TDS on Mutual Fund Dividends

Mutual funds are a popular investment option in India, offering diversification and professional management. They can distribute a portion of their profits to investors as dividends. However, a tax called TDS (Tax Deducted at Source) may apply to these dividends. This blog explores TDS on mutual fund dividends in India, its implications, and strategies to manage it.

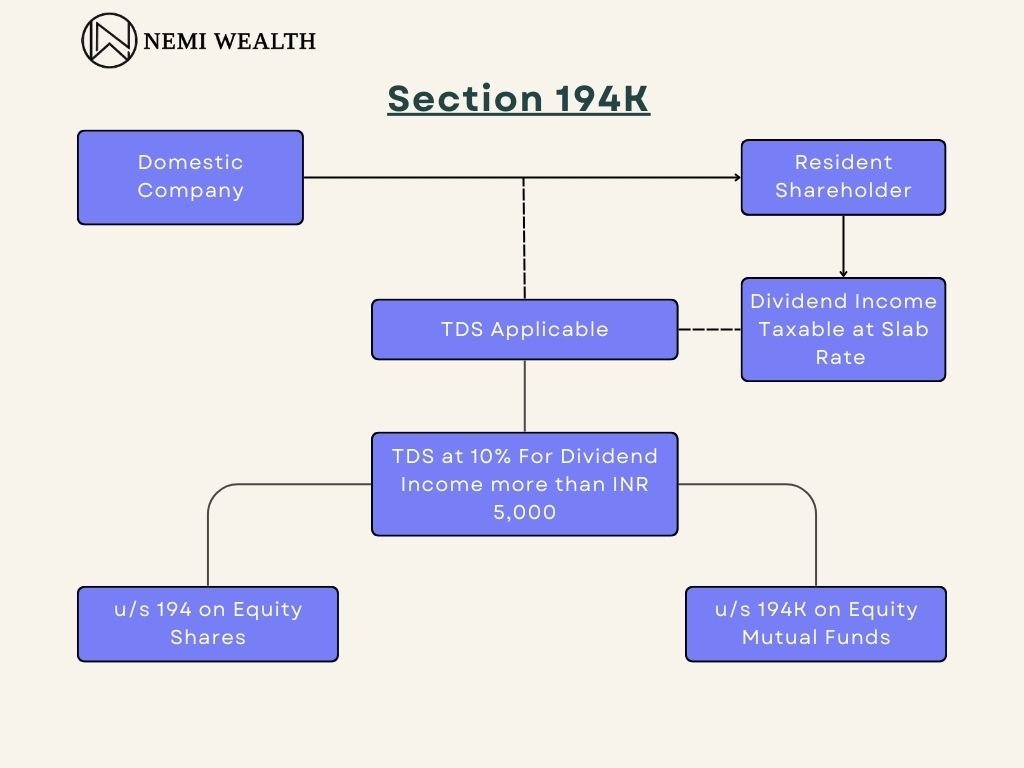

What is TDS on Dividend?

TDS is a mechanism where the fund house deducts a specific percentage of tax from the dividend payout before crediting it to your account. This simplifies tax collection for the government and ensures you pay at least some tax on your investment income.

How Does TDS on Dividend Work?

The current TDS rate on mutual fund dividends in India is 10%. However, this deduction only applies if your total dividend income from all mutual funds in a financial year exceeds INR 5,000. For example, if you receive INR 4,000 in dividends from various funds, no TDS will be deducted. But, if you receive INR 6,000, TDS of 10% will be applied on the amount exceeding INR 5,000 (i.e., INR 1,000), leading to a deduction of INR 100.

TDS on Different Types of Dividend Options

Mutual funds offer various dividend options, each with different TDS implications:

- Dividend Option: In this option, all declared dividends are paid out to investors, and TDS applies if the yearly total exceeds Rs. 5,000.

- Growth Option: Dividends are reinvested in the fund, increasing the Net Asset Value (NAV) and no TDS is deducted.

- Income Distribution Cumulative Option (IDCC): Dividends are paid out regularly, and TDS applies if the yearly total exceeds Rs. 5,000.

- Systematic Withdrawal Plan (SWP): Regular withdrawals are made from the fund, including capital gains and reinvested dividends. TDS applies to any dividend portion exceeding Rs. 5,000 withdrawn in a year.

Impact of TDS on Dividend

While TDS ensures some tax is paid upfront, it reduces the actual dividend received by the investor. This can impact your investment returns, especially if you rely on dividends for regular income.

Strategies to Manage TDS on Dividend

Here are some strategies to manage TDS on mutual fund dividends:

- Invest in Growth Option: Consider the growth option if you don’t need immediate income and want to avoid TDS. Reinvested dividends can potentially boost your capital appreciation.

- Submit Form 15G/15H: If your taxable income falls below the exemption limit, submit Form 15G (for individuals) or Form 15H (for senior citizens) to the fund house. This allows them to skip TDS deduction.

- Plan Dividend Withdrawals: If you opt for dividend payout, plan your withdrawals to stay within the Rs. 5,000 limit and avoid TDS.

- Explore SWP: Consider a Systematic Withdrawal Plan (SWP) to withdraw a fixed amount regularly. TDS applies only to the dividend portion within the SWP withdrawal, minimizing the impact. To get more information about the strategies to manage TDS on dividend click here.

Conclusion

TDS on mutual fund dividends is an essential aspect to understand. By being aware of its implications and using available strategies, you can make informed investment decisions and manage your tax liability effectively. Remember, consulting a financial advisor can help you choose the most suitable dividend option and plan your investments based on your financial goals.