7 Key Reasons Why a Child Education Plan Is a Must for Every Parent in India

Every financial goal needs a clear execution roadmap and when it comes to your child’s future, you can’t afford to leave things to chance. That’s where a Child Education Plan steps in. In today’s ever-changing economy, education costs are skyrocketing, and families are getting smaller, leaving a single earning member to manage all expenses. Without a proper plan in place, funding your child’s higher education could become an overwhelming burden.

In this blog, we’ll walk you through 7 reasons why a Child Education Plan is essential for Indian parents, how you can structure your investments, and what types of plans are available. We’ll also share practical steps, a relatable story, and frequently asked questions to guide you toward a financially secure future for your child.

1. Rising Education Costs Demand Early Planning

The cost of education in India has been steadily increasing due to inflation, competition, and an increasing preference for private institutions. From school fees and books to coaching classes and professional courses, every element of a child’s learning journey now carries a significant price tag.

Especially in the case of higher education, whether in India or abroad, expenses often run into several lakhs or even crores. Without a structured Child Education Plan, families may find themselves borrowing heavily or compromising on the quality of education their child deserves.

2. Smaller Families, Bigger Financial Pressure

As the traditional joint family system is replaced by nuclear households, the responsibility of managing the child’s education falls squarely on the parents often on just one earning member. Rising inflation, healthcare expenses, and lifestyle costs only add to the financial strain.

A Child Education Plan acts as a financial cushion. It ensures that even if unexpected events occur, job loss, illness, or market changes your child’s education remains on track.

3. Education Is a Right, But It’s Getting Expensive

In India, education is considered a fundamental right and a key pillar of socio-economic upliftment. Yet, despite government schemes like Sarva Shiksha Abhiyan, quality education often remains inaccessible for families without proper financial planning.

With competitive exams, foreign university applications, and private coaching now a norm, your child’s potential must not be hindered by a lack of funds. This is where a Child Education Plan ensures your finances grow with your child’s age and ambition.

4. What Is a Child Education Plan?

A Child Education Plan is a hybrid financial tool — typically offered by insurance companies — that combines investment and insurance. It allows you to invest regularly (monthly, quarterly, half-yearly, or annually) and in return, provides a lump sum or staggered payouts during key education milestones.

There are two main categories:

1. Private Child Education Plans

These are offered by private financial institutions or insurers. The two most common types are:

- Traditional Endowment Plans

- Guaranteed returns and life cover

- Lump sum payout at maturity

- Suitable for conservative investors

- Ideal for safety-first goals

2. Unit Linked Insurance Plans (ULIPs)

- Market-linked returns (stocks, bonds)

- Potential for high growth

- Comes with life insurance cover

- Ideal for parents with higher risk appetite and long investment horizons

In Government Child Education Plans

These are schemes offered by the Indian government to promote education and savings:

1. Sukanya Samriddhi Yojana (SSY)

- Designed for girl children

- Higher interest rates compared to regular savings

- Tax benefits under Section 80C

- Maturity amount is tax-free

- Can be opened at a bank or post office

2. Sarva Shiksha Abhiyan (SSA)

- A government program for free and compulsory education for children aged 6–14

- While not an investment scheme, SSA highlights the state’s focus on universal access to education

