Basics of Mutual Funds to Know Before You Invest Your First ₹10,000

When it comes to investing, understanding the basics of mutual funds is a great starting point. Whether you’re just starting your financial journey or looking to diversify your investments, mutual funds offer a simple, flexible, and accessible option. They are managed by experts and can suit almost every type of investor. In this blog, we’ll guide you through the basics of mutual funds in clear, easy-to-understand language so you can feel confident in making informed decisions.

What Are Mutual Funds? (Understanding the Basics of Mutual Funds)

To put it simply, mutual funds are a way for many people to pool their money together and invest in a variety of financial assets such as stocks, bonds, or other market instruments. A professional fund manager handles this collective pool of money and decides where to invest it based on the fund’s goal.

When you invest in a mutual fund, you buy units or shares of that fund. The value of each unit is called the Net Asset Value (NAV). This value changes daily based on how the underlying investments perform. In other words, when the fund’s investments increase in value, so does your investment. Mutual funds are regulated by SEBI (Securities and Exchange Board of India), making them a safe and transparent option for investors.

Types of Mutual Funds (Exploring the Basics of Mutual Funds Categories)

There are many mutual funds to choose from, depending on your financial goals and risk appetite. Here are the most common types:

1. Equity Funds

These funds mainly invest in stocks of companies across sectors. They are designed for investors seeking long-term capital growth. While they offer higher return potential, they also carry higher risks due to market fluctuations.

2. Debt Funds

Debt funds invest in fixed-income instruments like government bonds, debentures, and treasury bills. These are more stable and less volatile, making them suitable for conservative investors or short- to medium-term goals.

3. Hybrid Funds

Hybrid funds combine both equity and debt instruments. This blend offers a balanced approach—some growth from equities and some stability from debt. They are ideal for investors who prefer moderate risk.

4. Index Funds

These passively managed funds aim to replicate the performance of a market index, such as the Nifty 50 or Sensex. Because they follow the index, they typically have lower management fees and are a good choice for long-term, cost-conscious investors.

Why Should You Consider MFs? (Benefits in the Basics of Mutual Funds)

Let’s explore some major reasons why mutual funds are widely recommended by financial experts:

1. Diversification

Your money is spread across different companies, sectors, and asset classes. This reduces the impact of poor performance in one investment.

2. Professional Management

You don’t have to be an expert. Fund managers, backed by research teams, manage the fund and make investment decisions for you.

3. Liquidity

Most mutual funds (except ELSS and close-ended funds) allow you to redeem your units at any time. This gives you easy access to your money.

4. Flexibility

There is a mutual fund for every investor, whether you’re looking for aggressive growth, capital protection, or regular income. You can invest a lump sum or choose SIPs (Systematic Investment Plans) for disciplined investing.

5. Affordability

You can start investing in mutual funds with as little as ₹500 per month via SIPs. This makes mutual funds accessible even for small investors.

