How to Start NRI Mutual Fund Investment: A Simple 4-Step Guide

India’s economy is expanding rapidly and naturally, many NRIs are looking for ways to be part of this growth story. Fortunately, mutual funds offer an ideal entry point. Not only are they professionally managed and diversified, but they also allow you to invest without constant market monitoring. Moreover, as India’s mutual fund industry continues to grow now crossing ₹64 lakh crore in assets the opportunity for long-term wealth creation becomes even more compelling. In this guide, we’ll walk you through everything you need to know: from completing KYC to choosing the right account and platform. So, if you’re ready to invest from abroad with confidence and compliance, this 4-step guide is the perfect place to begin.

Why NRI Mutual Fund Investment Makes Sense

Before we jump into the “how,” let’s talk about the “why.”

- Mutual funds are managed by professionals, so you don’t need to watch the market every day.

- They offer diversification, meaning your money is spread across many stocks or bonds — reducing risk.

- You can start small and grow over time.

- And most importantly, you can invest from anywhere in the world.

As of February 2025, the Indian mutual fund industry’s Assets Under Management (AUM) crossed ₹64.53 lakh crore. That’s more than double what it was five years ago. This growth shows increasing trust among both Indian and global investors.

Step 1: KYC – The First Step for NRI Mutual Fund Investment

To begin with, if you want to invest in mutual funds in India, you must complete the KYC (Know Your Customer) process. This is important because it’s a mandatory step set by SEBI, India’s market regulator.

Documents you’ll need:

- Passport (for identity)

- PAN card (for tax tracking)

- Overseas address proof (like utility bill or driving license)

- Cancelled cheque or a bank statement from your Indian account

- FATCA declaration (to comply with international tax rules)

- CDC (if you’re in merchant navy)

How to do it?

Right now, most mutual fund companies (AMCs) require offline KYC, which means a physical visit to India. But don’t worry SEBI is working on digital KYC using video calls and GPS location, which will make it easier soon.

Step 2: Choose the Right Bank Account

Next up you’ll need a Indian Bank Account. But here’s where you need to choose wisely. You can go with either:

- NRE Account (Non-Resident External):

Ideal if your income is from abroad. The money is fully repatriable (you can take it back abroad anytime). - NRO Account (Non-Resident Ordinary):

Best if you have income in India like rent, pension, or dividends. The money in this account is partially repatriable.

Tip: Match your account type with your investment source and future financial goals. This ensures smooth transactions and better planning.

Step 3: Choose a Platform to Start Investing

Once your KYC is done and your bank account is ready, you’re all set to begin investing. There are plenty of digital platforms you can use. These allow you to invest, monitor, and manage your portfolio even if you’re sitting halfway across the world.

Popular platforms include:

- AMC websites and apps

- myCAMS and KFintech (registrar platforms)

- MF Central

- MF Utility

- BSE STAR MF (BSE exchange platform)

- NSE NMF-II and MFSS platforms

- Exchange Online Portals (EOPs)

- Nemi Wealth

Most platforms MF Central aren’t very user-friendly for NRIs, especially if you’re new to mutual funds. Any paperwork or KYC steps can be confusing too. That’s why it’s smarter to invest through an advisor or Mutual Fund Distributor like Nemi Wealth. We guide you at every step, handle the formalities, and make the whole process simple and stress-free.

Step 4: Upgrade Your KYC Before April 2025

ChatGPT said:

Here’s something important and time-sensitive. Currently, NRIs can invest if their status shows “KYC Registered.” But starting April 2025, all mutual fund investors must upgrade to “KYC Validated.” This means you’ll need to provide Aadhaar-based address proof (SEBI is still finalizing digital options for NRIs). So, keep an eye on your KYC status or contact your fund house, Advisor, or Mutual Fund Distributor (MFD) to assist with the upgrade.

Eligibility for NRI Mutual Fund Investment

Before you start investing, it’s important to know whether you meet the basic eligibility criteria as an NRI. Here’s a quick checklist to help you stay on track:

- You must already hold a bank account in India. This is because a Customer ID linked to your bank is required.

- Your savings account should be in either “Single” or “Either/Survivor” holding status.

- The holding pattern of your mutual fund account will match the one in your bank account.

- All applicants need to sign the account opening form for the Investment Services Account (ISA).

- PAN (Permanent Account Number) is mandatory for all mutual fund investors, regardless of the investment amount.

If you’re an NRI and unable to visit India:

- Your PAN card copy must be attested by the Indian Embassy in your country.

- After attestation, you can send the documents to your home branch or share them with your Relationship Manager.

- Additionally, the PAN must be verified by the RM as “Seen Original & Verified” before attaching it to your ISA form.

- Don’t forget to sign the bank account linkage letter, this too must be signed by the account holders.

Tip: The KYC processing is handled by CVL Ventures Ltd., and sometimes they may ask for extra documents, so stay in touch with your fund house or advisor for updates.

