SEBI Regulations in 2025: What They Mean for Mutual Funds and Investment Strategies

SEBI Regulations have always played a vital role in shaping India’s financial markets, ensuring that investors are protected while the industry continues to grow. In the mutual fund industry, these regulations are particularly important as they maintain transparency, prevent misuse of investor money, and simplify choices for retail investors.

Over the last decade, the mutual fund industry has expanded rapidly. According to AMFI India, Assets Under Management (AUM) grew from ₹11.73 trillion in June 2015 to ₹74.41 trillion by June 2025. This growth reflects investor trust and the rising popularity of mutual funds across the country. However, rapid growth also brings challenges such as overlapping schemes, oversized funds, and limited diversification opportunities.

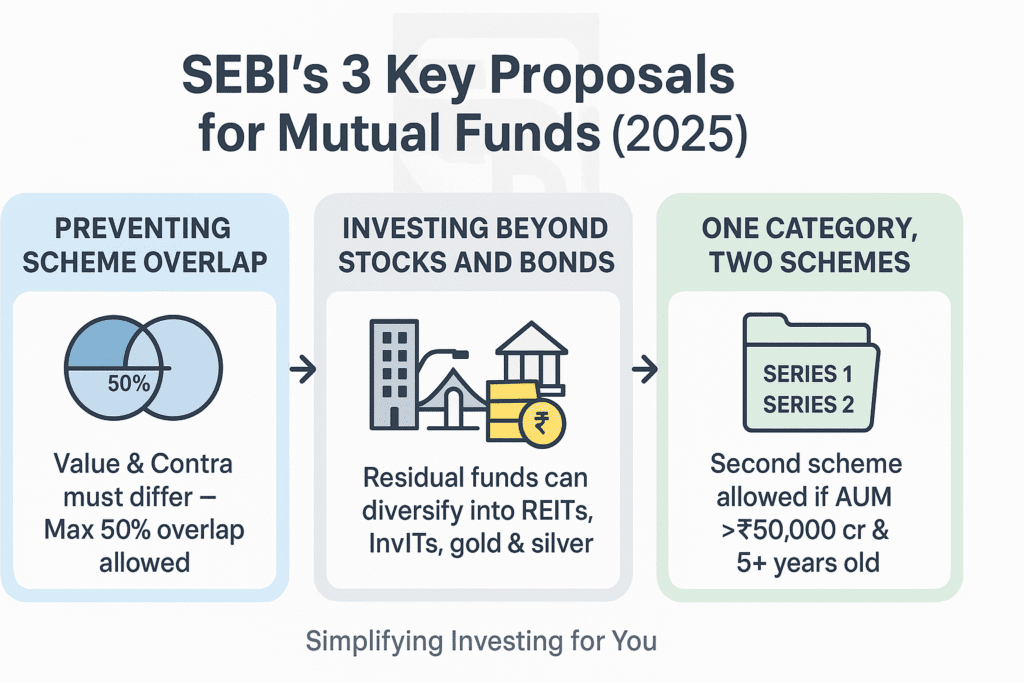

To address these issues, SEBI Regulations are being updated under the “Categorization and Rationalization of Mutual Fund Schemes” framework. The new proposals target three key areas: reducing portfolio overlap, diversifying investments beyond equities and bonds, and allowing more than one scheme in specific categories. These changes directly affect how fund houses design investment strategies and how investors choose mutual funds.

In this article, we will explain these proposals in simple terms and break down what they mean for you as an investor.

Why SEBI Regulations Matter in Mutual Funds

The mutual fund industry thrives on trust. Investors commit their money expecting professional management, transparency, and fair returns. Without a regulatory body, fund houses could launch multiple similar products, charge unnecessary fees, or blur the lines between investment strategies.

SEBI Regulations bring order by:

- Defining scheme categories clearly.

- Preventing duplication and overlap between funds.

- Allowing diversification while protecting investors.

- Ensuring fair fee structures.

When you invest in mutual funds, you are indirectly depending on these regulations to ensure that the product you choose is distinct, transparent, and managed in your best interest.

Key Proposals by SEBI

1. Preventing Scheme Overlap

One challenge in the mutual fund space has been overlapping schemes. For example, a fund house might run both a Value fund and a Contra fund, but in practice, both funds could end up holding very similar stocks. This reduces the meaningful choice available to investors and makes comparing different investment strategies more difficult.

What SEBI Regulations Say Now:

- Fund houses can continue to offer both Value and Contra funds.

- However, their portfolios cannot overlap by more than 50%.

- This overlap will be checked when a New Fund Offer (NFO) is launched and reviewed every six months.

- If the 50% limit is breached, the fund house has 30 business days to correct it.

- If they fail, investors are allowed to exit the scheme without paying any exit load.

Why It Matters:

This ensures that Value and Contra funds remain distinct. Investors will have clarity when choosing mutual funds, knowing that they are getting genuinely different investment strategies instead of duplicates under different names.

