Indian Stock Market: Who Really Owns It? The Surprising Truth

The Indian stock market is booming, and more people are investing every day. But have you ever wondered about Indian stock market ownership? Who actually owns the shares of top Indian companies? Is it the government, foreign investors, or retail investors like you? Let’s dive into the details and understand who controls the stock market and what it means for your investments.

What Does “Indian Stock Market Ownership” Mean?

When we say Indian stock market ownership, we’re talking about who holds the shares of companies listed on the stock exchanges – like NSE and BSE. Shareholders can include:

- Foreign Institutional Investors (FIIs)

- Domestic institutions (like mutual funds and insurance firms)

- Promoters (company founders or the government)

- Retail investors (individuals like you and me)

Each group plays a different role in shaping the market.

FPIs: A Big Part of Stock Market Ownership

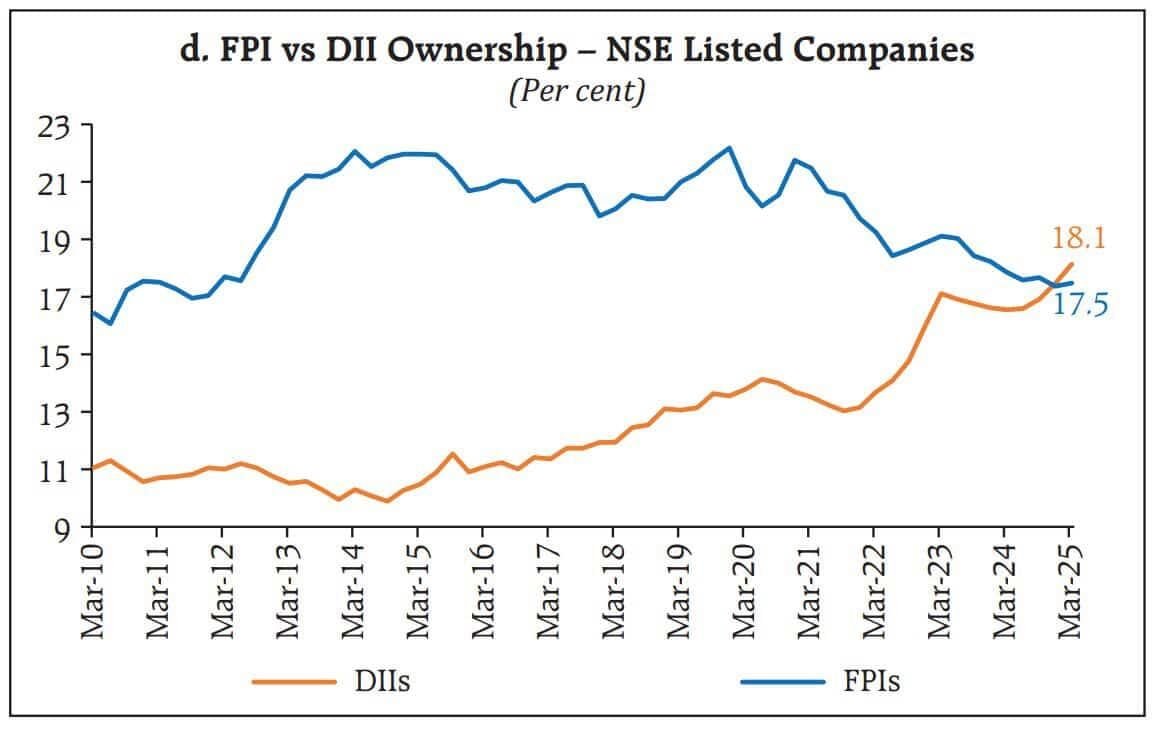

Foreign Portfolio Investors (FPIs) have been pulling back. In Q4 2024 alone, they pulled out $12 billion from Indian equities. As a result, their stake in the top 500 NSE-listed companies fell to 18.8%, the lowest in 12 years.

Though they cut exposure in large-cap stocks like the Nifty 50 (from 25.8% in Dec 2023 to 24.3% in Dec 2024), they increased holdings in midcaps and small caps:

- Midcap : Up from 15.8% → 16.2%

- Small Caps: Up from 11.9% → 12.5% Know more

Promoters and Government: Holding the Majority

A big chunk of stock market ownership still rests with promoters. These are the original owners or families who started the companies. For example:

- The Tata Group owns a majority in TCS

- The Ambani family controls Reliance Industries

- The Bajaj family holds Bajaj Finance

In the case of public sector undertakings (PSUs), the Indian government is the promoter owning major stakes in:

- SBI

- ONGC

- Coal India

Together, promoters (private + public) own more than 50% of listed companies.

Domestic Institutions: A Growing Share

Domestic Institutional Investors (DIIs) are stepping up. Their share in the top 500 companies reached a record 17.9% in Dec 2024. Mutual funds alone now hold over 10.7% of the market. Here’s how their share changed:

- Nifty 50: Up from 19.8% → 21.9%

- Midcap 100: Up from 16% → 17%

- Small Caps: Up from 12.1% → 12.8%

This growing presence shows that Indian institutions are becoming more confident and committed to long-term investing companies. Unlike FIIs, they stay invested for the long run, which adds stability to the market.

Retail Investors: The Rising Force in Indian Stock Market

Retail investors are the most exciting part of Indian stock market ownership. Just a few years ago, retail investors owned only 4-5% of the market. Today, it’s over 7%, and growing fast. What’s driving this?

- Easy access to investing apps (like Zerodha, Groww, Motilal Oswal)

- Financial education on YouTube and Instagram

- Growing trust in SIPs and mutual funds

- Low starting amounts – even ₹100 is enough

India now has over 14 crore demat accounts, showing a massive shift in financial participation.

The Stock Market Ownership Is Shifting – And That’s Good

The structure of stock market ownership is changing. Here’s how:

- FIIs are still important, but not dominant

- Domestic institutions are growing stronger

- Retail investors are more active and informed

- Promoters continue to hold majority stakes

This balanced ownership structure is healthier for the long-term. It means less dependence on foreign capital and more local confidence.

Why Stock Market Ownership Matters to You

Why should you care who owns the market? Because these ownership patterns affect:

- Market stability

- Volatility during global events

- How companies are run

- Long-term investment opportunities

The more Indian investors participate, the more resilient and self-reliant our market becomes.

Final Thoughts from Nemi Wealth

Understanding Indian stock market ownership helps you make smarter investing decisions. At Nemi Wealth, we believe in:

- Long-term investing

- Financial clarity

- Empowering retail investors

Whether you’re starting with ₹500 or ₹50,000, you’re becoming part of a financial revolution.

Start Your Investing Journey Today

- Simple SIPs

- Expert-selected mutual funds

- Clear, long-term strategy

Visit Nemi Wealth and take charge of your wealth one smart decision at a time.

If you wish to invest in stocks, open a Free Demat account here.

If you enjoy simple, real, and actionable money tips, follow us on-