Algo Trading in India: A Beginner’s Guide

The Indian stock market is a dynamic landscape, and keeping up with the pace can be challenging. This is where algo trading in India comes in. Imagine a tool that can analyze markets, identify opportunities, and execute trades automatically – that’s the power of algo trading.

What is Algo Trading in India?

Algo trading, short for algorithmic trading, uses computer programs (algorithms) to automate trading decisions. These algorithms are based on pre-defined rules that consider factors like price movements, technical indicators, and market sentiment.

Think of it like a recipe for your trading strategy. You define the ingredients (trading rules) and the algorithms follow them to the letter, removing emotions and human error from the equation.

Benefits of Algo Trading in India

- Traders are given the best possible prices.

- Instant and accurate placement of trade orders

- To avoid significant price changes, trades are timed correctly and instantly.

- Reduced chance of errors based on emotional and psychological factors by human traders.

- Lower transaction costs.

- Simultaneous automated checks on various market circumstances.

- Decreased risk of manual mistakes when placing trades.

- Algo trading can be back-tested using available historical and real-time data to see if it is a legitimate trading strategy.

- Effective for time-conscious trading.

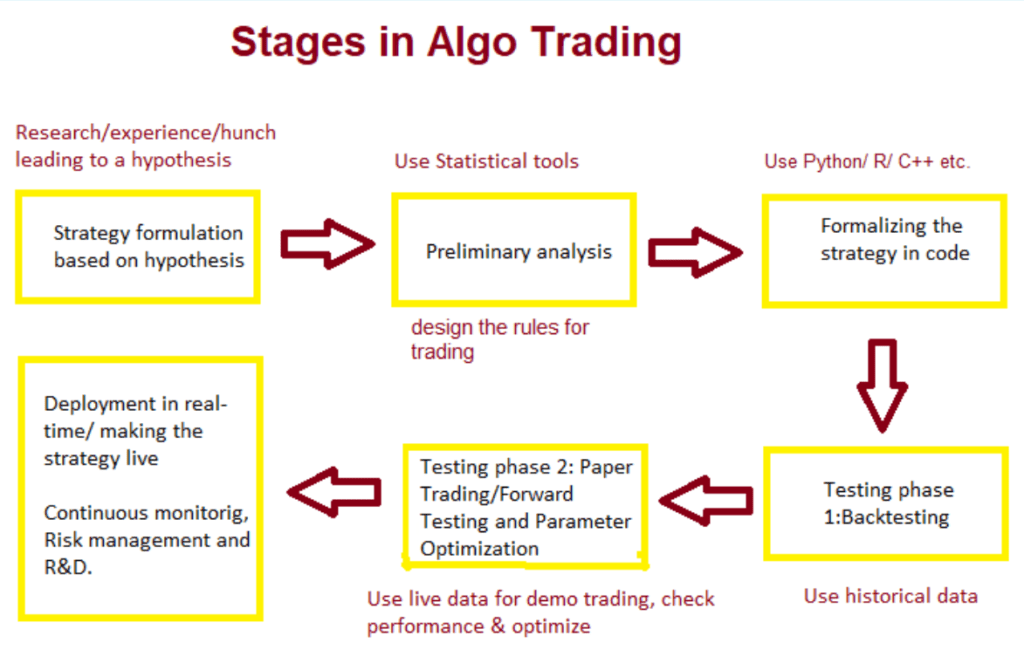

How does Algo Trading work in India

- Form a trading idea based on experience or research.

- Develop a strategy with entry and exit conditions.

- Test the strategy with historical data (backtesting).

- Refine the strategy in a simulated market (paper trading).

- Deploy the strategy to trade live in the market.

- Continuously monitor and adjust the strategy.

Getting Started with Algo Trading in India

If you’re interested in algo trading, here are some initial steps:

- Educate Yourself: Learn about the basics of algo trading, technical analysis, and risk management.

- Develop Your Strategy: Define your trading goals and identify suitable strategies.

- Choose a Platform: Select a trading platform that supports algo trading in India and caters to your needs.

- Start Small: Begin with a small amount of capital and a basic strategy before scaling up. To get started click here.

Conclusion

Algo trading in India can be a powerful tool for active traders, but it requires knowledge, discipline, and a well-defined strategy. Carefully evaluate your risk tolerance and comfort level before diving in. Remember, algo trading is a tool, and like any tool, its success depends on the user.