Non-Life Insurance Industry in India: Growth, Segments, and Top Players

The non-life insurance industry in India has emerged as one of the fastest-growing sectors of the financial services market. In the first half of FY25 (April–September 2024), non-life insurers collected over ₹1.54 lakh crore in premiums, marking a 7% growth compared to the same period last year. This rapid rise highlights how general insurance is becoming a necessity for individuals, families, and businesses. From health coverage to motor insurance, and from liability to marine policies, the industry protects people against risks that life insurance cannot cover.

At Nemi Wealth, we believe understanding the non-life insurance industry in India is crucial for both policyholders and investors, as it reflects financial security and long-term economic stability.

What is Non-Life Insurance?

Before diving into trends and numbers, let’s simplify the concept.

- Non-life insurance (also called general insurance) provides protection against risks other than death.

- It covers specific events such as illness, car accidents, fire damage, theft, or liabilities.

- Unlike life insurance, which pays out on death or maturity, general insurance works on an indemnity basis it compensates you for the actual financial loss incurred.

Examples of Non-Life Insurance Products:

- Health insurance – covers medical bills and hospital expenses

- Motor insurance – protects cars, bikes, or commercial vehicles

- Fire insurance – safeguards against fire or property damage

- Travel insurance – covers trip cancellations, baggage loss, medical emergencies abroad

- Marine & aviation insurance – protects cargo and aircrafts

- Liability insurance – covers legal claims against companies or individuals

This wide range shows why the non-life insurance industry in India is so vital in a growing economy.

Size and Growth of the Non-Life Insurance Industry in India

The industry’s expansion is backed by multiple factors:

- Rising Awareness – More Indians now understand the need for general insurance for health, vehicles, and businesses.

- Regulatory Push – The Insurance Regulatory and Development Authority of India (IRDAI) is actively encouraging product innovation and higher insurance penetration.

- Corporate Demand – Businesses require fire, marine, liability, and cyber insurance for risk management.

- Economic Growth – As incomes rise, so does the demand for general insurance products.

Industry Snapshot (FY25 – April to September 2024):

- Total Premium Collected: ₹1.54 lakh crore

- Growth Rate: 7% YoY

- Market Share: Top 10 players control nearly 70% of the market

This steady performance shows how the non-life insurance industry in India is maturing while still offering opportunities for new players.

Top Players in the Non-Life Insurance Industry in India

Let’s look at the companies leading the market:

| Company | Premium Collected (₹ Crore) | Market Share |

|---|---|---|

| New India Assurance | 19,390 | 12.6% |

| ICICI Lombard | 14,408 | 9.4% |

| Bajaj Allianz | 10,557 | 6.9% |

| United India Insurance | 10,068 | 6.5% |

| Oriental Insurance | 10,052 | 6.5% |

| Star Health | 8,900+ | 5.8% |

| National Insurance | 8,800+ | 5.7% |

| HDFC Ergo | 7,500+ | 4.8% |

| SBI General | 6,700+ | 4.3% |

| Tata AIG | 6,500+ | 4.2% |

Together, these companies dominate the general insurance space, covering everything from health and motor to fire and liability.

