Cost of Smoking in India: ₹15 Cigarette, ₹40 Lakh Loss Explained

Cost of smoking in India is often misunderstood as a small, harmless ₹15-a-stick habit.

But in reality, smoking is one of the biggest silent wealth destroyers for Indians.

Most smokers are aware of the health risks.

Very few realise the true cost of smoking in India—a financial trap that can wipe out lakhs and even crores over a lifetime.

In this detailed guide, we break down:

- The true monthly, yearly, and lifetime cost of smoking in India

- The hidden financial losses smokers ignore

- How smoking makes health and term insurance expensive

- The ₹40 lakh opportunity cost due to lost compounding

- A step-by-step quitting plan that can build long-term wealth

🚬 1. Cost of Smoking in India: Real Price of a Cigarette

The average price of one cigarette in India (single stick) ranges between:

- ₹12 to ₹20 per cigarette

For realistic calculation, we take ₹15 per cigarette as the national average.

Average smoking consumption in India

Most smokers fall into one of these categories:

- Light smoker: 5 cigarettes/day

- Moderate smoker: 10 cigarettes/day

- Heavy smoker: 15 cigarettes/day

💸 2. Monthly and Yearly Cost of Smoking in India

A. Light Smoker (5 Cigarettes/Day)

- 5 × ₹15 × 30

- ₹2,250 per month

- ₹27,000 per year

B. Moderate Smoker (10 Cigarettes/Day)

- 10 × ₹15 × 30

- ₹4,500 per month

- ₹54,000 per year

C. Heavy Smoker (15 Cigarettes/Day)

- 15 × ₹15 × 30

- ₹6,750 per month

- ₹81,000 per year

This money is burnt daily.

But the real cost of smoking in India is much higher than this.

📉 3. Cost of Smoking in India Due to Opportunity Loss (₹40 Lakh Reality)

If the same money spent on cigarettes is invested in an index fund or equity mutual fund with an average 12% CAGR, the numbers change drastically.

₹4,500/month invested instead of smoking

- 10 years → ₹10.5 lakh

- 20 years → ₹39–40 lakh

- 30 years → ₹1.3 crore

This is why the cost of smoking in India is not ₹15 per cigarette—

it is a ₹40 lakh mistake.

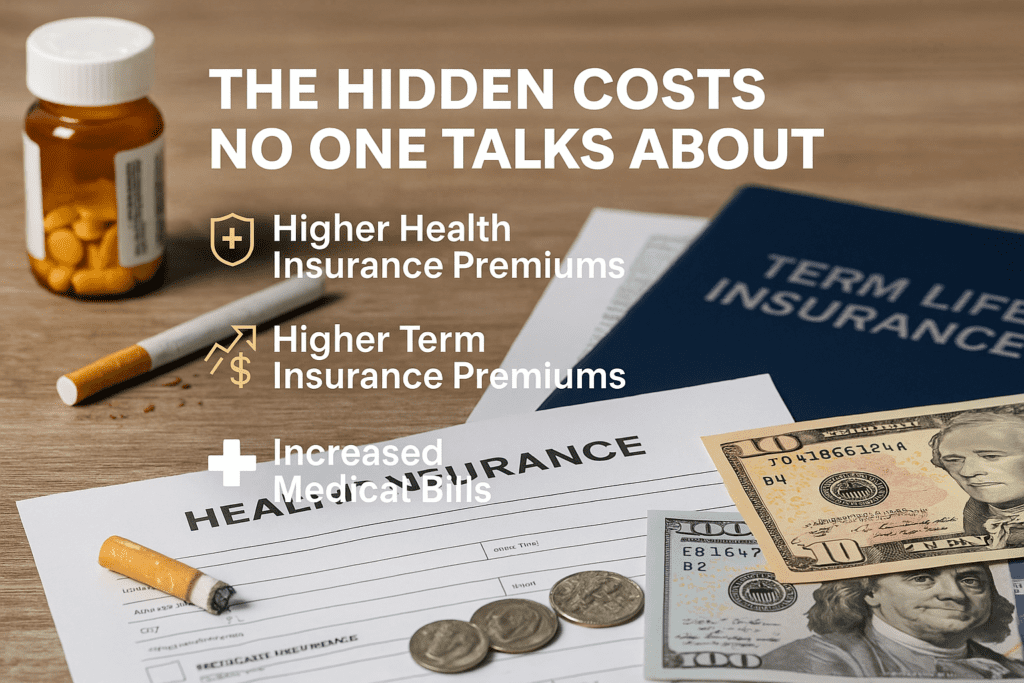

🏥4. Hidden Cost of smoking in India Nobody Talks About

Smoking doesn’t just cost cigarette money.

It creates multiple long-term financial burdens.

A. Higher Health Insurance Premiums

Smokers pay 30% to 100% higher health insurance premiums in India. Click here to read more about benefits of Insurance.

Example:

- Non-smoker (Age 30): ₹8,000/year

- Smoker: ₹12,000–₹16,000/year

Over 20 years, this adds ₹80,000 to ₹1.6 lakh extra.

B. Higher Term Insurance Premiums

Smokers pay 40%–80% higher term insurance premiums.

Example (₹1 crore cover):

- Non-smoker: ₹8,500/year

- Smoker: ₹12,000–₹15,000/year

Extra lifetime cost: ₹70,000 to ₹1.3 lakh

C. Increased Medical Bills

Medical costs for smokers are 30%–50% higher due to:

- Lung disease

- Heart disease

- COPD

- Cancer screenings

- Hospitalisation

Estimated extra lifetime cost: ₹4–10 lakh

✅ True Cost of Smoking in India

Cigarettes + Insurance + Medical bills + Lost compounding

👉 ₹50 lakh to ₹1.5 crore lifetime loss

🧠 5. Why Smokers Underestimate the Cost of Smoking in India

Most smokers think:

“Ek cigarette toh sirf ₹15 ki hai.”

They forget:

- ₹15 × 10 cigarettes × 365 days

- Daily recurring expense

- Long-term compounding loss

Small habits feel cheap today,

but become massive financial drains tomorrow.

🌱 6. Best Way to Reduce the Cost of Smoking in India (Gradual Quitting Plan)

Quitting gradually works better than quitting suddenly.

📊 Step-by-Step Reduction Plan

| Phase | Daily Cigarettes | Monthly Saving | 20-Year Wealth @12% |

| Phase 1 | Reduce by 25% | ₹1,125 | ₹9–10 lakh |

| Phase 2 | Reduce by 50% | ₹2,250 | ₹19–20 lakh |

| Phase 3 | 2 per day | ₹3,600 | ₹31–32 lakh |

| Phase 4 | Quit | ₹4,500 | ₹39–41 lakh |

💡 7. Why Quitting Smoking Improves Financial Freedom

Reducing the cost of smoking in India helps you:

- Save more money

- Pay lower insurance premiums

- Reduce medical bills

- Gain compounding years

- Invest in SIPs, NPS, FD, gold, or business

- Achieve financial freedom faster

🔥 Final Thought: Cost of Smoking in India vs Your Future

A cigarette burns for 5 minutes.

But the cost of smoking in India lasts for decades.

You can either burn money…

or build wealth.

One decision today can save ₹40 lakh+.

Click here to build your ultimate Baby Budget today.