Invest Smarter with Mini PMS: Start Your Portfolio Management Journey

Portfolio Management Services (PMS) have long been associated with high-net-worth individuals (HNIs) and large investment thresholds. But what if you could access similar benefits with a much smaller starting capital? Enter Mini PMS a revolutionary approach that democratizes portfolio management in India.

In this blog, we’ll take a deep dive into what Mini PMS is, how it works, its benefits, how it compares with traditional PMS and mutual funds, and whether it suits your financial journey.

What is Mini PMS?

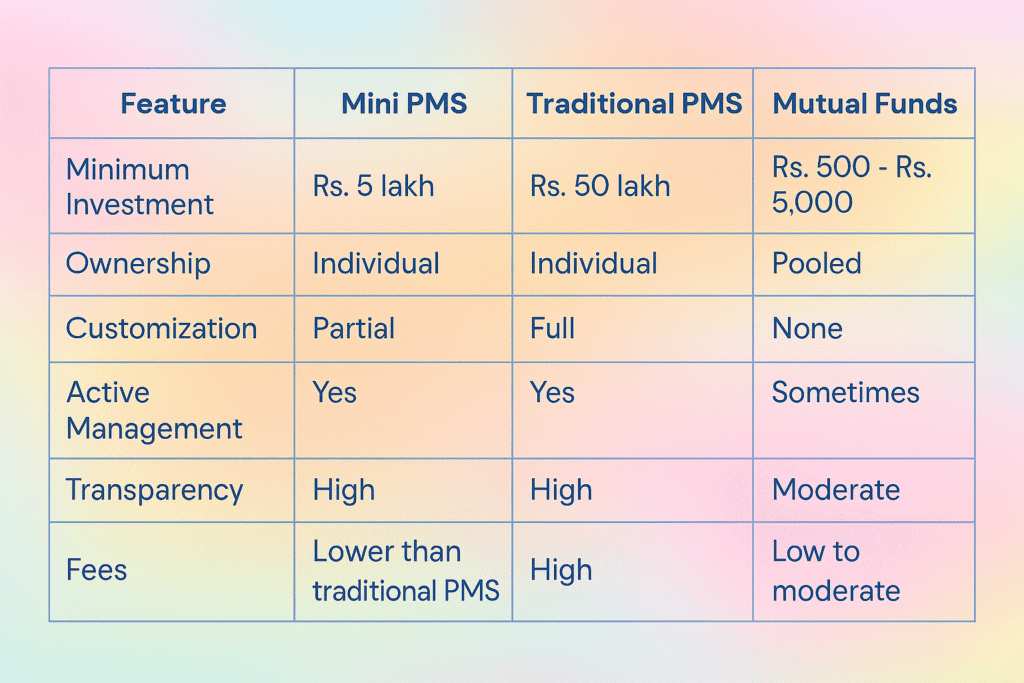

Mini PMS, or “Mini Portfolio Management Services,” is a simplified version of traditional PMS tailored for investors with a lower investment budget. While standard PMS requires a minimum investment of Rs. 50 lakhs or more, Mini PMS makes portfolio management accessible with a minimum capital starting at Rs. 5 lakhs. Despite the reduced entry barrier, Mini PMS retains many of the core features of traditional PMS, including active fund management, personalized investment strategies, and expert oversight.

How Does Mini PMS Work?

Just like traditional PMS, Mini Portfolio Management Services involves an expert fund manager or team managing your portfolio. Here’s how it typically works:

- Account Setup: You open a demat and trading account through the PMS provider.

- Initial Investment: You deposit your initial investment (usually Rs. 5 lakh or above).

- Strategy Selection: Based on your goals and risk profile, a portfolio strategy is chosen.

- Active Management: The manager actively buys and sells securities in your account.

- Tracking: You receive regular updates and performance reports.

Unlike mutual funds, where your money is pooled with other investors, in PMS (including Mini PMS), the investments are made in your name. You own the underlying securities.

