Investing Made Easy: Active vs Passive Fund

The world of investing can be difficult to understand, especially for beginners. One of the first significant decisions you’ll face is choosing between active and passive investing. Let’s break down these two popular approaches to funding and help you determine which one aligns better with your risk tolerance and financial goals.

Active Investing Explained

Imagine a skilled investor who watches the market carefully, does a lot of research on companies, and buys and sells stocks to try to beat the market. That’s what active funding is all about.

Active fund managers are in charge of actively managed funds. These managers believe they can find stocks that are priced too low and can make more money than the overall market. They buy and sell stocks based on what they think will happen in the market.

However, active funding isn’t free. Since it takes a lot of time and skill to research and make decisions, active funds usually cost more than passive funds. This is because fund managers have to spend money on research and resources to make the best choices. So, while active funding could bring bigger rewards, it can also be more expensive.

Who Should Consider Active Investing?

Active investing might suit investors with a high-risk tolerance, a strong understanding of the stock market, and the time to dedicate to researching potential investments.

Passive Investing

Passive investing adopts a more laid-back approach. Instead of attempting to outperform the market, passive investors aim to match the market’s performance over time.

Index Funds: A popular tool for passive investing is index funds. These funds replicate a particular market index, like the Nifty 50 or Sensex. By buying units of an index fund, you essentially own a small portion of each company in the index.

Benefits of Passive Investing:

- Lower Costs: Index funds generally come with lower expense ratios compared to actively managed funds. This translates to potentially higher returns for you in the long run.

- Diversification: Index funds give you instant diversification, which means you can invest in many companies all at once. For example, instead of buying stocks from just one company, you can own pieces of lots of different companies. As a result, this helps spread out the risk, so if one company doesn’t do well, others might do better. Therefore, index funds make it easier to invest in a variety of companies without needing to pick them individually.

- Long-Term Focus: Passive investing is all about thinking long-term to build wealth. In other words, instead of trying to make quick profits, you focus on growing your money over time. This approach can help you stay steady, even when the market goes up and down. Therefore, by sticking with it, you can ride out the ups and downs of the market and see better results in the long run.

Who Should Consider Passive Investing?

Passive investing is a compelling option for investors seeking a low-cost, diversified, and long-term approach to wealth building. It’s also suitable for those who may not have the time or expertise to actively manage their investments.

Example of Passive Investing in India

Several index funds are available in India, such as Nifty 50 Index Funds or Sensex Index Funds. These passively track their respective indices.

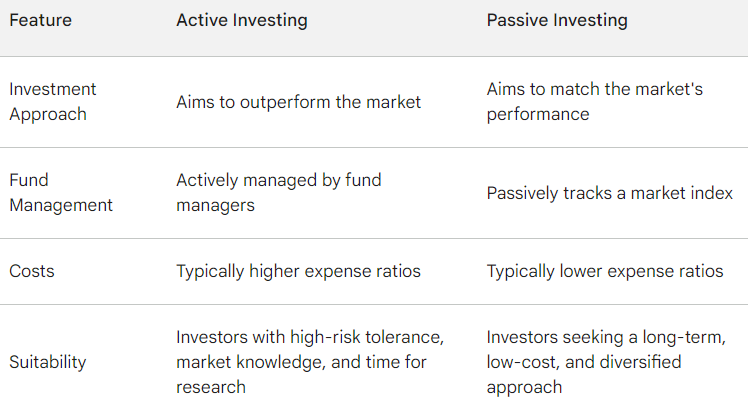

Differences between Active and Passive Investing

To get the detailed guidance about active and passive investments click here.

Conclusion

The choice between active and passive funding ultimately depends on your individual circumstances and financial goals. If you’re a beginner, starting with passive investing through index funds can be a prudent strategy. As you gain experience and knowledge, you can explore incorporating actively managed funds into your portfolio for potentially higher returns, but be prepared for the associated risks and costs.