In a Nutshell: Your NRI Mutual Fund Journey

Let’s recap the 4 key steps:

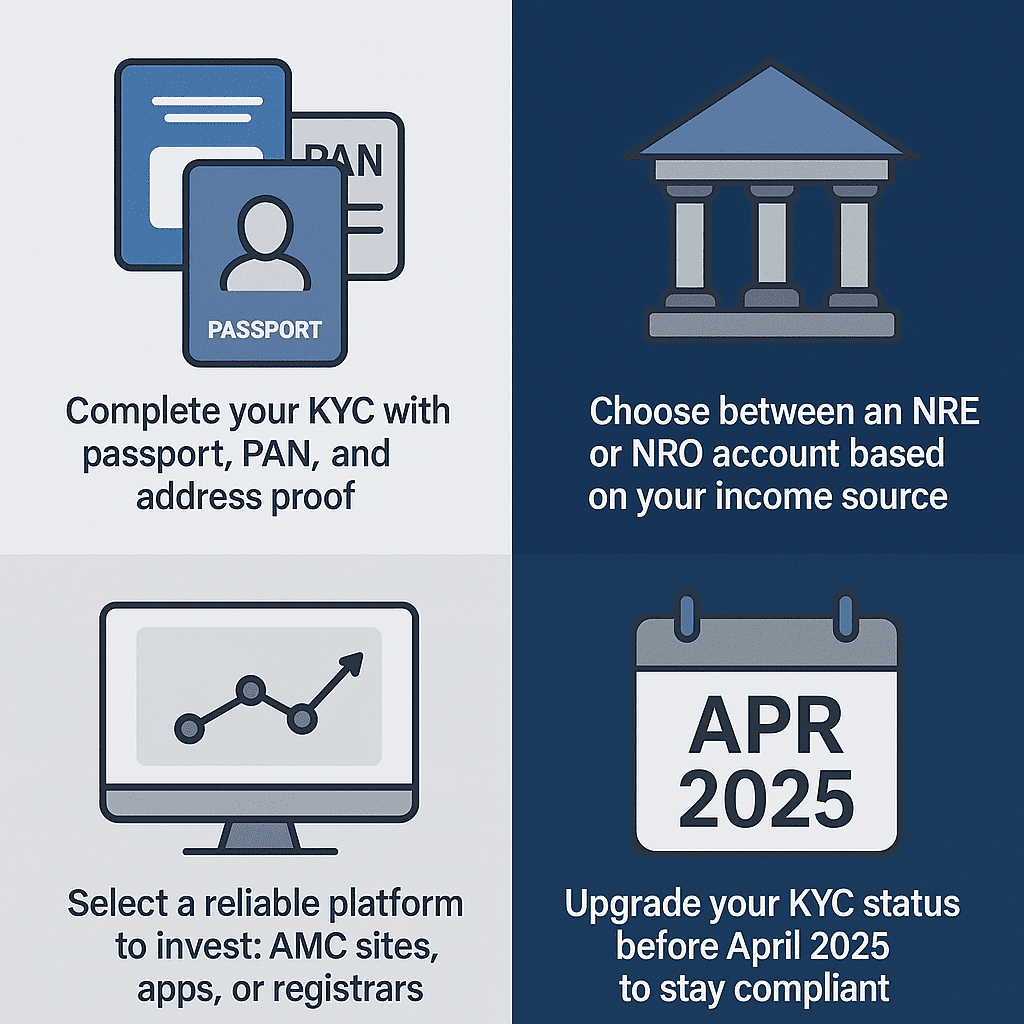

To get started on your NRI mutual fund journey, you must first complete your KYC by submitting key documents such as your passport, PAN card, and address proof. Next, choose between an NRE or NRO account based on your income source this decision helps align your financial goals with the right account type. Once that’s done, select a reliable investment platform like AMC apps, websites, or registrars to begin investing. Finally, make sure to upgrade your KYC status to “Validated” before April 2025 to stay fully compliant with SEBI rules.

Final Thoughts from Nemi Wealth

Mutual funds are not just for residents they’re for every Indian, no matter where in the world you live. For NRIs in particular, they offer a structured, low-maintenance, and cost-effective way to grow wealth in India. Moreover, with the right steps, you can easily tap into India’s fast-growing markets and build a future that benefits from the country’s economic momentum.

If you’re unsure where to begin, we’re here to help. At Nemi Wealth, we simplify investing for NRIs from KYC guidance to fund selection and everything in between. So, whether you’re starting fresh or looking to improve your portfolio, we’re with you at every step. Follow us for regular updates, simplified insights, and smart investing tips tailored for global Indians.

FAQs

Can NRIs invest in mutual funds in India?

Absolutely. NRIs are allowed to invest in Indian mutual funds under FEMA regulations. However, before you begin, you must complete the KYC process and use either an NRE or NRO bank account, depending on your source of funds.

Are NRI mutual fund investments taxable in India?

Yes, NRIs are subject to capital gains tax depending on the type and duration of the investment. Typically, tax is deducted at source (TDS) by the mutual fund house. Therefore, it’s wise to consult a tax advisor to understand your specific tax situation more clearly.

Which bank account should I use NRE or NRO?

That depends.

- Choose an NRE account if your funds come from abroad and you want full repatriation.

- On the other hand, use an NRO account if your income is from India (like rent or pension) and you’re okay with partial repatriation.

In short, the account type should match your income source and financial goals.

How can I invest while living abroad?

Once your KYC is done and your bank account is linked, you can invest using digital platforms. These include:

- AMC websites and mobile apps

- myCAMS, KFintech, or MF Central

- MF Utility, BSE STAR MF, or NSE NMF-II

Fortunately, these platforms are easy to use and allow you to invest, track, and redeem no matter where you are in the world.

Do I need to update my KYC in 2025?

Yes. As per SEBI guidelines, starting April 2025, all investors must upgrade from ‘KYC Registered’ to ‘KYC Validated’ status. This involves submitting Aadhaar-based address proof.

Therefore, it’s important to stay updated and complete the validation in time to avoid restrictions on your investments.