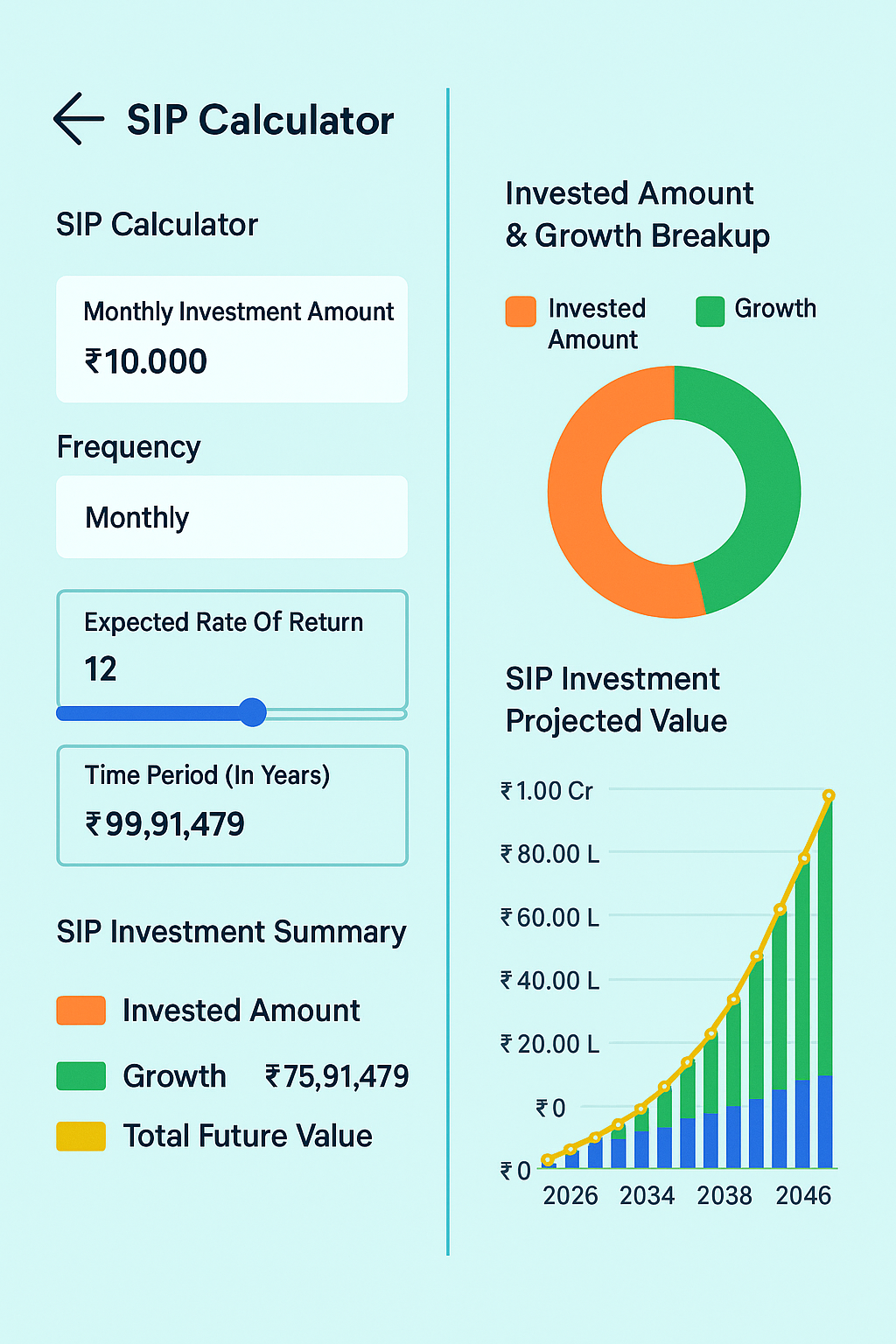

Invest in SIP for a Better Tomorrow

Today, investing your hard-earned money smartly is more important than ever. One simple way to build long-term wealth is through a Systematic Investment Plan (SIP). It lets you invest a fixed amount in mutual funds regularly usually every month or quarter. Think of it like a recurring bank transfer, but instead of going to a savings account, it helps grow your money in the market.

What is SIP?

SIP is a simple way to invest. You put in small amounts regularly into a mutual fund. This way, you don’t need a large sum to begin. Your money is combined with other investors’ money. Then, professionals manage and invest it in different assets like stocks or bonds. This gives you diversification and expert management.

How SIP Works

Let’s make it easy to understand:

- Pick a Mutual Fund Scheme: First, look at different funds. Each one has its own goal and risk level. Choose the one that matches your needs.

- Start Your SIP: Next, decide how much to invest and how often. Most platforms let you set this up online in minutes.

- Sit Back and Invest Automatically: On the set date, money is taken from your account and invested in the fund. It runs on autopilot.

[Explore top mutual funds with Nemi Wealth]

Benefits of SIP

- Rupee-Cost Averaging

Markets rise and fall. SIP helps you buy more when prices are low and fewer when they’re high. This averages your cost. - Power of Compounding

Your returns earn more returns. Over time, your money grows faster. - Disciplined Investing

SIP builds a habit. You invest every month without overthinking. - Flexibility and Convenience

You can start with small amounts. As you earn more, you can increase your SIP. You can also pause or stop anytime. - Expert Management

Fund managers make smart choices to grow your money. You benefit from their experience.

What to Know Before Starting a SIP

- Your Goal and Time Frame: Know why you’re investing and for how long. SIPs work best for long-term goals.

- Your Risk Level: Some funds are riskier than others. Pick one that fits how much risk you’re okay with.

- Review Your SIP: Check on your SIP from time to time. Adjust it if your goals or income change.

Conclusion

SIPs are one of the easiest ways to grow your money. They’re simple, automatic, and smart. Whether you’re just starting or already investing, SIPs can help you reach your goals. So don’t wait. Start your SIP today with Nemi Wealth and take a big step toward your future.

FAQs

What is a SIP (Systematic Investment Plan)?

A SIP is a method of investing a fixed amount regularly in a mutual fund. You can invest weekly, monthly, or quarterly. It helps you build wealth over time through small, disciplined investments.

Is SIP better than a lump sum investment?

It depends on your goals and market timing. However, SIP spreads your investment over time, which helps reduce the impact of market ups and downs. As a result, it’s a smart choice for regular, low-risk investing. It’s a safer option for most investors, especially in volatile markets.

Can I stop or pause my SIP anytime?

Yes, you can stop, pause, or change your SIP anytime without any penalty. In other words, it’s highly flexible and can be adjusted easily based on your changing financial needs.

How much should I invest in SIP?

There’s no fixed rule. In fact, you can start with as little as ₹500 per month. Depending on your income, expenses, and financial goals, you can choose an amount that suits you. Over time, as your income grows, you can gradually increase your SIP to build more wealth.

Are SIP returns guaranteed?

No, SIP returns are not guaranteed because they depend on market performance. However, staying invested long-term in good mutual funds increases your chances of earning better returns.

3 Comments