IPO Investing Demystified: Investor Needs to Know in 2026

IPO Investing (Initial Public Offerings) have taken center stage in the Indian stock market. Names like Zomato, LIC, Nykaa, and Paytm drew millions of retail investors with the promise of wealth creation and early-mover advantage. But are IPOs really a golden ticket or a gamble?

At Nemi Wealth, we believe informed investing is powerful investing. This blog will demystify the IPO process, examine key metrics to analyze upcoming offerings, explain listing gains vs long-term potential, and help you decide whether IPO investing is right for your financial goals.

What is an IPO?

An Initial Public Offering (IPO) is the process by which a private company becomes a publicly traded entity by offering its shares to the public for the first time. The goals?

- Raise capital for expansion, debt repayment, or operations

- Allow early investors or promoters to exit

- Gain market visibility and public trust

Once the Initial Public Offerings is complete, the company’s shares are listed on stock exchanges like NSE or BSE and become available for trading.

Why Do Companies Go Public?

1. Access to Capital

By selling shares, companies can raise substantial funds without taking on debt.

2. Liquidity for Promoters

Founders and early investors can liquidate part of their holdings.

3. Brand Credibility

A listed company earns more trust and credibility in the eyes of clients, lenders, and partners.

4. Employee ESOP Realization

Going public creates a market for employee stock options (ESOPs), incentivizing talent.

How Does the IPO Process Work?

1. Pre-IPO Planning

The company hires investment bankers, legal advisors, and auditors. It decides how much capital to raise and which type of investors to target.

2. Filing DRHP

A Draft Red Herring Prospectus (DRHP) is submitted to SEBI. This document outlines the company’s business model, financials, risks, and use of funds.

3. Price Band Declaration

The company and underwriters set a price band for the Initial Public Offerings say ₹300 to ₹320 per share.

4. IPO Opens for Subscription

Typically open for 3 days. Investors can apply via UPI through their brokers.

5. Allotment & Refund

Shares are allotted based on subscription, and refunds are processed for unsuccessful bids.

6. Listing on Stock Exchange

The shares get listed on a predetermined date, and investors can trade them freely thereafter.

Types of Investors in an IPO

1. Retail Individual Investors (RIIs)

Can invest up to ₹2 lakh. 35% of IPO quota is reserved for this category.

2. Qualified Institutional Buyers (QIBs)

Include banks, mutual funds, FIIs. 50% is reserved for QIBs.

3. High Net-Worth Individuals (HNIs)

Invest more than ₹2 lakh. 15% is reserved for this segment.

How to Evaluate an IPO: Nemi Wealth’s 6-Point Framework

- Company Fundamentals

- Revenue growth, profitability, industry standing

- Compare past performance via financial ratios

- Valuation

- P/E, P/B, EV/EBITDA vs listed peers

- Is it reasonably priced or overpriced?

- Promoter Background

- Promoter’s experience, reputation, and past ventures

- Use of Initial Public Offerings Proceeds

- Will the funds be used for growth or just repaying debt?

- Market Sentiment

- Are retail and institutional investors showing interest?

- Grey Market Premium (GMP)

