How to Know Your Risk Tolerance Before Investing

How to Find Your Risk Tolerance Before Investing is a question every investor should ask themselves early on. By understanding your comfort with market ups and downs, you’ll be better prepared to make smart, confident investment decisions that align with your goals.

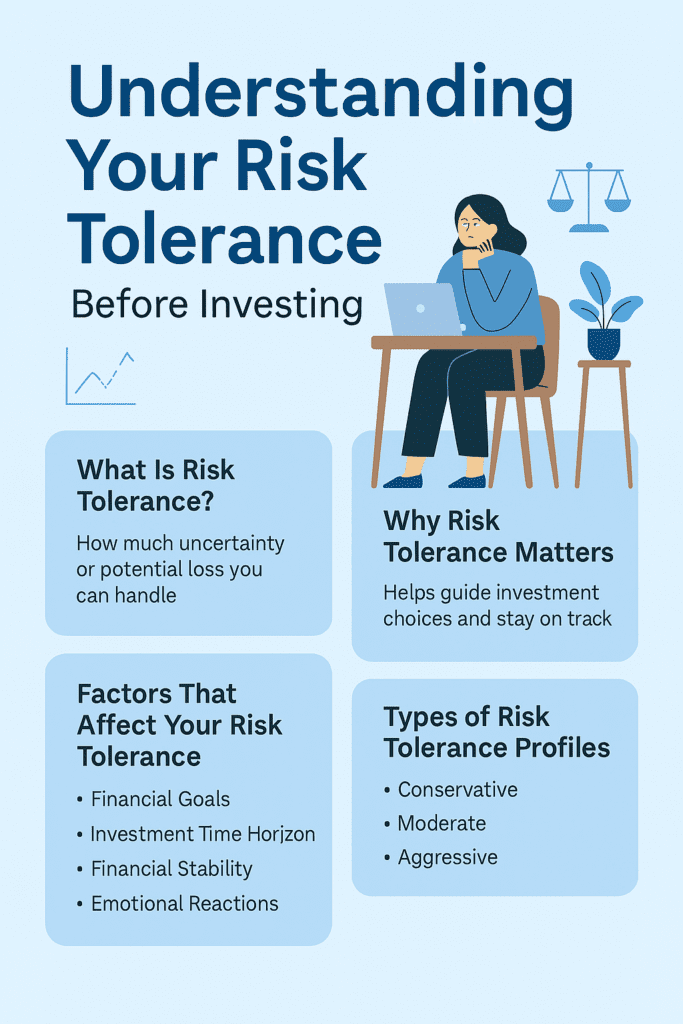

Understanding your risk tolerance is the first step to smart investing. To begin with, this question helps you choose the right investments and remain confident in both calm and volatile markets. In fact, your risk tolerance how much uncertainty or potential loss you can handle is the foundation of a strong financial strategy. As a result, identifying your comfort level can help you avoid emotional decisions and stay on track toward your financial goals.

What Is Risk Tolerance?

Risk tolerance refers to how much uncertainty or potential loss you can handle in your investments. You can learn more about risk tolerance in this Investopedia guide. For example, some investors stay calm during market dips, while others feel anxious with even slight fluctuations. Therefore, knowing where you stand helps you build a portfolio that aligns with your mindset. In addition, understanding your comfort level with risk ensures you don’t panic when the market drops and helps you stay the course for long-term gains.

Why Does It Matter?

Recognizing your comfort with market risk helps you:

- Stick to your long-term financial goals

- Choose investments that match your style

- Try to avoid emotional reactions when markets drop

Assessing Your Risk Tolerance

Several factors shape how much risk you can comfortably take:

Your Financial Goals and Risk Tolerance

Are you saving for a home in 2 years or retirement in 20 or for child education? Short-term goals usually need safer investments, while long-term ones can handle more growth-oriented strategies.

Investment Time Horizon and Risk Tolerance

Longer timeframes allow you to recover from market fluctuations, making it easier to take on higher risk.

Financial Stability and Risk Tolerance

A steady income, savings, or emergency fund makes it easier to handle temporary losses, giving you more flexibility in your strategy.

Emotional Response and Risk Tolerance

Would a 15% drop in your investment make you panic or stay calm? Your emotional reaction to losses helps determine how aggressive or cautious your investment plan should be.

Types of Risk Tolerance Profiles

Conservative

You may have a conservative risk tolerance if you prefer safety and capital preservation. Typically, conservative investors focus on protecting their capital rather than seeking high returns.

As a result, they often invest in fixed-income options like bonds and stay cautious about stock market exposure.

For example, Preeti, a retiree, prefers the stability of fixed deposits. She values peace of mind and steady returns over potential gains from volatile markets.

Moderate Risk Tolerance

A moderate risk tolerance reflects a balanced investment mindset.

In other words, investors with this profile aim to grow their wealth while managing risk effectively.

Consequently, they build a diversified portfolio that combines both stable and growth-oriented assets.

Take Raj, for instance—a middle-aged professional who spreads his investments across stocks and bonds to achieve a balanced risk-reward ratio.

Aggressive Risk Tolerance

An aggressive risk tolerance signals a strong comfort with market ups and downs.

Therefore, these investors are open to short-term losses in exchange for potentially higher long-term returns.

For example, Karan, a young entrepreneur, allocates a large portion of his portfolio to high-growth stocks.

Because of his long-term outlook, he’s willing to take bold risks for greater capital appreciation.

The Importance of Alignment

Aligning your investments with your risk tolerance is crucial for a stress-free investment experience. Nevertheless, going too far outside your comfort zone can lead to sleepless nights during market downturns. On the other hand, being too cautious may result in missed opportunities. Therefore, it’s wise to regularly reassess your comfort level and make changes when necessary. In doing so, you ensure your investment strategy stays aligned with your financial goals and peace of mind.

How to Discover Your Investment Comfort Zone

You don’t have to guess—there are simple ways to understand your personal approach to investment risk:

- Take a free risk profile quiz available online

- Talk to a financial advisor for personalized guidance

- Reflect on past behavior—do you stay calm or panic when markets are volatile?

Final Thoughts

Assessing your tolerance is not a one-time task; it’s an ongoing process. Life circumstances, financial goals, and market conditions evolve, as should your risk tolerance assessment. Regularly revisit your risk profile to ensure your investments align with your comfort level and financial objectives.

Remember, there’s no one-size-fits-all approach to risk tolerance. Each investor is unique. For instance, some may prefer steady returns, while others are comfortable with market swings. In addition, your financial goals and emotional comfort play a big role in shaping your risk profile. As a result, understanding your own tolerance becomes a personal journey. By doing so, you empower yourself to make informed investment decisions that truly support your financial well-being.

Invest wisely, stay informed, and let your tolerance be your guiding light in the dynamic world of investments. If you wish to check your risk tolerance for free, click here.