7 Types of Mutual Funds in India Every Beginner Should Know

Mutual funds are one of the most popular investment options in India, offering something for every kind of investor from cautious savers to aggressive wealth builders. But with so many choices available, it’s easy to feel overwhelmed. That’s where understanding the types of mutual funds becomes crucial. Each type is designed to serve a different financial goal, time horizon, and risk appetite. Whether you’re looking for long-term growth, stable income, tax savings, or even international exposure, there’s a mutual fund suited for your needs. In this guide, we break down all the major types of mutual funds in India in simple terms, so you can invest smarter and with more confidence.

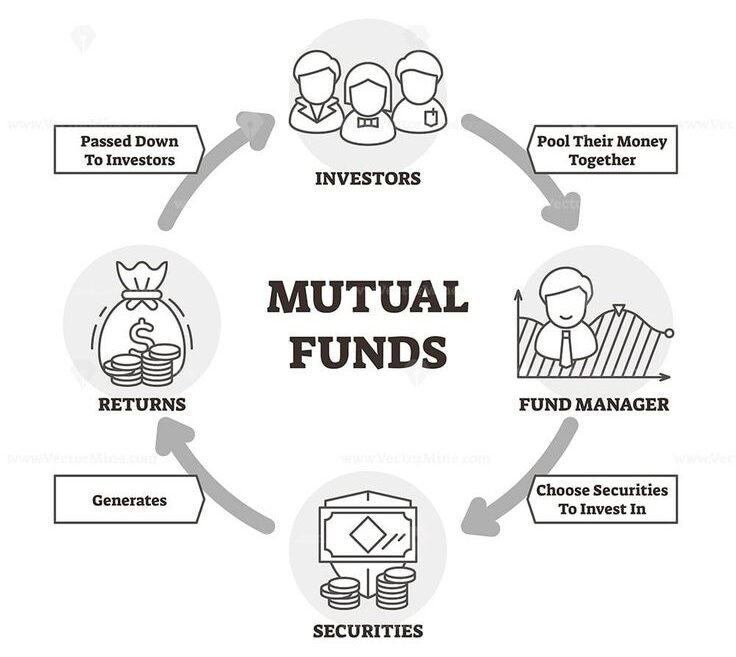

What Are Mutual Funds?

Mutual funds are collective investment schemes that pool money from multiple investors and invest it in a diversified portfolio of assets like stocks, bonds, or a combination of both. This diversification spreads risk and increases the potential for better returns compared to investing in a single stock or asset. Think of it like joining a group tour: everyone contributes to the cost, and a guide (the fund manager) leads the way to the best destinations (investments). To choose wisely, you need to understand the types of mutual funds available in the market

Types of Mutual Funds in India (Explained Simply)

Let’s explore the types of mutual funds in India using everyday analogies so you can understand them better:

1. Equity Funds: A Type of Mutual Fund for Growth

Among all the types of mutual funds, equity funds typically carry higher risk. Imagine a basket filled with various delicacies, each delicacy representing a company’s stock. Equity funds invest primarily in shares of companies with the aim of growing your portfolio over time.

- Benefits: High growth potential; suitable for long-term goals like retirement or children’s education

- Risks: Volatile in the short term due to stock market fluctuations

- Best For: Young investors and those with a higher risk appetite

Subtypes include:

- Large-cap funds

- Mid/small-cap funds

- Multi-cap funds

- Sectoral and thematic funds

2. Debt Funds: A Type of Mutual Fund for Stability

Debt funds are like larger, more sophisticated piggy banks. They invest in fixed-income securities such as government bonds and corporate bonds, providing regular interest income.

- Benefits: Lower risk than equity funds, stable income

- Risks: Lower returns than equity funds; interest rate changes can affect value

- Best For: Conservative investors, short-term goals, emergency fund parking

Popular types:

- Liquid funds

- Corporate bond funds

- Short-term funds

3. Balanced or Hybrid Funds: A Type of Mutual Fund Offering Balance

Balanced funds are like having both a spice basket (equity) and a piggy bank (debt) in one box. hybrid funds offer a compromise between risk and reward among various types of mutual funds. These funds invest in a mix of equities and fixed-income instruments.

- Benefits: Balanced returns and risk, suitable for moderate-risk investors

- Risks: Lower growth than pure equity, and lower income than pure debt

- Best For: First-time investors, those seeking stability with moderate returns

Types include:

- Aggressive hybrid funds

- Conservative hybrid funds

- Dynamic asset allocation funds

4. Thematic Funds: A Specialized Type of Mutual Fund

Imagine a collection of toys based on a theme cars, dinosaurs, or superheroes. These types of mutual funds offer focused exposure. Thematic funds invest in companies linked by a specific theme such as technology, healthcare, or ESG (environmental, social, governance).

