Term Insurance: A Complete Guide 2025

Term Insurance is one of the simplest yet most powerful financial tools available today. Unlike investments that aim to grow wealth or stock market products that fluctuate with economic trends, term insurance has one straightforward goal: protection. It ensures that if something happens to you, your loved ones will not struggle financially.

This blog serves as a comprehensive guide to understanding, choosing, and benefiting from this essential life cover.

What is Term Insurance?

Term Insurance is a life cover that provides financial protection for a fixed period (known as the policy term). The policyholder pays premiums either annually, semi-annually, quarterly, or monthly. If the insured person passes away during the policy term, the nominee receives a lump sum payout, known as the sum assured.

If the policyholder survives the term, there is usually no maturity benefit, except in special plans like the Return of Premium (TROP) option. This makes term plans affordable compared to other life insurance products.

Why Do You Need It?

Life is unpredictable. While we plan for goals like home ownership, children’s education, and retirement, we often overlook the possibility of sudden uncertainties. In case of the breadwinner’s death, household expenses, EMIs, school fees, and medical costs continue to exist.

A term plan ensures that your family does not have to compromise on their lifestyle or long-term goals even in your absence. It provides financial stability and acts as a shield against the risk of income loss.

How Term Plans Work

The working of a term plan is simple:

- Choose the Coverage Amount (Sum Assured) – Decide the payout your family would need.

- Pick the Policy Duration (Term) – Choose how long you want to stay protected.

- Pay Premiums Regularly – Depending on your payment mode.

- Claim Settlement – If the insured passes away, the nominee receives the sum assured.

There are no hidden complexities, making it one of the most transparent financial products.

Difference Between Term Insurance and Other Life Covers

| Feature | Term Plan | Endowment Plan | ULIP | Whole Life |

|---|---|---|---|---|

| Premium | Low | High | Medium | High |

| Investment | No | Yes | Yes | No |

| Returns | None (except TROP) | Moderate | Market-linked | None |

| Purpose | Protection | Savings + Cover | Investment + Cover | Lifetime cover |

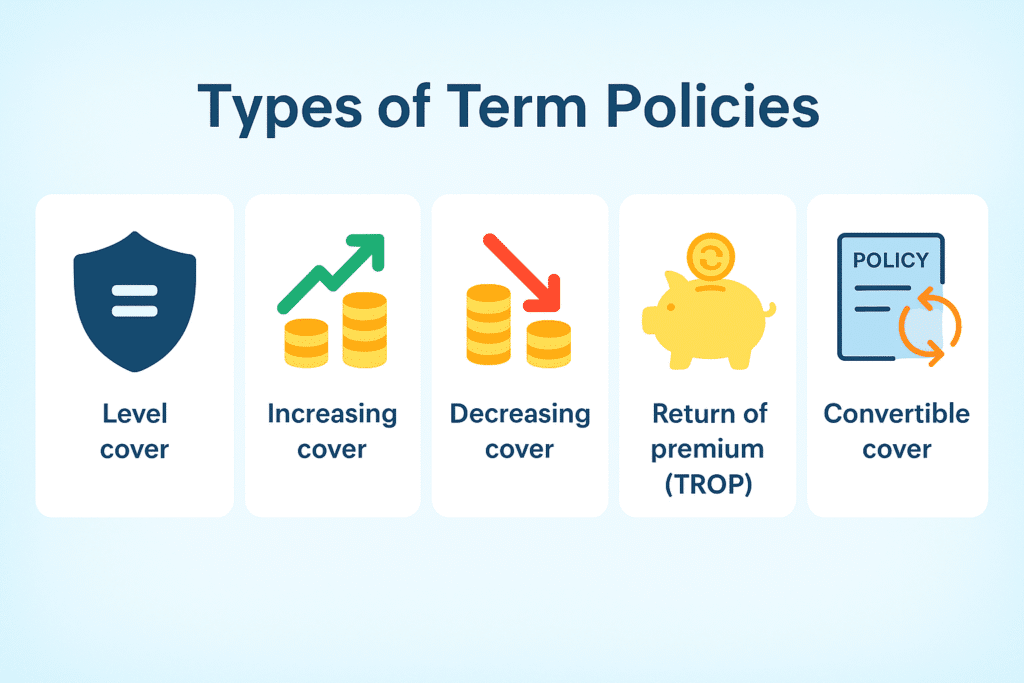

Types of Term Plans

- Level cover – Fixed payout throughout.

- Increasing cover – Sum assured grows each year.

- Decreasing cover – Cover reduces, ideal for loans.

- Return of premium (TROP) – Get premiums back if you survive.

- Convertible cover – Switch to other life covers later.

- Joint plan – One policy for both spouses.

Market Share of Life Insurers (FY 2024–25)

According to the IRDAI New Business Premium Report, these are the companies leading the life insurance market in India:

| Rank | Company Name | Market Share (%) | Year Started | Primary Investors / Promoters |

| 1 | LIC | 68.58% | 1956 | Government of India |

| 2 | SBI Life | 10.77% | 2001 | State Bank of India, BNP Paribas Cardif |

| 3 | HDFC Life | 10.22% | 2000 | HDFC Ltd and Abrdn |

| 4 | ICICI Prudential Life | 6.83% | 2000 | ICICI Bank and Prudential PLC |

| 5 | Bajaj Allianz Life | 3.72% | 2001 | Bajaj Finserv Ltd and Allianz SE |

| 6 | Axis Max Life | 3.68% | 2001 | Max Financial Services, Axis Bank |

| 7 | TATA AIA Life | 3.12% | 2001 | Tata Sons Pvt. Ltd., AIA Group |

| 8 | Aditya Birla Sun Life | 3.09% | 2000 | Aditya Birla Capital, Sun Life Financial (Canada) |