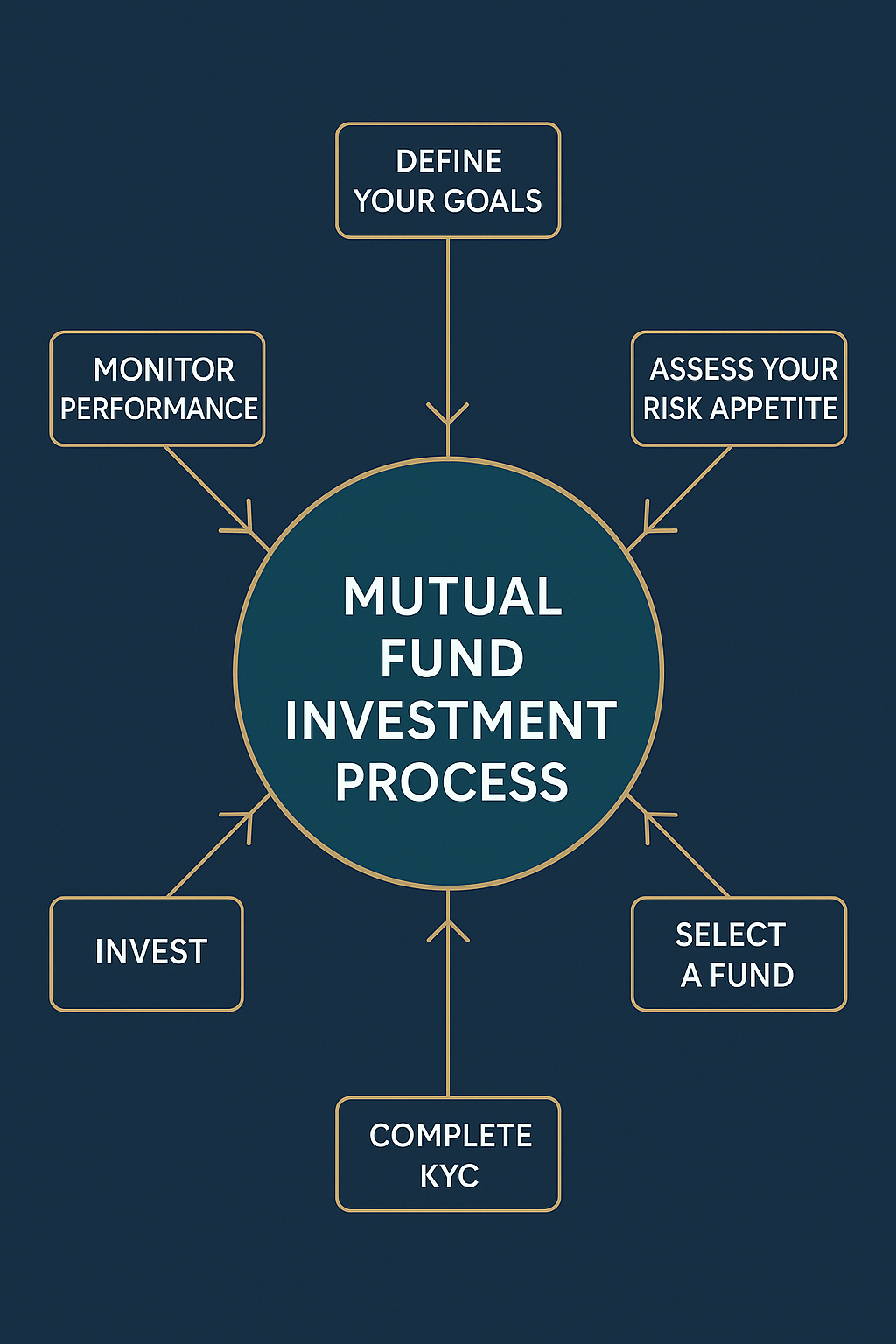

How to Invest in Mutual Funds (Step-by-Step Basics of Mutual Funds Investing)

Getting started with mutual funds is easier than ever. Here’s a simple step-by-step process:

- Define Your Goals: Know your purpose, saving for a house, building a retirement corpus, or children’s education.

- Assess Your Risk Appetite: Understand how much risk you are comfortable taking. This helps in selecting the right type of fund.

- Select a Fund: Choose a fund that matches your goals and risk level. You can do this online or through a financial advisor.

- Complete KYC: Fulfill Know Your Customer (KYC) formalities by submitting documents like PAN, Aadhaar, and a photo.

- Invest: You can invest a lump sum amount or set up a Systematic Investment Plan (SIP) for regular monthly contributions.

- Monitor Performance: Keep track of your fund’s performance, but avoid reacting to every market change. Stay focused on your long-term goals.

Final Thoughts: Learn and Master the Basics of Mutual Funds

Understanding the basics of mutual funds helps you make smart investment choices. They are ideal for growing wealth over time, whether you’re a beginner or looking to add stability to your portfolio. With diversification, expert management, and flexibility, mutual funds can support various financial goals. Still curious about how market ups and downs affect your investments? Don’t miss our blog: Navigating Market Volatility: A Guide for Investors.

At Nemi Wealth, we simplify investing and help you make informed decisions. Let us help you build a smart, risk-aware portfolio that works for your future.

FAQs

Can I start investing in mutual funds with just ₹10,000?

Yes, you absolutely can. Many mutual funds allow you to begin with a lump sum of ₹5,000 or even set up a SIP (Systematic Investment Plan) starting at ₹500 per month. With ₹10,000, you can either invest it all at once or spread it across multiple funds.

Which type of mutual fund is best for beginners?

For beginners, index funds or balanced (hybrid) funds are a good starting point. They are diversified, lower in cost, and offer a balanced risk-reward profile. If you’re new to investing, these options help you get started without too much complexity.

Do mutual funds guarantee returns?

No, mutual funds do not guarantee returns. They are market-linked instruments, which means their performance depends on the assets they invest in (like stocks or bonds). However, they are professionally managed and regulated, making them a reliable long-term investment option.

What is the risk if I invest ₹10,000 in a mutual fund?

The risk level depends on the type of fund. Equity funds carry higher risk but offer higher returns over time. Debt funds are safer but may offer lower returns. You can reduce risk by choosing funds that match your financial goals and time horizon.

How do I track the performance of my mutual fund?

You can track your investment easily through the AMC’s website, apps like myCAMS or KFintech, or consolidated platforms like MF Central. They show you your fund’s NAV, growth, and overall returns over time.