SIF different from mutual funds and PMS?

Unlike mutual funds, DSP Endurance SIF offers greater customization and strategy alignment, while maintaining a regulated, transparent structure. Compared to PMS, it has a more accessible minimum investment and combines innovation with investor protection.

What are the benefits of investing in DSP Endurance SIF?

Key benefits include tailored portfolio strategies, access to institutional-grade research, robust risk management, and the ability to stay invested for long-term compounding. It also provides transparency and governance under a SEBI-regulated framework.

Is there a lock-in period or minimum investment for DSP Endurance SIF?

While the exact terms may vary by strategy, DSP Endurance SIF typically has a lower entry barrier than PMS and AIF. Investors should consult their advisor or refer to the scheme documents for specific investment requirements and lock-in terms.