Why Jio Financial Services Might Win Big in 2025

Jio Financial Services (JFS) is making strong moves. Since its listing in August 2023, JioFin has delivered strong returns, reflecting investor confidence in its digital-first financial strategy. But this isn’t luck it’s backed by real progress across banking, broking, and mutual funds. Let’s break it down step by step.

Did You Know Where Jio Financial Services Began?

It all started back in July 1999, when the company was first incorporated as Reliance Strategic Investments Private Limited under the Companies Act, 1956. Fast forward to July 2023, it officially became Jio Financial Services (JioFin) marking a new chapter in its journey. JioFin is now a non-deposit-taking systemically important NBFC (NBFC-ND-SI) registered with the Reserve Bank of India (RBI). But that’s not all it’s more than just a financial entity.

To bring financial services directly to consumers, JFSL acts as a holding company, operating through its specialized subsidiaries:

- (JFL) Jio Finance Limited

- (JIBL) Jio Insurance Broking Limited

- (JPSL) Jio Payment Solutions Limited

Additionally, it partners through a joint venture Jio Payments Bank Limited (JPBL) to strengthen its reach in the digital banking space. In short, JioFin is not just building a brand, it’s shaping the future of consumer finance in India. where to add this in the blog

Broking License – A Key Step for Jio Financial Services

JioFin took a major step forward with SEBI’s approval for Jio BlackRock Broking Pvt Ltd. This allows JioFin to act as a stockbroker and a clearing member. Simply put, it can now help investors buy and sell shares. This milestone opens the door for a full-fledged, digital-first investment platform. It’s a key piece in JioFin’s growing financial services ecosystem.

Market Cap & Valuation

- As of July 15, 2025, JioFin has a market capitalization of approximately ₹2.03 trillion (₹2,03,000 Cr), placing it among India’s largest listed NBFCs

- Its enterprise value is nearly identical at around ₹2.03 T .

- The stock trades at a P/E ratio of ~126x reflecting strong growth expectations.

Moreover, since its August 2023 listing, JioFin’s market cap has surged from roughly ₹₨1.48 T to ₹2.03 T a gain of over 28% (~14% annualized) .

Mutual Fund Business – Ready to Launch

On May 27, 2025, SEBI approved:

- Jio BlackRock Mutual Fund, and

- Jio BlackRock Asset Management Pvt Ltd as the AMC.

This gives Jio the green light to launch mutual fund schemes. What’s exciting? This is a 50:50 joint venture between:

- JioFin, and

- BlackRock, the world’s largest asset manager with over $11.5 trillion AUM.

They’ve also brought in Sid Swaminathan, a former senior BlackRock executive, as CEO. The mutual fund arm is designed to be digital-first, low-cost, and investor-friendly.

First Funds Already Live

The platform isn’t waiting. By late June, Jio BlackRock launched three debt funds:

- Money Market Fund

- Overnight Fund

- Liquid Fund (NFO ran from June 30 to July 2)

Let’s connect the dots.

- JioFin was carved out of Reliance in 2023.

- Since then, it has moved fast, getting approvals, investing capital, and building partnerships.

- Now, JioFin has presence in banking, broking, and asset management.

It’s no longer just a plan. It’s execution in motion.

What Should Investors Know?

Here are the key takeaways:

- Broking license approved – retail or institutional focus is still unclear

- Jio Payments Bank is now 100% owned – with ₹190 crore in fresh capital

- Mutual fund business launched – backed by BlackRock, fully approved by SEBI

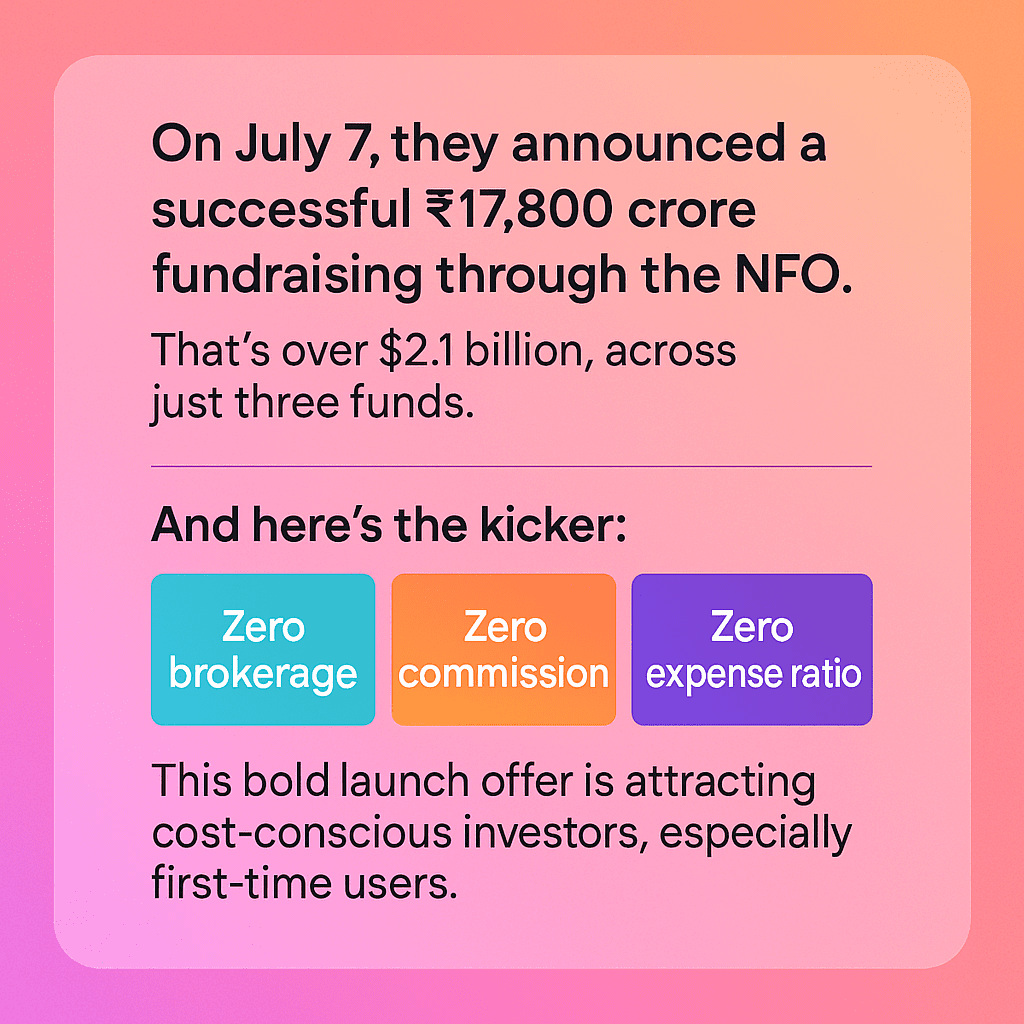

- Three debt funds already live – ₹17,800 crore raised

- Digital-first and zero-cost launch – using the JioFinance app

- Backed by Reliance – bringing scale, trust, and tech

Final Thoughts

Jio Financial Services is moving fast. In just weeks, it has:

- Secured licenses

- Completed acquisitions

- Launched products

- Raised serious capital

Now, the real challenge begins – execution and adoption. Can Jio win over users in a space dominated by Zerodha, Groww, Paytm, and HDFC? Time will tell. But one thing is clear: Jio Financial isn’t just another player, it’s here to lead.

Want to stay ahead in India’s fast-changing financial world?

Follow Nemi Wealth for clear, simplified updates and smart investing insights.