Understanding Short-Term & Long-Term Capital Gains Tax in Equity & Debt

Congratulations on your decision to invest! Whether you’ve chosen stocks, mutual funds, or bonds, you’re on your way to growing your wealth. But before you celebrate your returns, it’s important to understand how capital gains tax will impact your profits.

In India, capital gains tax applies to profits earned from selling capital assets like stocks, mutual funds, and bonds, among others. This blog will explain the different types of capital gains tax for Equity and Debt investments, helping you make informed investment decisions.

What is Capital Gains Tax?

Capital gains tax is levied on the profit you make when you sell a capital asset, such as stocks, mutual funds, or bonds. This tax is calculated by subtracting the purchase price (including any additional costs) from the selling price. The resulting difference is your capital gain.

Understanding Holding Period

The tax treatment of your capital gains depends on how long you hold the investment before selling it. This period is known as the holding period.

In India, the holding period differs for Equity and Debt investments.

- Equity: For Equity investments like stocks and equity mutual funds, the holding period is one year.

- Debt: For Debt investments like bonds and debt mutual funds, the holding period is three years.

Types of Capital Gains Tax

Based on the holding period, capital gains tax is categorized into two types:

- Short-Term Capital Gains (STCG): This applies to profits earned from selling an investment within the holding period. STCG tax rates are higher as compared to LTCG.

- Long-Term Capital Gains (LTCG): This applies to profits earned from selling an investment after the holding period. LTCG benefits from lower tax rates compared to STCG.

Note: Check detailed information on tax regime specific to mutual fund investors in India.

Capital Gains Tax on Equity Investments

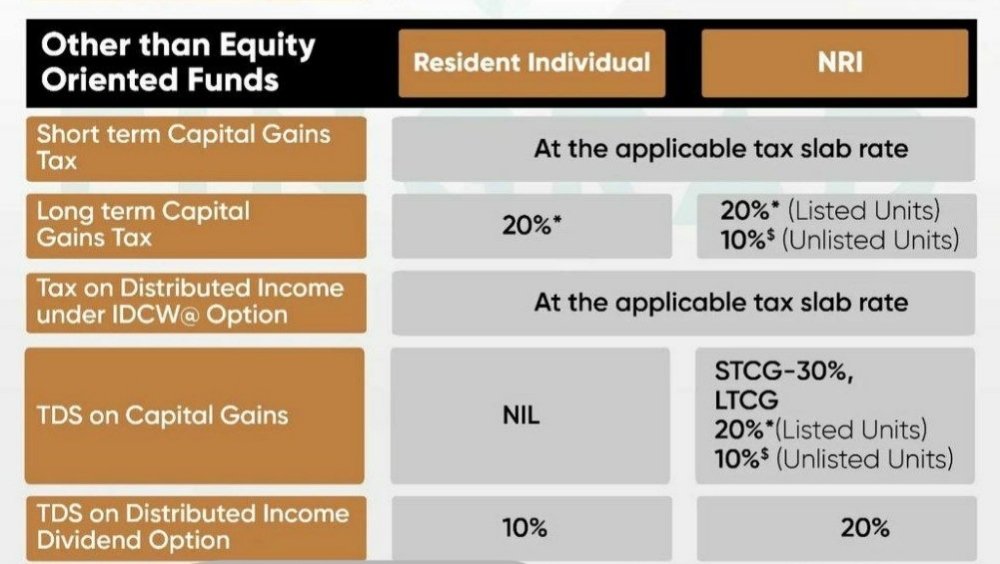

Taxation on Debt Investments

Equity: One-year Debt: Three years ( Holding Period)

- Generally, holding your investments for a longer period (beyond one year for Equity and three years for Debt) qualifies for lower tax rates.

- Short-term capital gains are taxed higher than long-term capital gains.

Tax Planning Strategies

Understanding capital gains tax can help you develop tax-efficient investment strategies. Here are a few tips:

- Invest for the Long Term: By holding your investments for the long term (beyond the holding period), you can benefit from lower LTCG tax rates.

- Tax-Saving Investments: Consider investing in tax-saving instruments like Equity Linked Savings Schemes (ELSS) to reduce your taxable income. Click here to understand ELSS and different types of Mutual Funds.

- Capital Gains Harvesting: If you need to sell investments, consider selling those with lower potential gains to minimize your tax burden. To learn more about tax planning strategies click here

Conclusion

Capital gains tax is an essential aspect of investing in India. By understanding the different types of capital gains tax applicable to Equity and Debt investments, you can make informed investment decisions and potentially minimize your tax liability. Remember, consulting a financial advisor can provide personalized advice and can boost your portfolio strength.