Economic Trends and P2P Lending

Peer-to-peer (P2P) lending has emerged as a popular alternative investment avenue in India. It allows individuals to borrow and lend money directly, bypassing traditional financial institutions. This blog explores the impact of economic trends on P2P lending and equips you, the savvy investor, with valuable insights to make informed investment decisions.

Economic Trends and P2P Lending

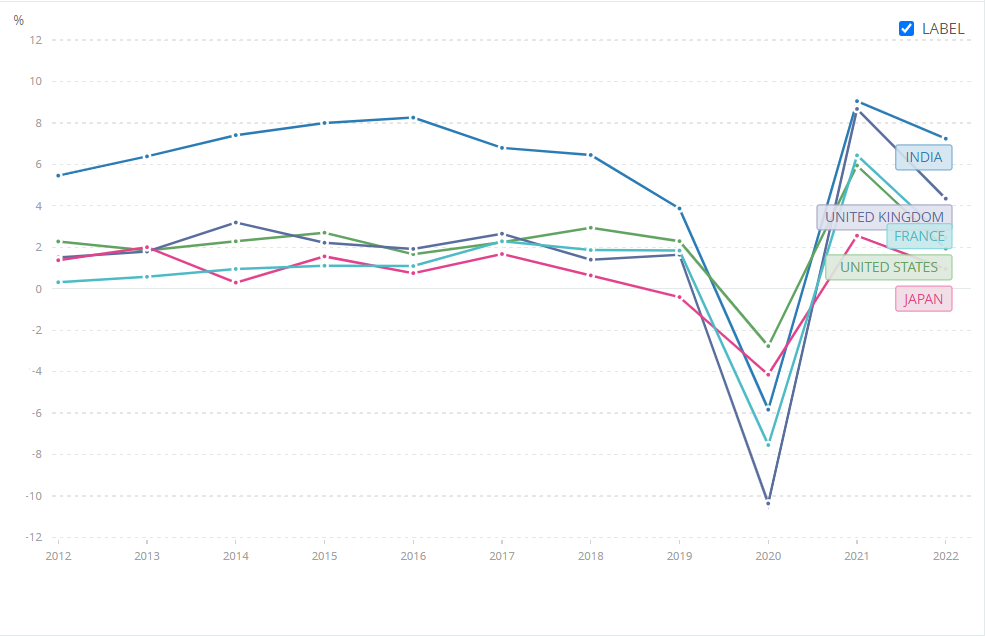

The Indian economy, like any other, experiences fluctuations. These fluctuations, influenced by factors like interest rates, inflation, and GDP growth, can significantly impact P2P lending. Let’s delve deeper into how these key economic trends affect borrowers, lenders, and the P2P platform itself.

- Interest Rates: When interest rates rise, borrowing becomes more expensive. This can lead to a decrease in loan applications on P2P platforms as borrowers may find traditional banks more attractive with potentially lower interest rates. Conversely, rising interest rates can benefit lenders on P2P platforms as they can earn higher returns on their investments.

- Inflation: Inflation erodes the purchasing power of money. In an inflationary environment, lenders may see a decrease in their real returns on P2P investments even if the nominal interest rates remain the same. Borrowers, on the other hand, may find it easier to repay loans as inflation reduces the real value of their debt.

- GDP Growth: A strong and growing GDP indicates a healthy economy with increased job opportunities and disposable income. This can lead to a rise in loan applications on P2P platforms as individuals and businesses have greater access to credit.

P2P Lending Examples in the Indian Context

Let’s consider some real-world examples to understand how economic trends can influence P2P lending in India:

- In 2024 the RBI increased interest rates to combat inflation. This could potentially lead to a decrease in loan applications on P2P platforms as borrowing becomes more expensive. However, it could also benefit existing lenders by offering them higher returns on their investments.

- The COVID-19 pandemic in 2020 had a significant impact on the Indian economy. This resulted in a decrease in loan applications and potentially higher defaults on existing P2P loans due to job losses and financial hardship. However, as the economy recovers in 2024 we might see a renewed rise in P2P lending activity.

Investment Strategies for a Savvy Investor

Understanding how economic trends impact P2P lending empowers you to make informed investment decisions. Here are some strategies to consider:

- Diversification: Spread your investments across borrowers with varying credit profiles to mitigate risk.

- Invest for the Long Term: P2P lending is a long-term investment strategy. Economic fluctuations may cause short-term variations in returns, but a long-term approach can help smooth out these effects.

- Stay Informed: Regularly monitor economic trends and their potential impact on P2P lending. Remain updated on the performance of the Indian economy and adjust your investment strategy accordingly.

Conclusion

The P2P lending landscape in India is dynamic and influenced by various economic factors. By understanding these trends and employing strategic investment practices, you can leverage P2P lending as a valuable tool to achieve your financial goals.