2. Investing Beyond Stocks and Bonds

Traditionally, mutual funds have focused on one core asset class—equities for equity funds and bonds for debt funds. The money not invested in the main asset class (called the residual portion) often had restrictions on where it could go.

What SEBI Regulations Propose:

- Equity schemes can now use their residual portion to invest in debt, gold, silver, REITs (Real Estate Investment Trusts), and InvITs (Infrastructure Investment Trusts).

- Debt schemes, except very short-term ones like liquid or overnight funds, can also invest in REITs and InvITs.

Why It Matters:

This change allows mutual funds to diversify further. Investors gain exposure to real estate and infrastructure assets that are traditionally difficult to access directly. With these new rules, fund managers can design more resilient and well-rounded investment strategies.

3. One Category, Two Schemes

Earlier, SEBI followed the principle of “one scheme per category.” A fund house could only offer one large-cap fund, one mid-cap fund, and so on. While this rule helped reduce clutter, it created challenges for extremely large funds with AUM above ₹50,000 crore. Managing oversized funds is difficult and can dilute efficiency.

What SEBI Regulations Propose:

- A second scheme in the same category can be launched if the first scheme is at least five years old and has AUM above ₹50,000 crore.

- The first scheme must stop accepting new subscriptions once the second one is launched.

- The second scheme must follow the same investment strategy and carry a similar name (e.g., “Large Cap Fund – Series 2”).

- The new scheme cannot charge a higher Total Expense Ratio (TER) than the original at the time of launch.

- No more than two schemes per category will be allowed.

Why It Matters:

This rule balances choice and efficiency. Fund houses can manage very large AUM more effectively, while investors continue to benefit from simplified scheme comparisons.

Impact of SEBI Regulations on Investors

- Greater Clarity – Clear differentiation between Value and Contra funds ensures meaningful choices.

- Improved Diversification – Access to REITs, InvITs, gold, and silver makes portfolios more balanced.

- Efficient Fund Management – Large funds can split into manageable sizes, maintaining efficiency without clutter.

- Stronger Investor Protection – Exit load waivers and regular compliance checks prioritize investor interests.

For investors, these changes mean that mutual funds are becoming more structured, versatile, and transparent.

The Bigger Picture: SEBI Regulations and the Future of Mutual Funds

The Indian mutual fund industry is entering a new phase. No longer limited to just stocks and bonds, mutual funds are evolving into vehicles that provide access to diverse asset classes. At the same time, SEBI Regulations are ensuring that this evolution happens responsibly, keeping the investor at the center.

Global trends show similar movements, where mutual funds are increasingly seen as gateways to a wide variety of assets, not just traditional equity markets. In India, this shift will make investment strategies more sophisticated while maintaining simplicity for retail investors.

Conclusion

The proposed SEBI Regulations are more than technical updates; they represent a significant shift in how mutual funds operate in India. By reducing overlap, expanding diversification opportunities, and balancing fund size management, SEBI is ensuring that the industry remains investor-friendly and future-ready.

For investors, the message is clear: mutual funds remain one of the most efficient and transparent ways to build long-term wealth. But staying informed about evolving SEBI Regulations and aligning your portfolio with the right investment strategies is essential.

If you want expert guidance on navigating these changes and choosing the right mutual funds for your goals, get started with Nemi Wealth. We help you design investment strategies that grow your portfolio while keeping compliance and transparency at the core.

FAQs

What are SEBI Regulations in mutual funds?

SEBI (Securities and Exchange Board of India) regulations are rules that mutual fund companies must follow to protect investors. These include defining scheme categories, limiting overlap between funds, and ensuring transparency in expenses and disclosures. The goal is to create fairness, prevent duplication, and simplify choices for investors.

How does SEBI prevent duplication of mutual fund schemes?

SEBI monitors portfolio overlap between similar funds like Value and Contra. If more than 50% of holdings are the same, fund houses must reduce duplication within 30 business days. If not, investors can exit without paying an exit load. This ensures schemes remain distinct and genuinely different.

What new investment options do SEBI Regulations allow in mutual funds?

Equity mutual funds can now use their residual portion to invest in assets like gold, silver, REITs, and InvITs. Debt mutual funds (except liquid/overnight funds) can also invest in REITs and InvITs. This diversification makes portfolios more resilient and gives investors access to new asset classes.

Can fund houses now launch more than one scheme in the same category?

Yes, under the new rules, a fund house can launch a second scheme in the same category if the first one is at least 5 years old and has over ₹50,000 crore AUM. The first scheme must stop new subscriptions, and both must follow the same strategy. This helps manage oversized funds without creating clutter.

How do these SEBI Regulations benefit investors directly?

The benefits include:

- Clarity: Distinct fund categories with reduced overlap.

- Diversification: Access to real estate, infrastructure, and commodities.

- Efficiency: Better-managed large funds.

- Protection: Exit load waivers and stricter compliance.

Overall, these updates ensure mutual funds remain transparent, structured, and investor-friendly.