Specialized Investment Funds in India: A Smarter Investment Strategy for 2025

India’s investment space is evolving fast. With rising interest in private equity, startups, and tactical strategies, many investors want more than just traditional mutual funds. This is where Specialized Investment Funds in India come into play offering a new option for experienced investors seeking more flexibility and higher returns.

Why Were SIFs Introduced?

Until now, investors had two main choices:

- Mutual Funds

- Low minimums (starting from ₹500)

- Safer, regulated options

- Limited strategy flexibility

- Portfolio Management Services (PMS)

- ₹50 lakh minimum investment

- Customised portfolios

- More aggressive and niche strategies

Clearly, there was a gap. Specialized Investment Funds now bridge this gap. With a minimum investment of ₹10 lakh, they allow investors to explore advanced strategies while maintaining mutual fund-like transparency and structure.

What Exactly Is a Specialized Investment Funds (SIF)?

A SIF is a new kind of mutual fund structure approved by SEBI. It’s designed for informed investors who want to explore strategies beyond traditional equity and debt schemes. Here’s what makes SIFs different:

- Minimum Investment: ₹10 lakh (not ₹50 lakh like PMS)

- Advanced Strategies: Long-short equity, sector rotation, hybrid models

- Professional Management: Managed by top-tier fund managers

- Higher Risk, Higher Reward: Suited for those with higher risk appetite

Key Features of SIFs

Let’s break down how SIFs are structured and what you can expect:

1. Investment Strategies

Specialized Investment Funds can offer:

- Equity Long-Short Strategies (with short positions using derivatives)

- Sector-Specific Bets (like tech or auto)

- Debt Strategies (with limited short exposures)

- Hybrid Models (mix of equity, debt, REITs, and commodities)

Each SIF can launch only one strategy per category, to avoid duplication.

2. Subscription and Redemption

Redemption frequency may vary:

- Daily, weekly, or monthly, based on the strategy.

- Fund houses may also apply notice periods (up to 15 days) before processing redemptions.

3. Benchmarking & Risk Meter

SIFs follow a single-tier benchmark similar to mutual funds.

They also come with a Risk Band from Level 1 (Lowest) to Level 5 (Highest). You’ll see this risk meter on fund documents and websites, updated monthly.

4. Listing

All close-ended or interval strategies under SIFs must be listed on a recognized stock exchange, giving you an exit option if you need liquidity.

5. Distribution Rules

Only qualified distributors (with NISM Series-XIII certification) can sell SIFs. This ensures that advisors understand the complexities of these funds.

