Sovereign Gold Bonds (SGB): A Beginner’s Guide

Gold has always held a special place in Indian households. Traditionally, people have invested in physical gold like coins and jewelry. But what if there was a way to own gold without the hassle of storage and security risks? Enter Sovereign Gold Bonds (SGBs).

In this beginner-friendly guide, we’ll explore everything you need to know about SGBs – what they are, how they work, their benefits, and how you can invest in them.

What are Sovereign Gold Bonds (SGBs)?

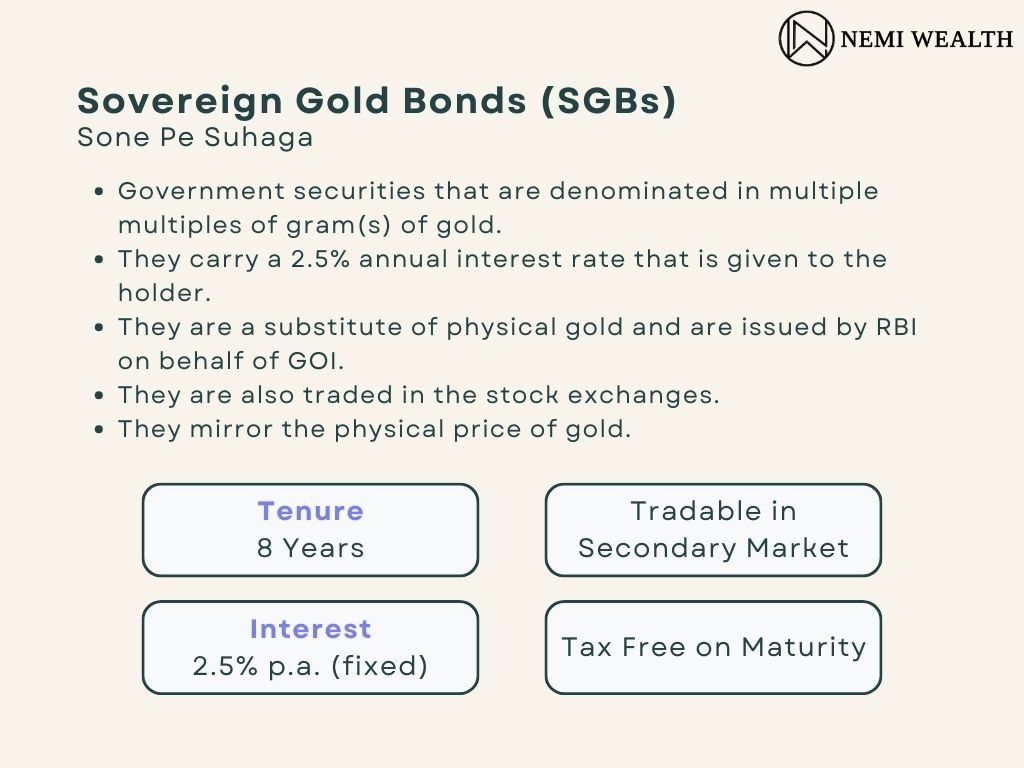

Sovereign Gold Bonds are government securities denominated in grams of gold. Issued by the Reserve Bank of India (RBI) on behalf of the Government of India, they offer a safe and convenient alternative to physical gold investment.

How do SGBs Work?

When you invest in an SGB, you pay the issue price in Indian rupees. This price is linked to the prevailing market price of gold. The SGB has a fixed tenure of 8 years, with a lock-in period of 5 years. This means you cannot redeem your investment before 5 years.

Here’s a breakdown of how SGBs work:

- Investment: You invest in SGBs during issuance periods announced by the RBI. The minimum investment is 1 gram of gold, and you can invest in multiples of 1 gram.

- Interest: SGBs offer a fixed interest rate of 2.5% per annum, payable semi-annually. This interest is credited directly to your bank account.

- Redemption: Upon maturity (after 8 years), you receive the redemption amount based on the prevailing gold price on the date of redemption.

- Early Redemption: You can exit your investment after the lock-in period (5 years) through the secondary market on stock exchanges. However, the redemption price will depend on the market price of gold at that time.

Benefits of Investing in SGBs

- Safe and Secure: Backed by the Government of India, SGBs are a highly secure investment option compared to physical gold.

- Earns Interest: Unlike physical gold, SGBs provide a fixed interest income of 2.5% per annum, offering a dual benefit of gold price appreciation and regular income.

- Tax Benefits: If you hold SGBs till maturity, any capital gains earned are exempt from income tax. This makes SGBs a tax-efficient way to invest in gold.

- Liquidity After Lock-in: While there’s a 5-year lock-in period, you can trade your SGBs on stock exchanges after that, providing liquidity if needed.

- Reduces Storage Risks: With SGBs, you eliminate the risks associated with storing physical gold, such as theft or damage.

Things to Consider Before Investing in SGBs

- Lock-in Period: SGBs come with a 5-year lock-in period. Ensure your investment horizon aligns with this timeframe.

- Market Price Fluctuations: The redemption value of SGBs is linked to the market price of gold. Gold prices can be volatile, so there’s a risk of getting less than your initial investment if you exit before maturity.

- Interest Rate: The fixed interest rate of 2.5% may not keep pace with inflation or potential returns from other asset classes.

How to Invest in SGBs

Investing in SGBs is a straightforward process:

- Track Issuance Dates: The RBI announces SGB issuance dates periodically. Keep yourself updated.

- Choose an Authorized Agent: You can invest in SGBs through authorized channels like banks, stock exchanges, and designated post offices.

- Submit Application Form: Fill out the application form with your investment details.

- Make Payment: Pay for your SGBs according to the issue price.

- Dematerialized or Physical Form: Choose to hold your SGBs in dematerialized (electronic) form or physical certificate format. To get guidance to invest in SGB’s click here.

Conclusion

Sovereign Gold Bonds offer a secure and convenient way to invest in gold. They provide the benefits of gold price appreciation, regular interest income, and tax advantages. However, it’s crucial to understand the lock-in period and potential market fluctuations before investing.