5. Plan Ahead to Beat Inflation

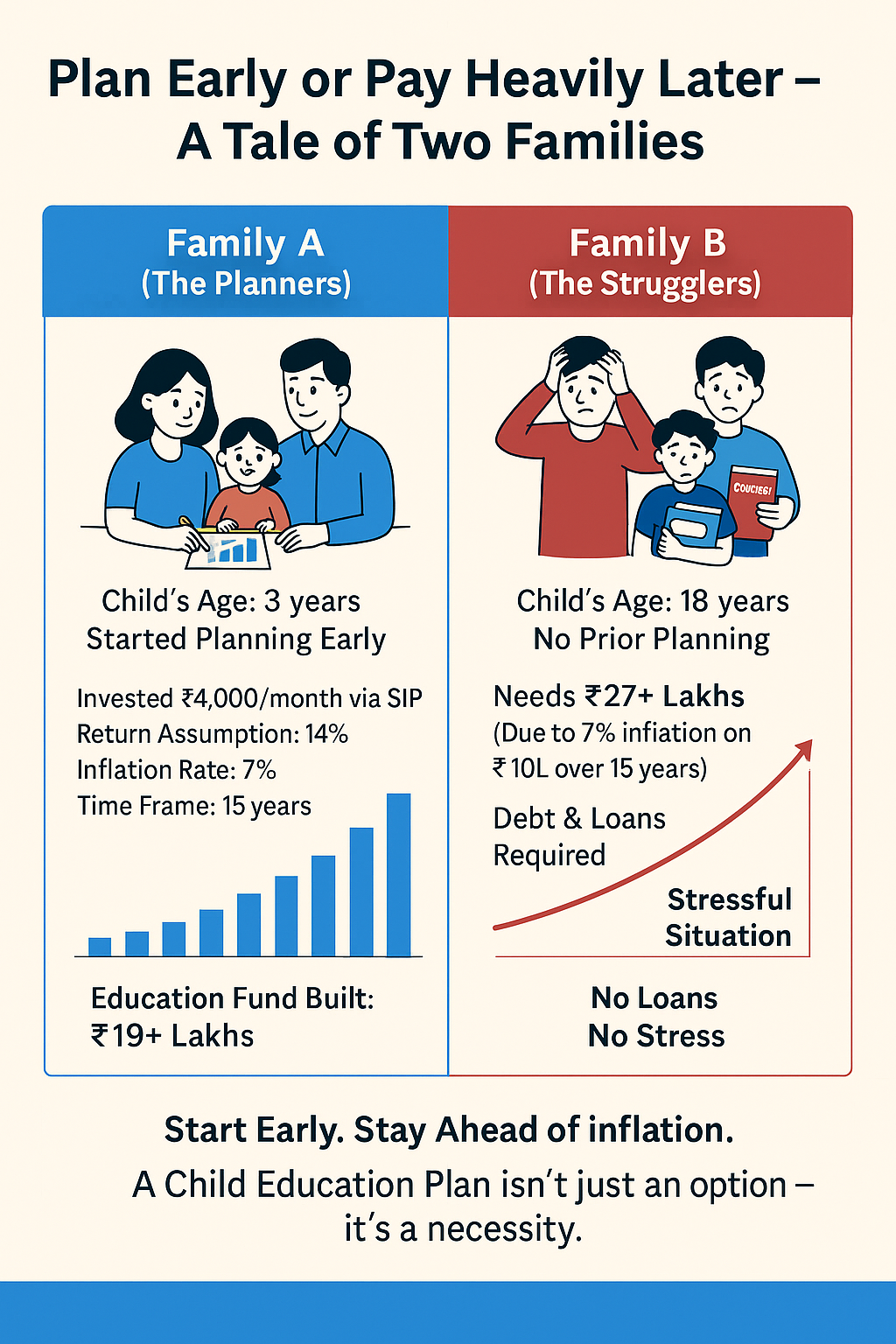

Let’s understand with an example how a Child Education Plan helps beat inflation and uncertainty. Imagine Family A and Family B, neighbors in a small Indian town:

- Family A has a 3-year-old child

- Family B has an 18-year-old child preparing for college

One evening, Family A hears Family B’s father saying, “I don’t have enough savings, I’m already in debt. I don’t know how I’ll pay the college fees.” This leaves Family A worried. Back home, they talk about it. Family A decides to take action early and invest in a Child Education Plan. The mother asks, “Our child is just 3 years old. Will it really make a difference?”

Let’s see the math:

- Current higher education cost: ₹10,00,000

- Expected inflation: 7% per year

- Time horizon: 15 years

- Expected returns on investment: 14%

By starting early, Family A can invest small monthly SIPs or a lump sum amount and build a strong education fund, instead of scrambling at the last minute.

6. SIPs vs Lump Sum – Choose Your Route

Depending on your financial situation, you can choose to invest in:

1. SIP (Systematic Investment Plan)

- Monthly disciplined investments

- Rupee cost averaging

- Lower initial capital required

- Great for salaried individuals

2. Lump Sum Investment

- One-time large investment

- Ideal if you receive a bonus, inheritance, or fixed maturity amount

- Immediate compounding benefit

7. Peace of Mind for You and Your Child

Financial stress can severely affect decision-making and peace of mind. A well-chosen Child Education Plan:

- Offers clarity and confidence for the future

- Helps you handle emergencies without dipping into education funds

- Prepares your child for academic freedom without financial guilt

- Ensures you never have to say, “We can’t afford it” at the crucial time

Final Thoughts

A Child Education Plan is not just about money. It’s about dreams, dignity, and the ability to empower your child without financial pressure. Whether your child dreams of becoming a doctor, artist, scientist, or entrepreneur, the cost of enabling that dream starts today. Let the cost of education never become the reason your child holds back.

At Nemi Wealth, we help you build, protect, and grow your financial future with expert-led solutions in investing, planning, and protection. Click here to get started and secure your journey today.

Frequently Asked Questions (FAQs)

When should I start a Child Education Plan?

The earlier, the better. Ideally, you should start when your child is born or within the first few years. This gives your investments enough time to grow and beat inflation.

What’s better a traditional plan or a ULIP?

If you prefer guaranteed returns and low risk, go with a traditional endowment plan. If you’re comfortable with market fluctuations for potentially higher gains, ULIPs are more suitable.

Are there tax benefits in Child Education Plans?

Yes. Most plans offer tax deductions under Section 80C. The maturity amount may also be tax-exempt, depending on the plan structure.

Can I use SIPs to invest in a Child Education Plan?

Absolutely. SIPs are a great way to build a large corpus over time with small, regular contributions. They also instill investment discipline.

What if the policyholder dies during the term?

Most plans include a waiver of premium and a life insurance component. This ensures that the child continues to receive funds even if something happens to the parent.