Avalanche Method Explained: The Fastest Way to Become Debt-Free in India (2025 Guide)

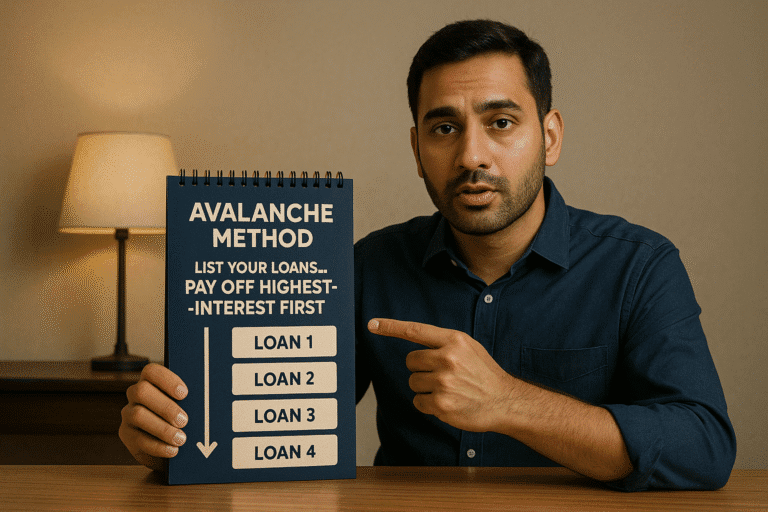

Learn how the Avalanche Method helps you close loans faster by targeting the highest-interest debt first. A proven strategy for becoming debt-free in India in 2025.