- Benefits: High returns if the theme performs well

- Risks: High risk due to focus on one sector

- Best For: Experienced investors who believe in a specific industry trend

5. Fund of Funds (FoF): A Type of Mutual Fund That Invests in Other Funds

Rather than directly investing in stocks or bonds, Fund of Funds invest in other mutual funds. It’s like hiring a portfolio manager who then selects other fund managers to work for you.

- Benefits: High diversification; exposure to multiple funds or markets

- Risks: Slightly higher fees; double expense ratios

- Best For: Investors looking for broad diversification and convenience

6. ELSS (Equity Linked Savings Scheme): A Tax-Saving Type of Mutual Fund

ELSS funds are special types of equity funds that offer tax benefits under Section 80C of the Income Tax Act (up to Rs. 1.5 lakh).

- Benefits: High growth potential and tax savings

- Lock-in Period: 3 years (shortest among all tax-saving investments)

- Best For: Salaried individuals and those planning tax-saving investments

7. Offshore Funds: A Global Type of Mutual Fund

Think of offshore funds as a treasure chest located on a remote island. These funds invest in international markets, offering global diversification.

- Benefits: Exposure to global companies like Apple, Tesla, etc.

- Risks: Currency risk and foreign market volatility

- Best For: Advanced investors wanting to diversify globally

How to Choose the Right Type of Mutual Fund

Before investing, ask yourself:

- What is my goal? (Wealth creation, tax-saving, emergency fund?)

- What is my time horizon? (1 year, 3 years, 10+ years?)

- What is my risk appetite? (High, moderate, low?)

Once you have clarity on these, choosing the right type of mutual fund becomes easier.

Conclusion: Simplify, Understand the Types of Mutual Funds, and Grow

Understanding the types of mutual funds in India doesn’t have to be complicated. With the right knowledge and guidance, anyone can build a strong portfolio suited to their financial goals. Whether you’re aiming for long-term growth, regular income, or tax savings, there’s a type of mutual fund for you. The key is to start early, stay consistent, and choose the right partner like Nemi Wealth to guide your journey.

Ready to invest smarter? [Click here to get started with Nemi Wealth.]

FAQs

What are the main types of mutual funds in India and how do they differ?

There are several types of mutual funds in India, each serving different investment needs and risk appetites:

- Equity Mutual Funds invest primarily in stocks and aim for long-term capital appreciation. They’re suitable for investors with higher risk tolerance and long-term goals.

- Debt Mutual Funds invest in fixed-income instruments like bonds and treasury bills. These are ideal for conservative investors looking for steady income with lower risk.

- Hybrid or Balanced Funds combine both equity and debt investments, offering a balance of risk and return great for medium-risk investors.

- Thematic Funds focus on specific sectors or trends (like technology, pharma, ESG). They can offer high returns but are riskier due to sector concentration.

- ELSS Funds (Equity Linked Saving Schemes) are equity funds that offer tax benefits under Section 80C. They come with a 3-year lock-in period.

- Fund of Funds (FoFs) invest in other mutual funds to provide broad diversification.

- Offshore Funds invest in global markets, giving you international exposure.

Each type has its own risk-return profile, investment horizon, and tax implications. Choosing the right one depends on your goals, risk capacity, and financial plan.

Which type of mutual fund is best for beginners?

For beginners, Hybrid Funds and Large-Cap Equity Funds are typically the safest entry points.

- Hybrid Funds (especially conservative or balanced hybrid) offer a mix of equity and debt, reducing overall risk while providing reasonable growth.

- Large-Cap Equity Funds invest in well-established companies and are relatively stable compared to mid- or small-cap funds. They help beginners experience equity investing with less volatility.

If you’re investing for tax-saving purposes, ELSS Funds are a smart choice because they combine the benefits of equity investing and tax deductions. It’s also important to start with SIP (Systematic Investment Plan) to build a disciplined habit and spread out your risk over time.

How are mutual funds taxed in India?

Mutual funds in India are taxed based on two factors:

- The type of fund (Equity or Debt)

- The holding period (Short-term or Long-term)

Equity Funds:

- Short-Term Capital Gains (STCG): If sold within 12 months, taxed at 15%.

- Long-Term Capital Gains (LTCG): Gains above ₹1 lakh (after 12 months) are taxed at 10% without indexation.

Debt Funds:

- For investments made after April 1, 2023, all capital gains from debt mutual funds are added to your income and taxed as per your income tax slab. Indexation benefits are no longer available.

ELSS Funds: These follow equity taxation. They also offer tax deduction up to ₹1.5 lakh under Section 80C.

Dividends: Mutual fund dividends are added to your income and taxed as per your slab rate. Always consult a tax expert or financial advisor if your investments are large or spread across multiple fund types.

How do I decide which type of mutual fund suits my goals?

The right mutual fund depends on your:

- Risk appetite (low, moderate, high)

- Investment objective (wealth creation, emergency fund, tax saving, income generation)

- Time horizon (short-term: 0–3 years, medium-term: 3–5 years, long-term: 5+ years)