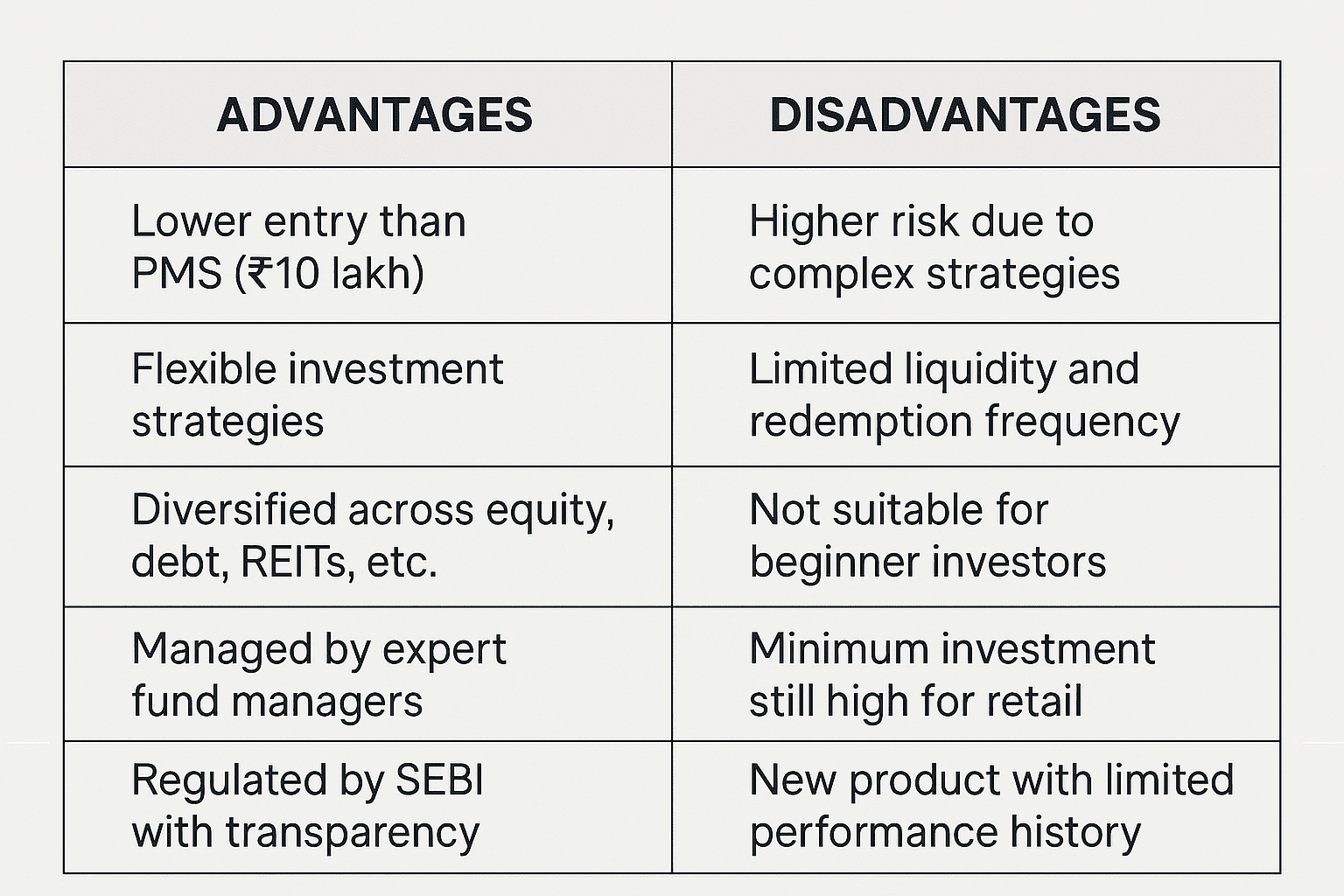

Advantages of Investing in Specialized Investment Funds

- More Flexibility: Fund managers have room to adapt and explore innovative strategies

- Higher Growth Potential: Access to niche sectors and high-growth themes

- Moderate Minimum Entry: ₹10 lakh is accessible compared to PMS

- Regulated Framework: Backed by SEBI, just like mutual funds

But Also, Know the Risks

SIFs aren’t for everyone.

- Not Liquid Like MFs: Some strategies may lock your money in for longer

- Higher Volatility: Focused strategies can be sensitive to market changes

- Sector Concentration: Funds may be heavily tilted towards specific themes

If you’re investing in SIFs, make sure you understand the underlying risks and are okay with short-term ups and downs.

Who Should Consider SIFs?

You should explore SIFs if you are:

- An HNIs or seasoned investor

- Willing to invest ₹10 lakh or more

- Comfortable with moderate to high risk

- Looking to diversify beyond standard mutual funds

Popular Specialized Investment Funds You Can Explore

Two early movers in the SIF space include:

- SBI Magnum SIF – Aimed at investors looking for long-short and sectoral strategies under India’s largest AMC.

- Edelweiss Altiva SIF – Expected to focus on themes like private credit, tactical asset allocation, and new-age sector bets.

Final Thoughts from Nemi Wealth

Specialized Investment Funds are the next evolution in India’s investment landscape. They offer a smart middle ground between mutual funds and PMS, giving experienced investors access to custom strategies with reasonable entry points. However, as with all sophisticated products, it’s important to proceed with clarity and guidance. At Nemi Wealth, our team is ready to help you evaluate whether Specialized Investment Fund fit into your financial goals. Whether it’s Edelweiss Altiva or SBI Magnum, we help you make informed, confident choices. New SIFs are expected to launch regularly.

We’re gearing up to host an insightful webinar tailored for Indian on SIFs smartly and securely. Don’t miss out on expert tips, real-life strategies, and actionable advice. Fill out the form now to stay updated with the webinar details, reminders, and exclusive resources.