The Ultimate Baby Budget for New Parents in India (2025 Guide)

Why New Parents Must Plan Early

Becoming a parent is magical. But it also introduces a new financial reality—one that most parents underestimate until it’s too late.

From diapers to doctor visits to school fees, the early years bring continuous expenses. And without a structured baby budget for new parents, parents often slip into stress, impulse spending, or unwanted debt.

This guide gives you a simple, practical A–Z plan to secure your child’s future while keeping your finances healthy today.

The Real Costs of Raising a Child in India

While the joy is priceless, the rising cost of living isn’t. New parents usually face:

1. Monthly Baby Essentials

- Diapers: ₹2,000–₹4,000

- Formula/feeding supplies: ₹1,000–₹4,000

- Doctor visits/vaccinations: ₹500–₹1,500

- Miscellaneous baby items: ₹1,000–₹2,000

These may seem small individually, but they add up—fast.

2. Healthcare Costs

Unexpected medical issues, checkups, and newborn care can create sudden expenses.

3. School & College Fees

The biggest financial shock.

Education inflation in India is nearly 10–12% per year.

Without planning, fees can overwhelm even financially stable families.

The 3 Biggest Money Traps New Parents Fall Into

❌ Trap 1: Underestimating Long-Term Costs

Parents focus on diapers and toys—but ignore school fees, medical emergencies, and inflation.

❌ Trap 2: Delaying Investments

The later you start, the more you must invest each month.

Starting early reduces financial pressure.

❌ Trap 3: Skipping Insurance

A single emergency or loss of income can derail an entire future.

Planning today eliminates these risks entirely.

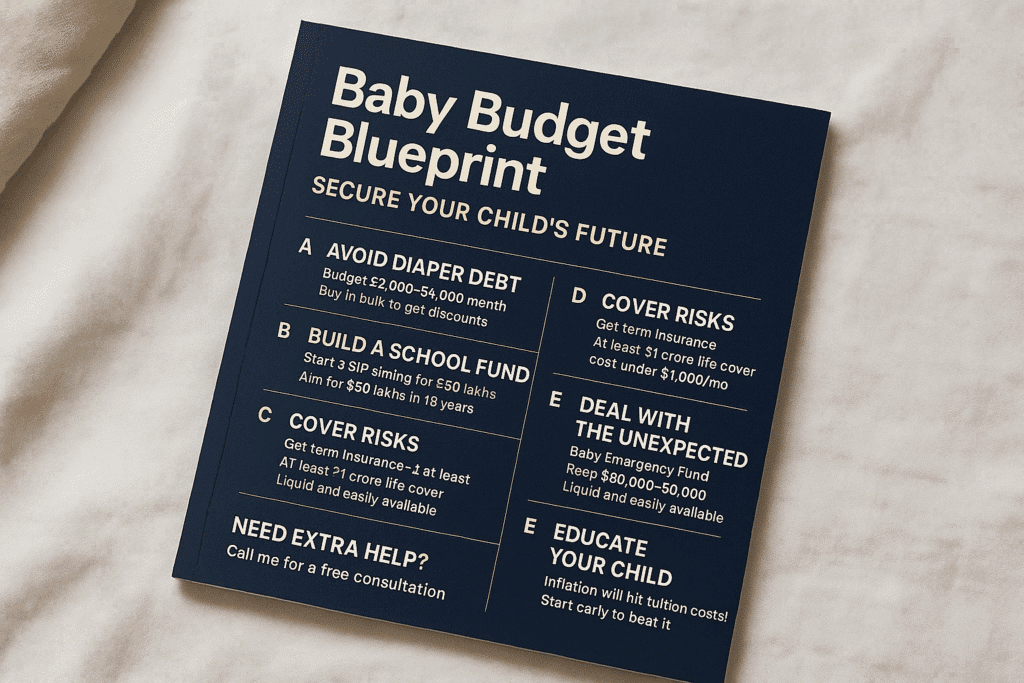

Your A–Z Baby Budget Blueprint (Simple & Practical)

A) Start With Monthly Baby Budgeting

Break your spending into four buckets:

- Essentials: diapers, food, clothes

- Medical: checkups, vaccines

- Savings: SIPs, insurance premiums

- Extras: toys, accessories

Pro Tip: Buy diapers, wipes, and formula in bulk for 10–15% savings.

B) Build a ₹50 Lakh Education Fund (Your Biggest Goal)

To reach approximately ₹50 lakhs in 18 years, start a SIP of:

👉 ₹5,000/month/child

(assuming long-term equity returns of 11–13%)

Invest in:

- Flexi-cap funds

- Large-cap + Mid-cap combinations

- Index funds (low cost, long-term stable growth)

Start early → Invest consistently → Increase SIP every year by 5–10%.

C) Create a Baby Emergency Fund

Target: ₹30,000–₹50,000

Use only for:

- Fever, infections, medicines

- Sudden baby expenses

- Hospital visits

Keep this in a liquid fund or high-interest savings account for easy access.

D) Secure Your Child’s Future With Term Insurance

Every parent needs:

👉 A ₹1 crore term plan

Estimated cost: ₹800–₹1,000/month

Why?

If something happens to you, your child’s education and lifestyle should remain protected.

This is non-negotiable.

E) Add Your Baby to Your Health Insurance

Check for:

- Newborn cover

- NICU expenses

- Vaccination or OPD benefits

A single hospital visit can cost ₹10,000–₹30,000.

A family floater plan saves stress and money.

F) Review the Plan Every Year

Your income will grow. So should your savings.

- Increase SIPs annually

- Update insurance

- Re-evaluate emergency fund

- Track your progress toward the 50-lakh goal

This ensures you stay ahead of inflation.

Section 4: What Happens If You Don’t Plan?

Without early planning, parents often face:

- Rising credit card debt

- No school fund

- Stress from medical emergencies

- Financial insecurity

- Compromised dreams for their child

Planning is not optional—it’s protection.

Section 5: What Happens If You Plan Today?

With a simple system, you gain:

✔ A fully funded education plan

✔ Protection through insurance

✔ Control over baby expenses

✔ Peace of mind

✔ A financially confident parenting journey

Your child gets the future they deserve—and you stay financially strong.

Conclusion: The Best Gift You Can Give Your Baby Isn’t a Toy — It’s a Plan

You don’t need to be rich to secure your child’s future.

You just need to start early, be consistent, and follow a clear roadmap.

The Baby Budget Blueprint makes it effortless.

CTA: Want a Personalised Baby Budget Plan?

Click here and share your details.

I’ll create a customized roadmap based on your income, goals, and timelines.

Your baby is adorable.

Let’s make sure your budget is too. 💙👶✨