Mutual Funds Explained for New Investors

The world of finance can feel complex, especially for newcomers. But sweat not! If you are interested in growing your wealth, collective finances can be a great place to start. This companion will explain collective finances in India mutual funds in India in a clear and terse way, equipping you with the knowledge to make informed investment opinions.

What are Mutual Funds?

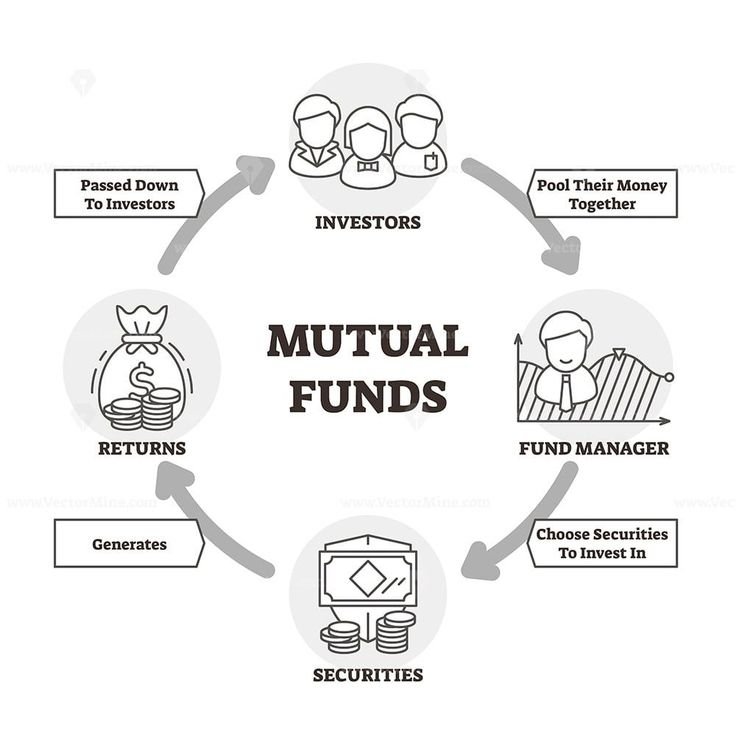

Imagine a handbasket filled with different fruits. A collective fund is analogous. It is a pool of plutocrat collected from numerous investors and managed by a professional fund director. This director invests the plutocrat in colorful means like stocks, bonds, and other securities, aiming to induce returns for the investors.

Benefits of Investing in Mutual Funds

- Diversification: By holding units (shares) in a mutual fund, you gain exposure to a variety of assets. This approach spreads your risk and reduces the impact of any single investment underperforming.

- Professional management: Experienced fund managers make investment decisions, saving you time and research effort.

- Affordability: You can start investing with a small amount, making mutual funds accessible to everyone.

- Liquidity: Most mutual funds offer easy redemption options, allowing you to withdraw your money when needed.

Types of Mutual Funds in India

Collective finances come in colorful flavors to feed to different investment pretensions and threat favors. Then is a breakdown of some common types.

Equity funds primarily invest in stocks of companies, offering the potential for high returns but also carrying higher risk. On the other hand, debt funds invest in fixed-income securities like government and corporate bonds, providing steadier returns with lower risk. In addition, balanced or hybrid funds combine both equity and debt, aiming to strike a balance between growth and stability.

Furthermore, offshore funds give you the opportunity to invest in companies outside India, enabling global diversification. Similarly, thematic funds focus on specific trends or themes believed to have high growth potential. For example, the SBI Energy Fund invests in the energy sector.

Moreover, Equity Linked Saving Schemes (ELSS) offer tax benefits on investments, making them an attractive option for tax-conscious investors. Finally, fund-of-fund schemes invest in a portfolio of other mutual funds, allowing greater diversification and potentially offering access to advanced investment strategies within a single holding.

How to Start Investing

- Choose an Investment Platform: elect an estimable broker, investment app, or bank that offers collective finances.

- Define Your Investment pretensions: Are you saving for withdrawal, a child’s education, or a down payment on a house?

- Pick the Right Mutual Fund: Consider your threat forbearance, investment horizon, and fiscal pretensions when choosing a fund.

- Launch Investing: You can invest a lump sum or conclude for a Methodical Investment Plan(draft) to invest a fixed quantum regularly. Nemi Wealth is a SEBI regulated Finance Advisor that builds client portfolios and offers all types of collective finances. It’s a digital process with a mobile operation where you can manage and track your portfolio. To get started, click here.

Conclusion

Mutual funds offer a simple and accessible way to invest in the Indian financial markets. By understanding the basics and aligning your investments with your goals and risk tolerance, you can build a strong financial future. Furthermore, mutual funds help you diversify your portfolio without requiring deep market expertise. Therefore, start with clear objectives and choose funds that match your timeline and comfort with risk.

While this guide serves as a helpful starting point, always consult a financial advisor for personalized advice and informed decision-making. Nemi Wealth is a SEBI regulated Finance Advisor that builds client portfolios and offers all types of collective finances. It’s a digital process with a mobile operation where you can manage and track your portfolio. To get started, click here.