The Impact of Inflation on Your Investment Portfolio

Imagine this: You saved ₹10,000 under your mattress five years ago. Today, you lift the mattress and find the same ₹10,000 untouched. But when you go to buy something, you realise that money can buy a lot less than it used to.

That’s inflation. It didn’t scream. It didn’t crash markets. But quietly, it stole your purchasing power bit by bit. In this blog, let’s understand:

- What inflation is

- How it impacts your money

- Why you shouldn’t ignore it

- How to fight it smartly using financial planning and asset allocation

What is Inflation?

Inflation is the rise in prices of goods and services over time. It reduces the purchasing power of your money. For example:

- In 2013, one litre of petrol cost ₹70

- In 2023, it crossed ₹100

If your income or returns don’t increase in the same proportion, you’re losing money in real terms.

Types of Inflation

| Type | Meaning |

|---|---|

| Demand-pull | Too much money chasing too few goods |

| Cost-push | Rising production costs passed on to consumers |

| Built-in | Inflation linked to wage demands and business price hikes |

Why Inflation is Called a Silent Thief

Inflation doesn’t crash your bank balance. It slowly chips away at what you can do with that money.

Example:

Let’s say you need ₹50,000 today for a vacation.

With 6% average annual inflation:

- In 5 years, you’ll need – ₹67,000 for the same trip.

- In 10 years, you’ll need – ₹90,000.

If your investments don’t beat inflation, you are essentially losing wealth even if you’re earning returns.

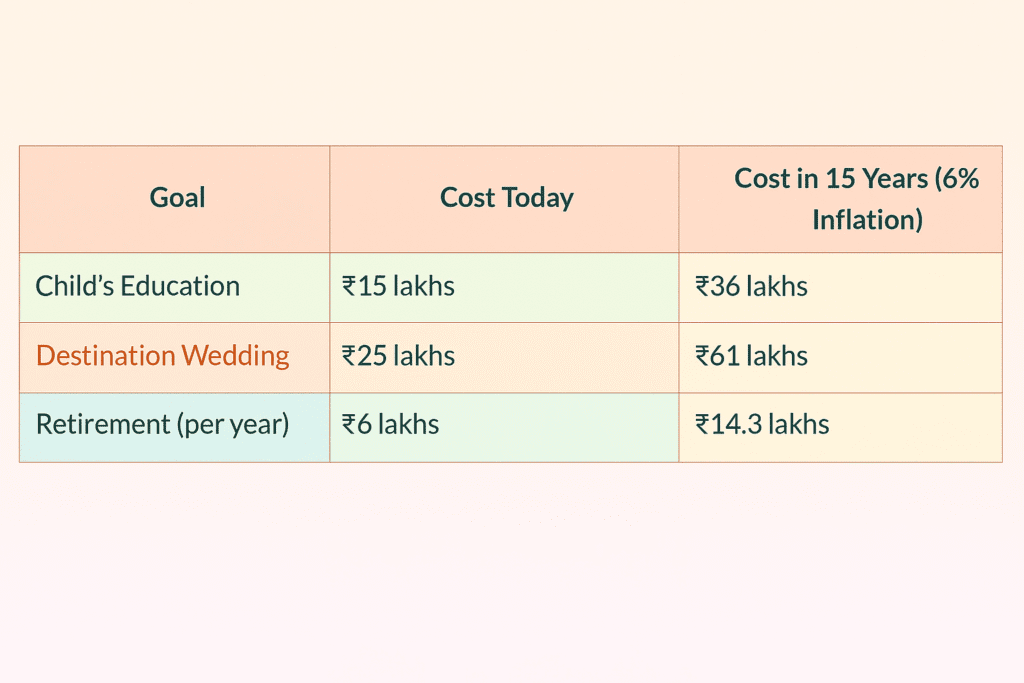

How Inflation Affects Your Financial Goals

Inflation impacts every goal from education and marriage to retirement.

A few real examples:

Without proper planning, your savings might fall short even if you are regularly investing.

