Multi Asset Allocation Funds: How to Grow Wealth Safely and Easily

If you’re looking for a smart way to manage your money in 2025, then Multi Asset Allocation Funds could be a great choice. Not only do they invest in a mix of stocks, bonds, and gold, but they also help spread risk. Moreover, they’re managed by experts who adjust to market changes, making them a flexible and balanced investment option. Overall, they offer a balanced and convenient way to grow your money. This mix helps you grow your money while reducing risk. Let’s explore what they are, why they work, and how to start investing.

What Are Multi Asset Allocation Funds?

Multi Asset Allocation Funds are mutual funds that invest in at least three asset classes. This includes:

- Equity (stocks)

- Debt (bonds)

- Commodities (like gold)

These funds aim to give you balanced growth. They spread your money across different types of investments, so you don’t depend on just one.

Why Choose Multi Asset Allocation Funds?

- Diversify Your Portfolio: Don’t put all your eggs in one basket. That’s why Multi Asset Allocation Funds can be a smart move. Since these funds invest in multiple assets, such as stocks, bonds, and gold, they offer built-in diversification. So, even if stocks don’t perform well, bonds or gold might. As a result, this reduces risk and helps balance your returns.

- Easy to Start and Exit: These are open-ended funds. You can start anytime. You can also withdraw a part of your money within one year for free (up to 10% in most cases). For anything more, there may be a small charge (exit load). But overall, entry and exit are simple.

- Get Expert Help: A professional fund manager takes care of your money. You don’t have to decide where to invest. The manager studies the market and adjusts the fund based on what’s working. Mutual funds are regulated by SEBI, ensuring transparency and investor protection.

- Earn in Short and Long Term: Because your money is in both debt and equity, you can see returns in both the short and long term. Bonds may give steady income soon, while stocks can grow your wealth over time.

- Lower the Risk: Markets go up and down. That’s normal. But when your money is spread across different assets, you feel fewer bumps. That’s the beauty of Multi Asset Allocation Funds.

Taxation of Multi Asset Allocation Funds

Tax treatment depends on how the fund allocates your money. If it invests more than 65% in equity, it qualifies for equity taxation. However, if the equity portion is less than 65%, the fund is treated as a debt fund, and short-term capital gains tax (STCG) applies. So, before you invest, take a moment to read the scheme-related documents carefully. This will help you understand the tax rules and make better decisions.

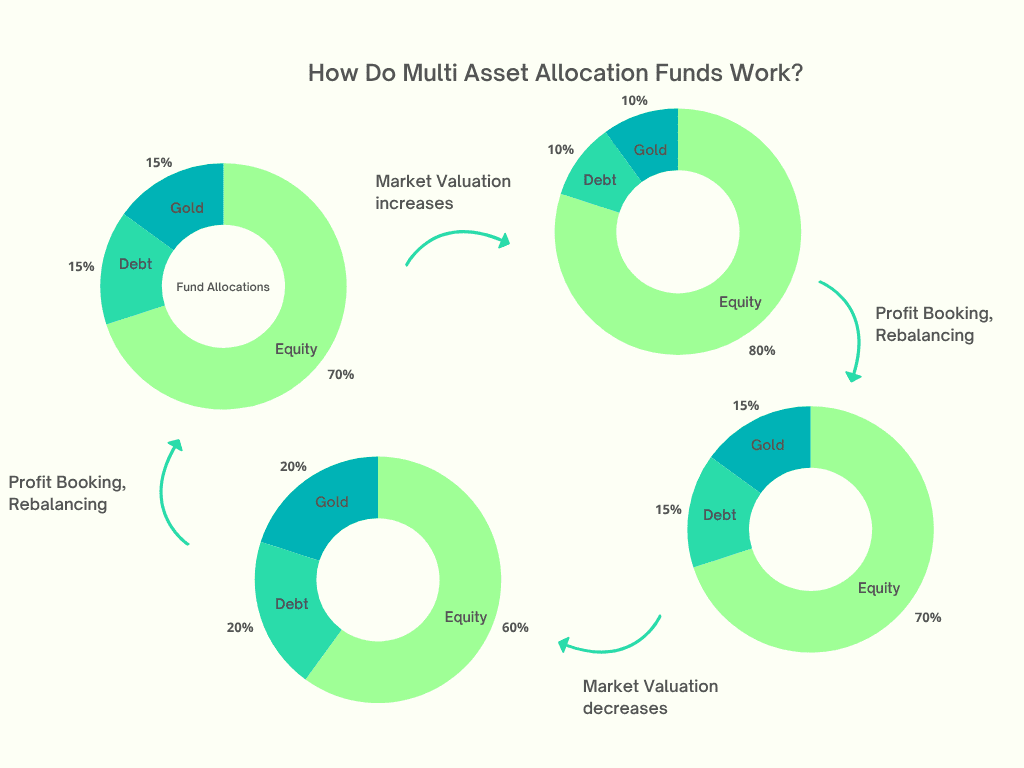

How Do Multi Asset Allocation Funds Work?

Here’s how they manage your money:

- Market Tracking: Fund managers track the economy and markets.

- Smart Distribution: They divide your money across assets like equity, debt, and gold.

- Timely Rebalancing: When markets shift, they adjust the mix to protect your money.

- Risk-Return Balance: Their main goal is to grow your wealth while managing risk.

How to Invest in Multi Asset Allocation Funds with Nemi Wealth

Get Started in Just 4 Simple Steps:

- Talk to Us – Visit Nemi Wealth and connect with our experts to begin your investment journey.

- Know Your Profile – Let us help you assess your risk profile and financial goals.

- Pick a Plan – Choose a Multi Asset Allocation Fund that aligns with your objectives.

- Start with SIPs or Lump Sum – Kick-start your investment with a one-time lump sum or opt for hassle-free monthly SIPs (Systematic Investment Plans) to build wealth gradually.

Who Should Invest in Multi Asset Allocation Funds?

These funds are ideal for:

- First-time investors

- People looking for both growth and stability

- Those who want professional fund management

- Long-term planners (3+ years)

Final Thoughts

Multi Asset Allocation Funds offer a smart way to grow your money without taking big risks. By combining safety and growth, they invest in different assets like stocks, bonds, and gold. Therefore, they provide diversification and help protect your investment. In other words, you get the potential for returns with reduced risk. Whether you’re starting your journey or planning long-term goals, these funds can help you stay balanced and focused.

At Nemi Wealth, we make it simple. Let our experts guide you through your investment journey with the right Multi Asset Allocation Fund that fits your needs.

FAQs

What are Multi Asset Allocation Funds?

They are mutual funds that invest in at least three types of assets like stocks, bonds, and gold.

How risky are Multi Asset Allocation Funds?

They carry moderate risk, but because your money is spread out, they are safer than pure equity funds.

Can I withdraw Multi Asset Allocation Funds anytime?

Yes. You can redeem part or all of your money easily. Small exit charges may apply if withdrawn early.

What returns can I expect from Multi Asset Allocation Funds?

Returns vary with the market, but these funds aim for steady growth over 3–5 years. Their returns can vary from a CAGR of 10% to 14% in the long term.

Is Multi Asset Allocation Funds good for beginners?

Yes. They are perfect for beginners looking for a balanced start.