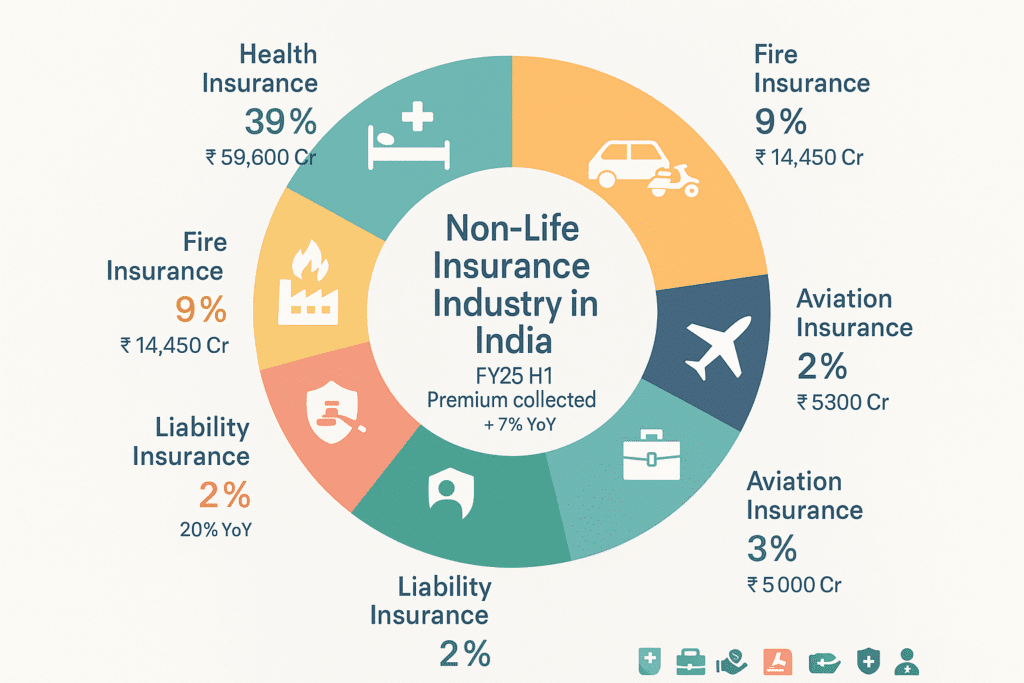

Segments of the Non-Life Insurance Industry in India

The strength of this industry lies in its diverse coverage. Let’s explore the key segments:

1. Health Insurance – The Largest Segment of General Insurance

- Premium Collected (FY25 H1): ₹59,600 crore

- Market Share: 39% of the industry

Rising healthcare costs and higher awareness have made health insurance the backbone of the non-life insurance industry in India. Star Health, New India Assurance, and Oriental Insurance are among the top players.

Families, individuals, and even corporates buy general insurance health policies to safeguard against medical emergencies.

2. Motor Insurance – Driving Growth in the Industry

- Premium Collected (FY25 H1): ₹45,000 crore

- Market Share: 29%

India’s booming vehicle sales directly support this segment. Motor insurance is also mandatory by law, making it one of the most stable parts of the general insurance business. ICICI Lombard, New India Assurance, and Tata AIG are leading players.

3. Fire Insurance – Safety for Assets and Businesses

- Premium Collected (FY25 H1): ₹14,450 crore

- Used widely by corporates, factories, and warehouses.

- Dominated by New India Assurance, ICICI Lombard, and Bajaj Allianz.

This segment reflects how the non-life insurance industry in India is crucial for protecting businesses against catastrophic risks.

4. Marine and Aviation Insurance

- Marine Insurance Premium: ₹3,000 crore

- Aviation Insurance Premium: ₹540 crore

As India’s trade and aviation industry grow, so does the need for these niche policies. They are vital for global businesses. ICICI Lombard, New India Assurance, and Tata AIG lead here.

5. Liability Insurance – Fastest Growing Segment

- Growth Rate: 20% year-on-year

- Covers corporate risks like product liability, directors’ liability, and cyber-attacks.

As Indian businesses become more global, liability insurance is expected to drive future growth in the general insurance market.

6. Personal Accident Insurance

- Premium Size: ₹5,000 crore

- Covers accidental death, disability, and hospitalization.

- Popular among individuals and corporate employee benefit packages.

This is a growing segment within the non-life insurance industry in India, as awareness about personal risk protection increases.

Opportunities in the Non-Life Insurance Industry in India

The future looks bright, supported by:

- Digital Growth – Online distribution and insuretech companies are making general insurance more accessible.

- Government Push – Schemes like Ayushman Bharat expand health insurance penetration.

- Corporate Risk Management – As businesses expand, they need tailored insurance products.

- Emerging Risks – Cyber insurance and climate-related covers are opening new opportunities.

Challenges for the Industry

Despite strong growth, the non-life insurance industry in India faces challenges:

- Low Penetration – Insurance penetration is still below 1% of GDP for non-life products.

- Awareness Gap – Many still see general insurance as optional.

- Price Competition – Aggressive discounting reduces profitability.

- Claim Settlement Delays – Trust issues arise when claims are slow.

Solving these challenges is key for the industry’s long-term success.

Final Thoughts

The non-life insurance industry in India is at an exciting stage. With strong growth in general insurance segments like health and motor, rising demand for liability and cyber coverage, and dominance of top players like New India Assurance and ICICI Lombard, the sector promises stability and expansion.

At Nemi Wealth, we believe non-life insurance is not just a product but a financial shield for individuals, families, and businesses. Understanding this industry helps investors, corporates, and policyholders make smarter financial decisions.