Next-Gen GST Reform 2025: New Slabs, Lower Taxes & What It Means for You

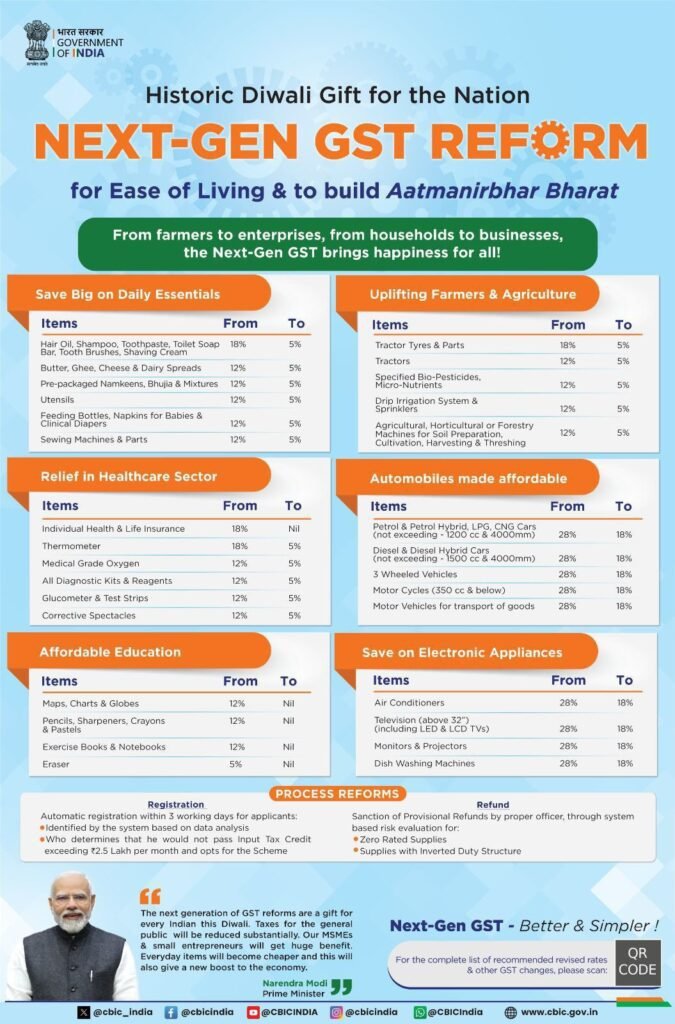

The Government of India has announced a historic GST reform — one of the biggest changes since GST was first introduced in 2017. This Next-Gen GST Reform is being called a Diwali Gift for the Nation, promising to make living cheaper, boost businesses, and simplify compliance.

So, what exactly is changing, and how does it affect you? Let’s break it down in simple words.

GST Slabs Simplified

Until now, GST had four main slabs — 5%, 12%, 18%, and 28%. This often created confusion and disputes about classification of goods.

Now, under the new reform, India is moving towards a two-tier GST structure:

- 5% (Merit Rate) → For essentials and mass-consumption items

- 18% (Standard Rate) → For most goods and services

- 40% (Sin Rate) → For luxury and sin goods like tobacco and luxury cars

- <1% concessional rate → May continue for precious stones and affordable housing

This means the 12% slab has been scrapped and most items from that category will now move to 5%, while goods in the 28% slab will shift to 18% (except luxury items).

Daily Essentials Become Cheaper

Everyday items that you and I use regularly will now cost less. For example:

- Hair oil, shampoo, toothpaste, shaving cream – GST down from 18% to 5%

- Butter, ghee, cheese, dairy spreads – from 12% to 5%

- Pre-packaged namkeens, bhujia, mixtures – from 12% to 5%

- Utensils, feeding bottles, baby diapers – from 12% to 5%

- Sewing machines – from 12% to 5%

In short: Your grocery and household shopping bills will come down.

Support for Farmers & Agriculture

The new GST rates also aim to uplift the agriculture sector.

- Tractor tyres, tractors, drip irrigation systems – all reduced to 5%

- Agricultural machines for soil preparation, harvesting, etc. – down to 5%

- Bio-pesticides and micro-nutrients – reduced from 12% to 5%

Farmers will spend less on equipment, leading to better productivity and lower food costs in the long run.

Relief in Healthcare

Healthcare costs have been a big concern, and this reform brings some relief:

- Health & life insurance – GST reduced to zero (earlier 18%)

- Medical oxygen, diagnostic kits, glucometers – down to 5%

- Thermometers – now 0% GST

This is a huge saving for middle-class families who spend on insurance and medical care.

Automobiles Get Affordable

Good news for car and bike buyers:

- Petrol/diesel hybrid cars – down from 28% to 18%

- Motorcycles (350cc & below) – from 28% to 18%

- Goods transport vehicles – 28% to 18%

Buying a car or bike is now cheaper, which will boost demand in the auto sector.

Affordable Education

To make learning accessible:

- Maps, charts, globes – 12% to 0%

- Pencils, sharpeners, crayons – 12% to 0%

- Exercise books, notebooks – 12% to 0%

- Erasers – 5% to 0%

This is a great step towards promoting education at affordable costs.

Electronics Made Cheaper

Households will also benefit as GST on electronic appliances is being reduced:

- Air conditioners – 28% to 18%

- Televisions (above 32”) – 28% to 18%

- Monitors, projectors, dishwashers – 28% to 18%

Expect lower appliance prices and festive-season discounts.

Benefits of Next-Gen GST Reform

- Lower prices on essentials, healthcare, and household goods

- Boost for MSMEs and small businesses through reduced tax burden

- Simpler compliance with only two main slabs (5% & 18%)

- Greater transparency and global best practices

- Stronger economy due to increased consumption and demand

Challenges Ahead

- Businesses may face issues with input tax credit (ITC) mismatches

- Surge in refund claims, especially for MSMEs and exporters

- Companies will need to revalue stock and update billing systems

- Anti-profiteering laws will ensure benefits are passed on to consumers

Final Thoughts

The Next-Gen GST Reform 2025 is being hailed as a Diwali Gift for the nation. By making daily essentials cheaper, supporting farmers, reducing healthcare costs, and boosting consumption, this move is expected to benefit households, small businesses, and the overall economy.

It’s not just a tax reform – it’s a step towards building an Aatmanirbhar Bharat.

👉 Stay updated on GST reforms, market news, and financial insights – Follow us on Instagram @finanshull