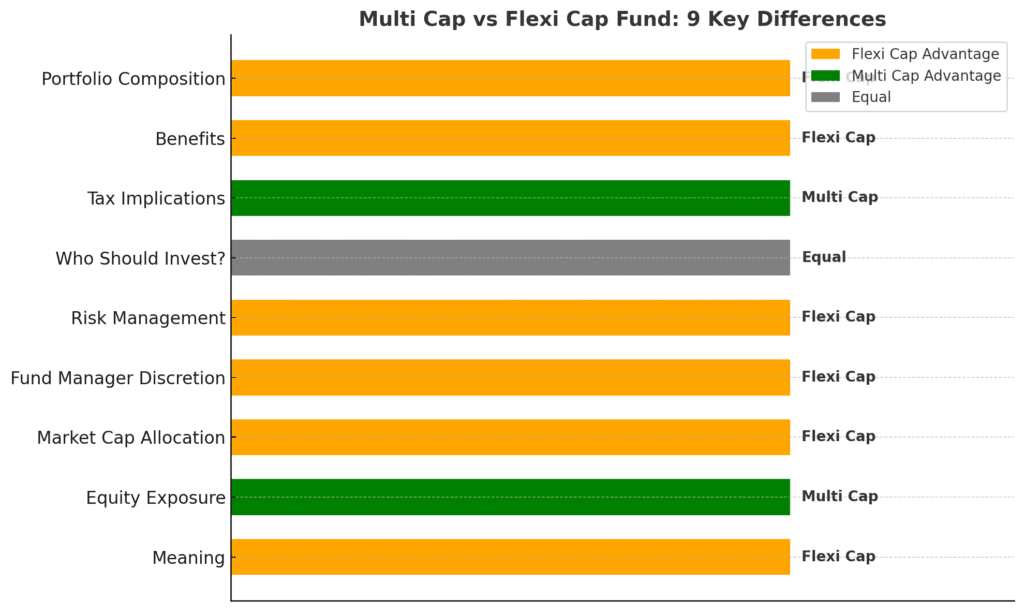

Flexi vs Multi Cap : Best Option for Long-Term Wealth Growth?

Over the past decade, mutual funds have emerged as one of the most preferred investment tools in India. Among these options, Flexi vs Multi Cap Mutual Funds is one comparison that often confuses investors. This is because both seem similar at first, yet they have important differences. Both have their own strengths, but choosing the right one depends on your goals and risk appetite. While they may seem similar, they have key differences that could impact your returns and risk profile. Let’s dive in and help you choose the one that suits your financial journey best.

Flexi vs Multi Cap Mutual Funds

| Particulars | Multi-Cap Mutual Funds | Flexi-Cap Mutual Funds |

| Definition | Invests in large-cap, mid-cap, and small-cap stocks in fixed proportions | Invests across all market caps without fixed allocation limits |

| SEBI Mandate | Minimum 25% each in large-cap, mid-cap, and small-cap stocks | Minimum 65% in equities; no cap-specific minimum required |

| Flexibility | Less flexible due to fixed allocation rules | Highly flexible; fund manager decides allocation based on market outlook |

| Risk Level | Moderate to High (due to small and mid-cap exposure) | Moderate (can adjust cap allocation based on market conditions) |

| Best Suited For | Investors with higher risk tolerance and long-term goals | Investors seeking balanced exposure with dynamic strategy |

| Fund Manager Control | Limited, must follow fixed allocation | Full discretion to shift between caps |

Benefits of Multi and Flexi Cap Funds

Multi-Cap Fund Benefits

- Balanced Exposure: Offers a steady mix of stability, growth, and aggression.

- SEBI-Regulated Allocation: Keeps risk in check.

- Long-Term Growth: Ideal for wealth-building goals.

Flexi-Cap Fund Benefits

- High Flexibility: Adjusts with market trends.

- Fund Manager Expertise: Leverages market cycles smartly.

- Adaptive Returns: Can outperform in bullish markets.

Tax Implications

Both Multi Cap and Flexi Cap funds follow the same tax rules as equity mutual funds. Understanding how these taxes work can help you plan your investments better and avoid surprises when you redeem your units.

Short-Term Capital Gains (STCG):

20% if units are sold within a year.

Long-Term Capital Gains (LTCG):

Tax-free up to ₹1 lakh annually. Beyond that, taxed at 12.5% without indexation.

Who Should Invest?: Flexi vs Multi Cap Funds

Multi-Cap Funds are good for investors who can take some risk. They invest in large-cap, mid-cap, and small-cap stocks. As a result, this gives a mix of safety, growth, and opportunity.

These funds are best for long-term goals. Think 5 to 7 years or more. They suit people who want steady growth. They also offer built-in diversification. That means your money is spread across different types of companies. So, if you want a balanced and steady option, Multi-Cap Funds are a strong choice.

On the other hand, Flexi-Cap Funds are better suited for investors who prefer giving the fund manager the flexibility to shift allocations based on market conditions. If you seek dynamic asset allocation with the potential to balance risk and reward across changing market cycles, Flexi-Cap Funds are a great fit. Both are suitable for long-term investors seeking growth through equity exposure.

Which Fund Should You Choose?

Now that you know the key differences between Multi and Flexi Cap Mutual Funds, the choice depends on your personal financial goals and risk appetite. If you prefer a fixed diversification across market caps and are comfortable with moderate to high risk, Multi-Cap Funds may suit you better. However, if you want more flexibility and prefer letting the fund manager decide allocations based on market conditions, Flexi-Cap Funds might be the way to go.

Remember, every investor is different so align your investments with your long-term goals, time horizon, and comfort with market volatility.

Visit Nemi Wealth to explore which option suits you best.

Final Thoughts: Flexi vs Multi Cap at a Glance

Both Multi-Cap and Flexi-Cap Mutual Funds offer diversified equity exposure, but they cater to different investor mindsets. If you prefer a structured approach with regulated diversification across all market caps, Multi-Cap Funds provide that stability. On the other hand, if you want a dynamic strategy that adapts to market changes, Flexi-Cap Funds offer the flexibility to maximize opportunities. Think about how hands-on or hands-off you want your investment to be and let that guide your choice.

FAQs

What is a Multi-Cap Fund?

A Multi-Cap Fund invests in large-cap, mid-cap, and small-cap stocks. In fact, it has fixed minimum allocations for each segment. Therefore, it provides balanced exposure across the market.

What is a Flexi-Cap Fund?

A Flexi-Cap Fund can invest in large, mid, or small-cap stocks without fixed limits. As a result, the fund manager can adjust the mix freely, depending on market trends.

Which fund is better for beginners?

Flexi-Cap Funds are often preferred by beginners because they offer more flexibility. Moreover, they are easier to manage. As a result, they carry lower risk.

How long should I stay invested in these funds?

It’s ideal to invest in both Multi and Flexi-Cap Funds for at least 5 years to get the full benefit of compounding and ride out market volatility.

Are these funds risky?

Yes, they do carry some risk as they invest in equities, but diversification in Multi-Cap and flexibility in Flexi-Cap help reduce the overall risk compared to single-cap funds.