Top AMCs in India to Help You Build Wealth Smartly

Choosing the right mutual fund company can be tricky. But picking from the top AMCs in India can give your investments a big boost. These companies manage huge amounts of money, have strong reputations, and offer funds that perform well over time. In this guide, we’ll break down the top AMCs in India, what they do, and how they help you build wealth. Let’s dive in.

What Is an AMC and Why Top AMCs in India Matter

An Asset Management Company (AMC) is a professional firm that manages money for individuals and institutions. They pool funds from investors and invest in various asset classes such as:

- Stocks

- Bonds

- Gold

- Real estate

- Commodities

The top AMCs in India aim to grow your wealth while managing risk. They hire expert fund managers who analyze market trends, economic data, and company performance to make informed investment decisions on your behalf. Every AMC is regulated by SEBI (Securities and Exchange Board of India), ensuring investor protection and market transparency.

What Is AUM & Why It Matters When Choosing AMCs in India

AUM stands for Assets Under Management. It refers to the total value of assets that an AMC manages for all its investors. The top AMCs in India usually have high AUMs, which indicates investor confidence and wide reach. However, a high AUM alone does not guarantee better returns. When choosing an AMC, look at:

- Past fund performance

- Fund manager’s expertise

- Expense ratios

- Investment strategies

Always consider how well the AMC’s funds match your financial goals and risk tolerance.

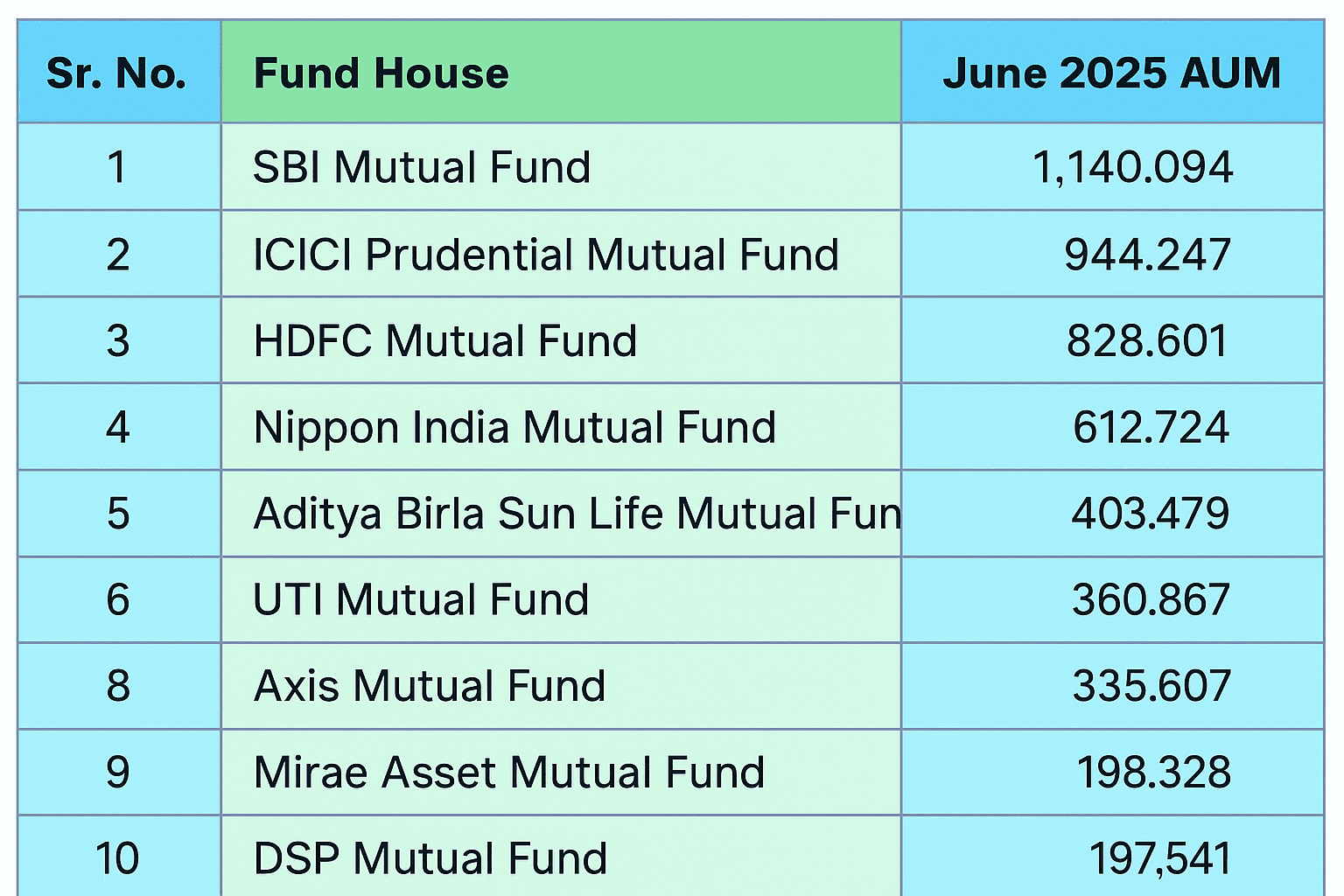

List of Top AMCs in India (By AUM & Performance)

Here are some of the top AMCs in India that are known for their performance and credibility:

How to Pick from the Top AMCs in India

With so many options available, how do you choose the right one? Here are some tips to help you decide:

- Check the Fund Categories: Does the AMC offer funds that suit your goals? (Equity, Debt, Hybrid, etc.)

- Review Past Performance: Look at the 3- to 5-year returns, not just short-term gains.

- Compare Expense Ratios: Lower charges can mean higher net returns.

- Study Fund Manager Track Record: Consistent performance often reflects a skilled manager.

- Understand Their Investment Philosophy: Some AMCs are aggressive, others are conservative. Pick what aligns with your risk appetite.

Final Thoughts

The top AMCs in India provide a strong foundation for your investment journey. They bring experience, market knowledge, and a wide range of fund options. But remember, it’s not just about brand names. Do your research. Match their strategies with your financial goals. Whether you’re aiming for long-term growth or short-term stability, there’s a right AMC for you.

At Nemi Wealth, we make the process simple. We help you:

- Explore India’s top AMCs

- Compare fund performance

- Pick funds tailored to your goals

Start investing the smart way. Choose from the top AMCs in India with Nemi Wealth by your side. and tailored for your journey.

FAQs

What is an AMC and how does it work?

An AMC (Asset Management Company) is a firm that manages pooled investments from investors and invests them in assets like stocks, bonds, or mutual funds. They have professional fund managers who make informed investment decisions based on market analysis.

How do I choose the best AMC in India?

Look at factors like AUM (Assets Under Management), past performance, fund variety, expense ratio, and the reputation of the AMC. Always choose one that aligns with your investment goals and risk appetite.

Does a higher AUM mean a better mutual fund?

Not always. A higher AUM shows investor trust and scale, but returns depend on fund management, asset allocation, and market conditions. Always check fund performance alongside AUM.

Are investments in mutual funds through AMCs safe?

AMCs in India are regulated by SEBI, ensuring transparency and investor protection. While market-linked products carry risk, choosing reputed AMCs and diversifying your investment reduces overall risk.

Can beginners invest directly through AMCs?

Yes. Most AMCs offer easy online platforms and mobile apps. They also provide SIP (Systematic Investment Plan) options which are great for beginners to start small and invest regularly.