- An unofficial indicator of listing expectations

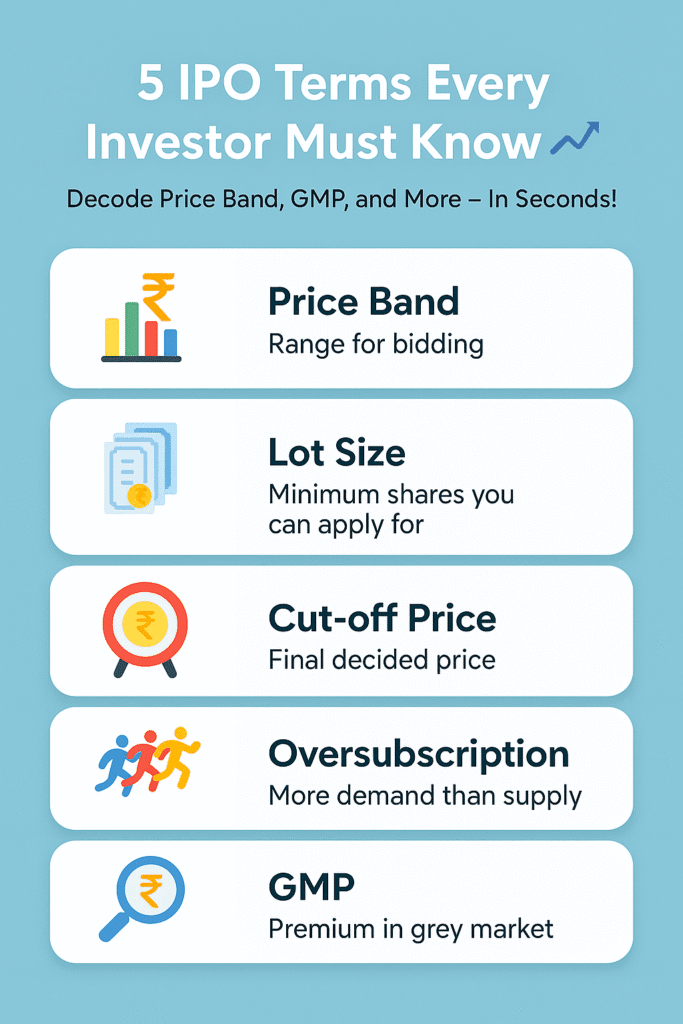

Key Terms You Should Know

Risks Involved

Even established companies can underperform post listing. Recent examples like Paytm and LIC show that high expectations don’t always translate into listing gains.

Risk Factors:

- Overvaluation

- Market volatility

- Limited historical data

- Lock-in periods for anchor investors

Case Studies: Indian Initial Public Offerings (2020–2025)

| Company | Year | Initial Public Offerings Price | Listing Day | Current Status |

|---|---|---|---|---|

| Zomato | 2021 | ₹76 | ₹125 (+66%) | Now below ₹100 |

| Nykaa | 2021 | ₹1,125 | ₹2,001 (+78%) | Significantly corrected |

| LIC | 2022 | ₹949 | ₹867 (-8.6%) | Still below issue price |

| Tata Technologies | 2023 | ₹500 | ₹1,200 (+140%) | Stable |

IPOs may offer listing gains, but long-term performance depends on fundamentals.

Listing Gains vs Long-Term Wealth Creation

Many investors enter Initial Public Offerings chasing short-term returns. While this can work during a bull market, it’s risky and often unsustainable.

| Criteria | Listing Gains | Long-Term Holding |

|---|---|---|

| Mindset | Speculative | Strategic |

| Time Horizon | 1–5 days | 3–5 years |

| Risk | High | Moderate |

| Return Potential | High volatility | Wealth compounding |

At Nemi Wealth, we encourage long-term thinking and support Initial Public Offerings entries only when they fit your goals and risk profile.

Should You Invest in Every IPO?

No. Not all IPOs are created equal. At Nemi Wealth, we follow a quality over quantity approach. A strong business model, reasonable valuation, and transparent promoters are our non-negotiables. If you wish to invest in IPOs, click below:

We classify them as:

- Invest: Clear fundamentals + pricing edge

- Watchlist: Strong company but expensive or volatile

- Avoid: Poor financials, unclear use of funds, or high promoter risk

Taxation of IPO Gains in India

- Short-term capital gains (STCG) if sold within 1 year – taxed at 20%

- Long-term capital gains (LTCG) after 1 year – taxed at 12.5% (for gains above ₹1.25 lakh)

- No TDS on Initial Public Offerings gains, but report in ITR

Final Thoughts

Initial Public Offerings can be a gateway to wealth but only when approached with discipline and insight. Want to explore upcoming IPOs with expert guidance?