| 9 | Kotak Life | 2.49% | 2001 | Kotak Mahindra Bank |

| 10 | PNB MetLife | 1.42% | 2001 | PNB, MetLife International Holdings Inc. |

| 11 | Star Union Dai-ichi | 1.30% | 2007 | Bank of India, Union Bank, Dai-ichi Life |

| 12 | Canara HSBC Life | 0.93% | 2008 | Canara Bank, HSBC Insurance, Oriental Bank of Commerce |

| 13 | IndiaFirst Life | 0.90% | 2009 | Bank of Baroda, Union Bank, Carmel Point Investments |

| 14 | Shriram Life | 0.699% | 2005 | Shriram Capital and Sanlam |

| 15 | Bharti AXA Life | 0.60% | 2006 | Bharti Enterprises and AXA |

| 16 | Ageas Federal Life | 0.41% | 2007 | Ageas, Federal Bank, IDBI Bank |

| 17 | Aegon Life | 0.38% | 2008 | Aegon NV and The Times Group |

| 18 | Reliance Nippon Life | 0.37% | 2001 | Reliance Capital, Nippon Life Insurance |

| 19 | Future Generali | 0.36% | 2007 | Future Group and Generali Group |

| 20 | GoDigit Life | 0.32% | 2023 | Go Digit General Insurance Group |

| 21 | Bharti AXA Life | 0.22% | 2006 | Bharti Enterprises and AXA |

| 22 | Edelweiss Tokio Life | 0.18% | 2011 | Edelweiss Financial Services, Tokio Marine |

| 23 | Aviva Life | 0.10% | 2002 | Aviva plc and Dabur Group |

| 24 | Bandhan Life (formerly Aegon Life) | 0.07% | 2008 | Bandhan Financial Holdings Ltd |

| 25 | CreditAccess Life | 0.06% | 2019 | CreditAccess Group |

| 26 | ACKO Life | 0.02% | 2022 | ACKO Technology & Services |

Why Term Insurance is Better

- High coverage at affordable premiums.

- Transparent structure without hidden conditions.

- Flexible policy duration (10 years to 80 years or even lifetime in some cases).

- Riders available for customization.

- Tax benefits under the Income Tax Act.

Riders: Extra Protection

Some popular add-ons are:

- Critical illness rider – Covers cancer, heart attack, etc.

- Accidental death benefit – Higher payout in case of accident.

- Waiver of premium – Future premiums waived if disability occurs.

- Income benefit – Monthly payout to family.

Importance of Sum Assured

Choosing the right sum assured is critical. Too low, and your family won’t be covered. Too high, and premiums may stretch your budget.

Rule of thumb: 15–25x annual income.

How Much Cover Should You Take?

- 25x income (ages 18–35)

- 20x income (ages 36–45)

- 15x income (ages 46–50)

- 10x income (ages 51–60)

This ensures all major life expenses are protected.

How Premiums Are Calculated

Factors include:

- Age

- Gender

- Smoking habits

- Health history

- Policy term

- Riders chosen

Example: A 25-year-old non-smoker may get ₹1 crore cover for ₹600/month, while a 45-year-old smoker may pay ₹2,500/month for the same cover.

Term Plans for Different Life Stages

- Students & freshers – Start small for future savings on premium.

- Married couples – Secure spouse and loans.

- Parents – Cover children’s education and daily costs.

- Business owners – Protect debts and business loans.

- Senior citizens – Some plans allow up to 75 years cover.

Online vs. Offline Term Insurance

| Feature | Online | Offline |

|---|---|---|

| Cost | Cheaper | Higher |

| Convenience | Easy comparison | Limited options |

| Transparency | Clear terms | May involve agent bias |

| Discounts | Available | Rare |

Why choose Offline Term Insurance?

Because insurance is not just about buying a policy it’s about understanding, trust, and support when your family needs it most. With offline policies, you get a dedicated advisor who will guide you, remind you, and even stand by you during claims. Looking for the right Term Insurance with trusted guidance? Contact us today we’ll help you choose the best plan for your family’s future security.

Claim Settlement Ratio (CSR)

CSR is the percentage of claims an insurer settles. A higher CSR means higher trust. Always pick companies with CSR above 95%.

Tax Benefits

- Section 80C: Premiums up to ₹1.5 lakh are deductible.

- Section 10(10D): Payouts are tax-free.

This makes it more tax-efficient than many other instruments.

Common Mistakes to Avoid

- Choosing low sum assured

- Ignoring riders

- Not disclosing health issues

- Short policy term

- Delaying purchase

Myths About Term Insurance

- Myth 1: Too expensive → Fact: Most affordable life cover.

- Myth 2: Wasted money if I survive → Fact: Peace of mind itself is valuable.

- Myth 3: Only for married people → Fact: Anyone with dependents should buy.

- Myth 4: Claim process is tough → Fact: Digital claims make it smooth.

Term Insurance vs. Health Insurance

- Term: Covers death risk.

- Health: Covers medical expenses.

- Both are essential for full protection.

Conclusion

A simple term plan is not just an expense it is a promise of financial security for your loved ones. Whether you are single, married, a parent, or a business owner, having this protection ensures peace of mind. Don’t delay choose wisely and protect your family today.

At Nemi Wealth, we simplify this journey for you. From understanding your risk appetite to tailoring the right portfolio mix, our experts help you make informed, confident investment decisions. Whether you’re a beginner looking for a safe entry into mutual funds or a seasoned investor seeking portfolio diversification, into your financial plan.

Get started with Nemi Wealth today and take the next step toward a more secure and balanced investment journey.