Where Inflation Hurts the Most

1. Savings in Bank Accounts

Most Indian savings accounts offer 2.5%–4% interest, while inflation averages 5%–6%. Your money is losing value every year if parked idle.

2. Fixed Deposits

FDs are safe, yes. But if they give 6.5% interest and inflation is at 6%, your real return is just 0.5%. After tax, it might even be negative.

3. Cash Holdings

Keeping cash “just in case”? Good for emergencies, bad for long-term value. ₹1 lakh in cash today won’t have the same power in 2030.

Inflation-Proof Your Portfolio: Where to Invest

To truly build wealth, your portfolio must beat inflation consistently. Let’s explore how:

1. Equity Mutual Funds

- Historically offer 12–15% returns

- Suitable for long-term goals

- Help in beating inflation significantly

- SIPs allow disciplined investing

- Great for: Retirement, child education, wealth creation

- Avoid if: You need the money in 1–2 years

Example: Nifty 50 TRI has grown over 11.5% CAGR over the past 10 years.

2. Equity Stocks

- High potential for returns (and risks)

- Requires knowledge, research, and patience

- Can create long-term wealth far above inflation

- Great for: Wealth builders and stock-savvy investors

- Avoid if: You can’t handle volatility

3. Real Estate

- Rental income + appreciation can beat inflation

- Good hedge in countries like India

- Liquidity and maintenance can be issues

- Great for: Physical asset lovers, long-term holding

- Avoid if: You want flexibility or low maintenance

4. Gold

- Historically preserved purchasing power

- Performs well during economic uncertainty

- Best when 5–10% of your portfolio

- Great for: Diversification and inflation hedge

- Avoid overexposure – returns may not beat equity

5. Inflation-Linked Bonds (ILBs)

- In India, RBI offers inflation-indexed bonds sometimes

- Interest is directly linked to inflation rate

- Great for: Risk-averse investors

- Availability is limited

6. Balanced Advantage Funds (BAFs)

- Mix of equity and debt

- Adjusts allocation based on market conditions

- Lower volatility, reasonable returns

- Great for: First-time investors or those seeking inflation-plus returns with lower risk

7. Multi-Asset Allocation Funds

- Invest in equity, debt, gold and more

- Diversification helps tackle inflation

- Dynamic allocation handles market swings

- Great for: Long-term goals, one-stop portfolio option

How to Build an Inflation-Beating Portfolio

Use asset allocation a mix of various asset classes tailored to your risk tolerance, goals, and timeline.

Sample Inflation-Beating Portfolio

| Risk Profile | Equity | Debt | Gold |

|---|---|---|---|

| Conservative | 40% | 50% | 10% |

| Balanced | 60% | 30% | 10% |

| Aggressive | 80% | 10% | 10% |

Review this every year. As your life and goals change, your portfolio should adapt too.

Bonus: Tax-Efficient Investing also Matters

Even if your returns beat inflation, taxes can reduce your gains. Plan smart:

- Use Equity Mutual Funds (LTCG taxed at 10%)

- Choose ELSS (Equity-Linked Savings Scheme) for 80C tax benefits

- Use Debt Funds with indexation benefits if held >3 years (until 2023 rules)

- Consider NPS and PPF for long-term tax-saving and inflation protection

Tips to Outsmart Inflation

- Start Early

The earlier you invest, the more compounding works for you. ₹5,000/month for 20 years grows much more than ₹10,000/month for 10 years. - Track Real Returns

Don’t just see the % return subtract inflation to find the real gain. - Review Yearly

Inflation levels change. So should your investment plan. - Avoid Idle Money

Money in a drawer or low-interest account = value loss. - Reinvest Gains

Use dividends or maturity proceeds to reinvest and grow your base.

Key Takeaway

Inflation may be silent, but its impact is loud. It eats away your dreams, your purchasing power, and your future lifestyle if left unchecked.

The solution?

Build an inflation-beating investment plan. Diversify. Start early. Stay consistent. That’s where Nemi Wealth comes in helping you choose the right mix of assets, optimise returns, and stay ahead of inflation, so your money works harder than inflation. Not the other way around.

One Comment