Multi Cap vs Multi Asset: Which Is Better for You?

Understanding the difference between Multi Cap vs Multi Asset Funds is key Whether you’re planning for long-term growth or steady returns with lower volatility, understanding the difference between these two fund types can guide you toward a smarter investment decision.

Thinking about mutual fund investing but unsure which route to take? You’re not alone. With so many options available, it’s important to choose a fund that aligns with your goals, risk appetite, and investment horizon. At Nemi Wealth, we offer both Multi Cap Funds ideal for those looking to tap into high-growth opportunities across large, mid, and small-cap stocks and Multi Asset Funds, which are perfect for investors seeking a balanced approach through a mix of equity, debt, and commodities.

Key Differences at a Glance: Multi Cap vs Multi Asset Funds

| Feature | Multi Cap Funds | Multi Asset Allocation Funds |

|---|---|---|

| Assets | Only stocks (large, mid, small caps) | Stocks + Bonds + Gold/Commodities |

| Diversification | Across market caps | Across asset classes |

| Risk | High | Moderate |

| Flexibility | Limited (25% each cap minimum) | High – dynamic allocation |

| Returns in Bull Market | Higher potential | Decent, but lower than pure equity |

| Returns in Bear Market | Riskier | Safer due to debt/gold mix |

| SEBI Rule | 25% in each cap | 10% in at least 3 asset types |

| Best For | Long-term, high-risk takers | Medium to long-term, moderate risk takers |

Which One Should You Choose: Multi Cap vs Multi Asset Funds

Choose Multi Cap Funds If:

- You have a high risk appetite, so multi cap funds may suit you well.

- You can stay invested for 5+ years, which means you’re more likely to benefit from long-term growth.

- You’re okay with short-term volatility, therefore you can handle market fluctuations.

- You want higher growth potential, and these funds aim to deliver just that.

Choose Multi Asset Allocation Funds If:

- Looking for balanced growth? A multi asset fund offers just that.

- Prefer to keep risk low? These funds focus on stability.

- They also come with dynamic management that adjusts to market changes.

- Ideal if your investment horizon is around 3–5 years.

Younger investors in their 20s or early 30s may prefer multi cap funds for long-term wealth creation. Closer to retirement? A multi asset fund might be safer and more stable.

Final Thoughts on Multi Cap vs Multi Asset Funds

There’s no one-size-fits-all answer. The best fund depends on your goals, risk tolerance, and time frame. Both multi cap and multi asset allocation funds have their place. If you’re seeking higher returns and can ride the ups and downs, go multi-cap. If you want steady growth with lower stress, multi asset is a smarter bet.

FAQs

What’s the main difference between multi cap and multi asset funds?

Multi-cap funds invest in stocks across caps; multi asset funds invest in stocks, bonds, and gold.

Are multi-cap funds riskier?

Yes, they have more exposure to small and mid-cap stocks.

Are multi asset funds good for short-term?

They’re better for medium-to-long-term (3–5+ years), offering lower volatility.

Which gives better returns?

Multi-cap funds can outperform in bull markets, but multi asset funds protect better in down markets.

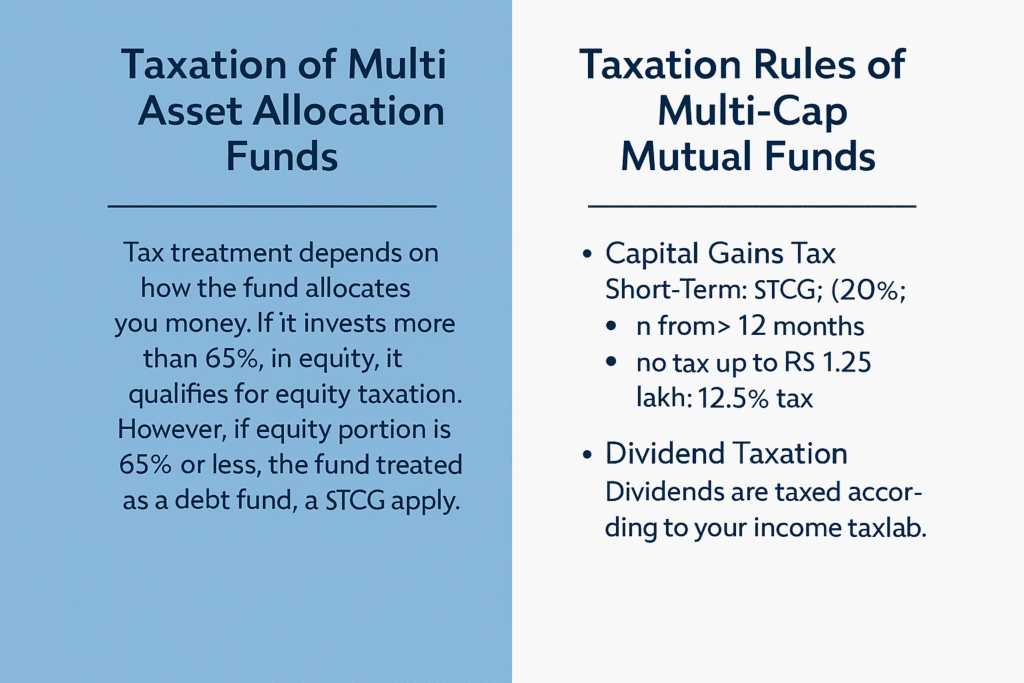

Are multi asset funds taxed like equity?

No. As per 2024 Budget, they’re taxed like debt funds, even if equity is >65%.