Invest Smarter with Mini PMS: Start Your Portfolio Management Journey

Mini PMS is a revolutionary concept that makes Portfolio Management Services (PMS) accessible to a wider range of investors in India. Traditionally, PMS required a significant initial investment, often exceeding Rs. 50 lakhs. This limited access for many potential investors. Mini PMS breaks down this barrier, allowing you to embark on your wealth creation journey with a smaller starting amount, typically Rs. 5 lakhs and above.

Understanding Mini PMS

Mini PMS functions similarly to traditional PMS. Here’s a breakdown of the core concept:

- Expert Management: A dedicated team of experienced portfolio managers oversee your investments. They conduct in-depth research, analyze market trends, and make investment decisions aligned with your financial goals and risk tolerance.

- Customization: Mini PMS offers a certain degree of customization. You can discuss your investment goals and risk appetite with the portfolio manager to tailor the investment strategy to your needs.

- Active Management: Mini PMS involves active management of your portfolio. The portfolio manager actively buys and sells securities to maximize returns.

- Transparency: Mini PMS providers offer regular updates on your portfolio performance and investment decisions.

Benefits of Mini PMS

Mini PMS offers several advantages for investors seeking to grow their wealth:

- Professional Expertise: Leverage the knowledge and experience of seasoned professionals to navigate complex financial markets.

- Flexibility: Compared to traditional PMS, Mini PMS offers greater flexibility with lower minimum investment requirements.

- Goal-Oriented: PMS can be tailored to align with your specific financial goals, be it retirement planning, a child’s education, or wealth creation.

Is Mini PMS Right for You?

Mini PMS can be a valuable tool for investors who:

- Seek professional guidance for managing their investments.

- Have a medium- to long-term investment horizon (typically 3 years or more).

- Possess a moderate risk appetite.

- Have a starting capital of around Rs.5 lakhs. To gain more information about PMS click here

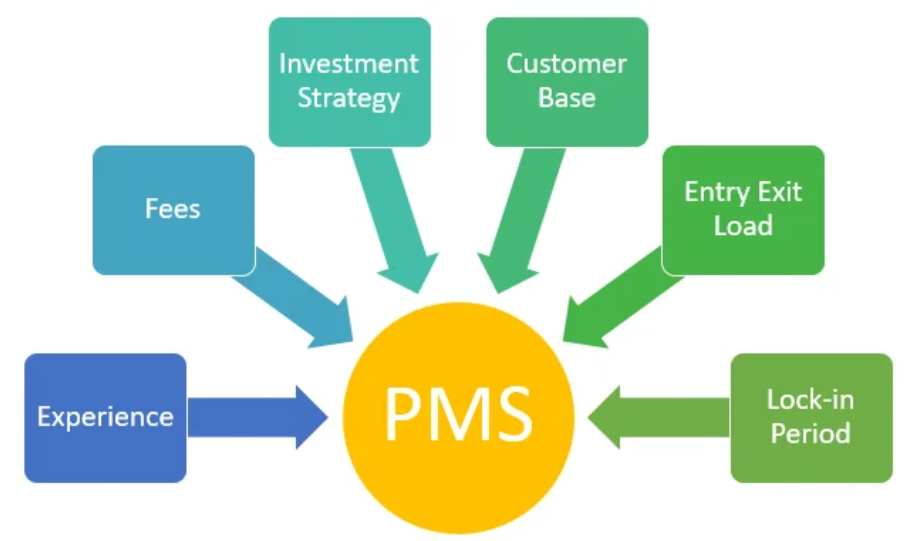

Things to Consider Before Investing

While Mini PMS offers numerous benefits, it’s crucial to consider certain factors before making a decision:

- Cost: PMS typically comes with fees that cover portfolio management and other associated services. Understand the fee structure before investing.

- Performance: Past performance is not necessarily indicative of future results. Research the track record of the PMS provider.

- Lock-in Period: Some PMS may have lock-in periods, restricting withdrawal flexibility for a certain duration.

Conclusion

Mini PMS presents a compelling option for investors seeking professional portfolio management with a smaller initial investment. By understanding the concept, its benefits, and suitability factors, you can make an informed decision about whether it aligns with your financial goals and risk tolerance. Remember, consulting a financial advisor can provide personalized guidance based on your unique circumstances.