Stock Tip Scam Exposed: The Dirty Secrets Behind Sanjiv Bhasin’s Tips

Every afternoon, thousands of investors tuned in to see Sanjiv Bhasin on business news channels. His segment, “Bhasin ke Haseen Shares,” was trusted by people. But behind the scenes, a massive stock tip scam was quietly unfolding, one that left retail investors exposed and insiders rich. Many trusted him. Why wouldn’t they? He sounded confident. He called himself a market expert. But here’s what viewers didn’t know: Bhasin wasn’t even registered with SEBI as a Research Analyst or Investment Advisor. SEBI investigation reveals that Bhasin wasn’t just giving advice, he was running a profit-making scheme using those very tips.

What made his influence even more misleading was his association with IIFL. Bhasin served as Director at IIFL (India Infoline Limited), a well-known brokerage firm. However, after 2022, he was only a consultant at IIFL. Despite this, TV channels continued to introduce him with the Director designation. His LinkedIn profile still reflects his IIFL title, further reinforcing a sense of credibility among viewers. This allowed him to leverage IIFL’s brand trust even after his exit—something many retail investors were unaware of.

The Trick Behind the Stock Tip Scam

Front running means buying shares before a big event that will move prices like a TV tip. Once the public buys the same shares, prices jump. The person who bought early can sell for a quick profit. Here’s how it worked:

- Just minutes before he recommended a stock on live TV or social media, his group had already bought it.

- When the public acted on his tip, prices went up.

- As prices rise, his team sold the stock at a profit, often on the same day.

- Investors who followed his advice were left holding expensive stocks that soon fell.

This wasn’t just occasional. It was repeated, planned, and coordinated. In one instance, Bhasin recommended a well-known tech stock on live television. The recommendation was clear: “Buy now, target price ahead.” Viewers rushed in. The price jumped. But just before the tip, his group had already loaded up on the stock. And just after the spike, they quietly sold their holdings. That quick move made them profit and left retail investors with stocks that had already peaked.

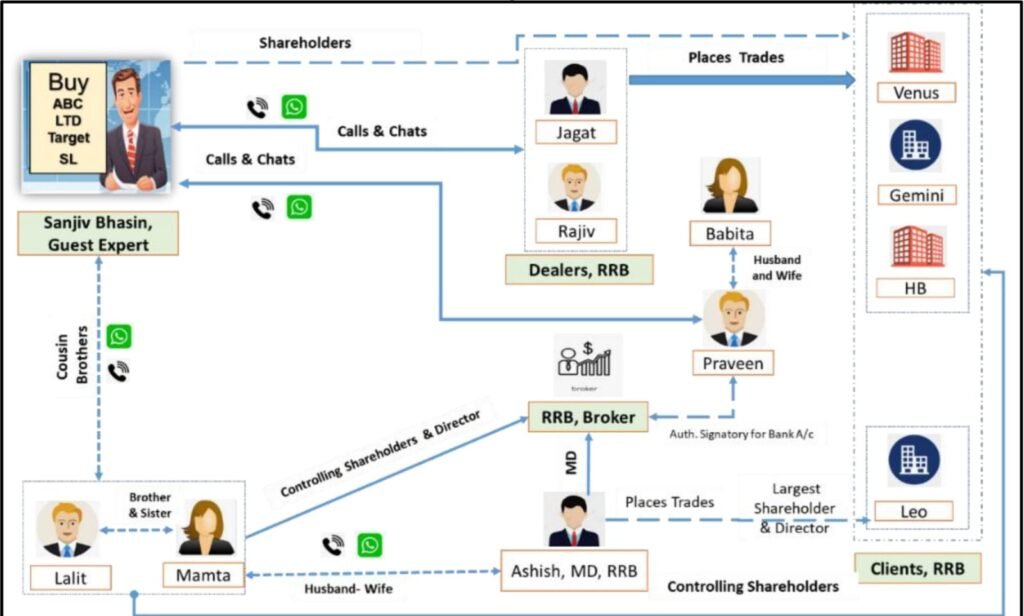

Stock Tip Scam: The People Behind the Curtain

The trades were executed through a close-knit group. Let’s look at the main players:

Sanjiv Bhasin

- The face on TV

- Gave public stock tips

- Secretly told his team to buy or sell just before those tips

Lalit Bhasin (His cousin)

- Director at HB Stockholdings

- Let Bhasin trade through these companies

Ashish Kapur (Lalit’s brother-in-law)

- MD of RRB Master Securities, the broker used in almost all trades

- Traded in his own and company accounts

- Helped execute the plan

Who Made the Most Trades?

| Entity | NSE Trades | Total Trades |

|---|---|---|

| Leo Portfolios Pvt. Ltd. | 10,163 | 10,263 |

| HB Stockholdings Ltd. | 6,264 | 6,363 |

| Venus Portfolios Pvt. Ltd. | 7,659 | 7,666 |

| Gemini Portfolios Pvt. Ltd. | 2,396 | 2,418 |

| Ashish Kapur (personal) | 4,988 | 5,171 |

| Babita Gupta | 1,953 | 2,012 |

| Rajiv Kapoor (dealer) | 1,807 | 1,817 |

| Jagat Singh (dealer) | 4,259 | 4,261 |

The L&T Tech Tip That Wasn’t So Innocent

Let’s look at one clear example from SEBI’s report. On January 11, 2022, at 1:33 PM, Bhasin went live on Zee Business.

He said:

“Buy L&T Technology Services (LTTS) at ₹5645. Target ₹5800. Stop loss ₹5520.”

Investors watching the show rushed to buy. But behind the scenes, his network had already bought the stock just minutes earlier. Once the price jumped due to public buying, they sold and exited. Retail investors the ones who followed his advice were left holding the stock at a higher price. This wasn’t expert advice. It was a carefully timed profit move.

The Power of Influence

What made this scheme so effective was Bhasin’s reach. He wasn’t just on TV. He had hundreds of thousands of followers on platforms like Twitter, YouTube, and Telegram. Every word he said could move stocks and his team knew that. They used that influence to create demand, then exited with profit while others were still buying.

What SEBI Did

SEBI took strong action:

- Froze ₹1.37 crore in illegal gains

- Banned all parties from giving advice or appearing on media

- Issued show-cause notices for further penalties

This may just be the beginning. SEBI hinted the actual gains could be much higher. Once trusted by thousands for his confident stock tips, Sanjiv Bhasin is now at the center of a massive stock manipulation scam. SEBI’s investigation reveals how retail investors were misled while insiders made quick profits.

But this isn’t an isolated case. SEBI is now more vigilant than ever closely monitoring suspicious trading activity. It has also exposed global players like Jane Street in recent actions.

Final Thoughts: What the Stock Tip Scam Teaches Us

The Sanjeev Bhasin case may be just the tip of the iceberg. It reveals how media, reputation, and coordination can be weaponized to exploit trust, especially in a country where millions of first-time investors are entering the markets each year. Financial freedom begins with financial awareness. As we celebrate India’s growing investor base, it’s time we also safeguard it through better regulation, sharper media accountability, and more informed individual decision-making.

Learn more about registered advisory platforms like Nemi Wealth. Stay smart, stay skeptical, and always double-check before you double down.