Features of Mini PMS

- Expert Management

- Fund managers with years of experience handle the research, analysis, and decision-making.

- Customization

- Strategies can be tailored to your specific risk appetite and financial goals.

- Transparency

- You can track portfolio holdings, trades, and performance in real time.

- Ownership of Securities

- The stocks and securities are held in your demat account. This offers more control and transparency compared to mutual funds.

- Smaller Investment Threshold

- Makes professional management accessible for investors with moderate capital.

Benefits of Mini PMS

1. Lower Entry Point

- With a starting capital of Rs. 5 lakhs, Mini Portfolio Management Services allows aspiring investors to access professional portfolio services earlier in their wealth journey.

2. Professional Expertise

- Fund managers use market research, quantitative tools, and sectoral insights to build a robust portfolio.

3. Personalized Approach

- Unlike mutual funds, Mini Portfolio Management Services portfolios are designed keeping your individual goals in mind.

4. Better Tax Efficiency

- Since trades are executed in your demat account, gains/losses are more tax-optimized compared to pooled investments.

5. Goal-Based Investment Planning

- You can align Mini Portfolio Management Services with specific goals: retirement, children’s education, wealth creation, etc.

Is Mini PMS the Right Fit for You?

Mini Portfolio Management Services can be an ideal investment vehicle if you:

- Have an investable surplus of at least Rs. 5 lakhs.

- Want to move beyond mutual funds.

- Seek hands-on management by experienced professionals.

- Have a medium- to long-term investment horizon (3+ years).

- Can tolerate moderate to high levels of market volatility.

If you’re new to equities but have the capital and mindset for long-term growth, Mini Portfolio Management Services bridges the gap between mutual funds and traditional PMS.

Key Differences: Mini PMS vs Traditional PMS vs Mutual Funds

What to Watch Out For: Things to Consider Before Investing

- Fee Structure

- While lower than traditional PMS, Mini Portfolio Management Services still charges a management fee (fixed or performance-linked). Understand the Total Expense Ratio (TER).

- Volatility

- Like all equity-based investments, Mini Portfolio Management Services portfolios can be volatile.

- Lock-in Periods

- Some providers may impose a 1-3 year lock-in. Read the fine print.

- Past Performance

- Always check the track record of the Portfolio Management Services provider and fund manager.

- Reporting and Support

- Ensure regular communication, performance reviews, and access to fund managers or advisors.

Real-Life Scenarios: Who is Using Mini PMS?

Case Study 1: Rohan, Age 32, IT Professional

He wants to invest Rs. 7 lakhs for wealth creation but doesn’t have time to track stocks daily. Mini Portfolio Management Services offers him a hands-off approach with expert management and real-time transparency.

Case Study 2: Meena & Suresh, Parents Saving for Daughter’s College

They begin a Mini PMS portfolio with Rs. 10 lakhs earmarked for 7-8 years. Their manager creates a moderate-risk plan with a balance of growth and stability.

Case Study 3: Deepak, Retiree

Wants capital preservation with income. His Mini Portfolio Management Services is focused on dividend-paying stocks and short-term bonds, customized to meet his monthly expenses.

Mini PMS vs Algo Trading

Mini PMS involves human decision-making with personalized strategies. On the other hand, Algorithmic Trading (or Algo Trading) uses automated systems to make fast trades based on pre-set rules. While both can be part of a diversified strategy, Mini PMS is ideal for those wanting a balanced, human-managed approach with a personal touch.

Final Thoughts: Mini PMS, Small Capital, Big Strategy

Mini PMS has opened the doors for many Indian investors who were previously excluded from PMS due to high investment thresholds. With the right strategy, professional guidance, and risk management, it can be a powerful addition to your portfolio. Whether you’re a young professional, a family planning for future milestones, or a retiree looking for expert help Mini PMS could be your gateway to smarter investing.

Ready to grow your wealth with expert guidance?

Get started with Nemi Wealth your trusted partner in building a smarter portfolio.