Gold Prices in India on 12 August 2025: Analysis, Drivers & Investor Strategies

Gold prices in India fell slightly on 12 August 2025 as traders booked profits ahead of crucial retail inflation data from both India and the United States. This pullback comes after the precious metal touched record highs in recent weeks, supported by global economic uncertainty and sustained central bank buying.

At around 1 PM on the Multi Commodity Exchange (MCX):

- Gold October 3 contracts were down 0.24% at ₹1,00,080 per 10 grams.

- Silver September 5 contracts gained 0.20% to ₹1,13,520 per kg.

Why Gold Prices in India Are Easing

1. Inflation Numbers in Focus

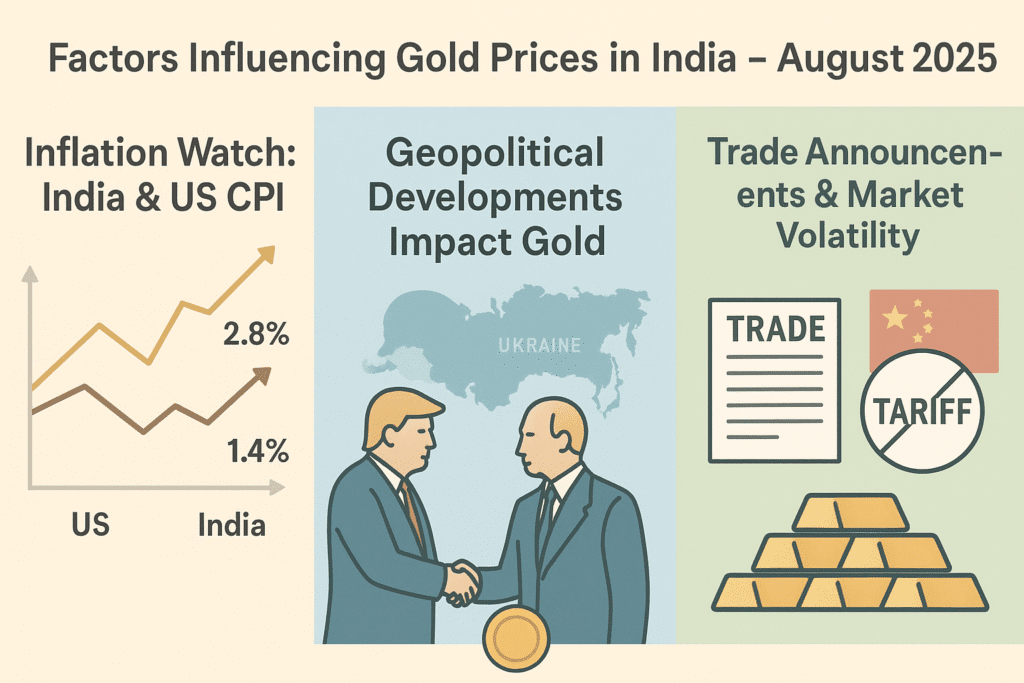

Market participants are closely tracking the July Consumer Price Index (CPI) inflation data.

India: CPI is expected at 1.4%, down from 2.10% in June 2025, indicating softening price pressures.

United States: CPI is projected at 2.8%, slightly higher than June’s 2.7%. This could influence the US Federal Reserve’s September interest rate decision.

If US inflation rises above expectations, it may delay aggressive interest rate cuts, potentially leading to short-term pressure on gold prices in India. However, the long-term outlook remains positive due to the metal’s role as an inflation hedge.

2. Geopolitical Optimism

Geopolitical tensions between Russia and Ukraine eased slightly as both nations agreed to resume peace talks. Notably, US President Donald Trump and Russian President Vladimir Putin are scheduled to meet in Alaska on 15 August 2025 for direct negotiations. This progress temporarily reduced demand for gold as a safe-haven asset, impacting gold prices in India.

3. Trade and Tariff Announcements

In a surprise policy move, President Trump announced that imported gold bars would not face tariffs, removing a recent price driver. Additionally, the US-China trade truce has been extended for 90 days, which has contributed to reduced volatility in global markets and a temporary pullback in gold prices in India.

Expert Insights – Is This a Buying Opportunity?

Manoj Kumar Jain, Prithvifinmart Commodity Research:

We suggest buying gold around ₹1,00,100 with a strict stop loss at ₹99,660 for a target of ₹1,00,750.

Technical Levels – MCX Gold:

- Support: ₹99,900 – ₹99,475

- Resistance: ₹1,00,650 – ₹1,01,100

Technical Levels – International Gold:

- Support: $3,389 – $3,360 per troy ounce

- Resistance: $3,434 – $3,455 per troy ounce

Rahul Kalantri, VP – Commodities, Mehta Equities:

Gold has support at ₹99,850 – ₹99,450 and resistance at ₹1,00,750 – ₹1,00,980.

Renisha Chainani, Head of Research – Augmont:

Gold may consolidate with a bearish bias towards $3,350 (around ₹98,500) before making its next move.

Nemi Wealth Perspective

From a strategic investment standpoint, gold prices in India remain underpinned by long-term bullish drivers such as central bank accumulation, currency market volatility, and its role as a hedge against inflation. The short-term dip on 12 August 2025 could present an attractive entry point for investors with a medium-to-long-term outlook.

Retail investors may consider staggered allocations via Gold ETFs, Sovereign Gold Bonds (SGBs), or systematic investment plans (SIPs) linked to gold. This approach helps average purchase costs and mitigates the risk of entering the market at unfavourable price levels.

Key Takeaway

The decline in gold prices in India on 12 August 2025 is primarily linked to inflation data anticipation, easing geopolitical risks, and tariff relief measures. Long-term investors can use the current market softness to accumulate positions gradually rather than waiting for an ideal price point that may never materialize.

FAQs

Why did gold prices in India fall on 12 August 2025?

Gold prices eased slightly due to profit booking by traders ahead of key retail inflation data from India and the US. Additionally, easing geopolitical tensions, trade announcements, and tariff relief measures reduced short-term safe-haven demand for gold.

How does inflation affect gold prices in India?

Gold is often seen as a hedge against inflation. Lower inflation in India (expected at 1.4% in July) signals reduced price pressures, which can temporarily ease demand for gold. Conversely, higher US inflation could influence global interest rate policies, indirectly affecting gold prices in India.

Are geopolitical events influencing gold prices in India?

Yes. Recent easing of tensions between Russia and Ukraine, along with scheduled high-level meetings like the Trump-Putin Alaska talks, have temporarily reduced safe-haven demand for gold, impacting prices in India.

What investment options are available for gold in India?

Retail investors can consider:

- Systematic Investment Plans (SIPs) linked to gold

- These options allow staggered investments, helping average costs and reduce the risk of buying at peak prices.

- Gold ETFs (Exchange-Traded Funds)

- Sovereign Gold Bonds (SGBs)

Is the current dip in gold prices a good buying opportunity?

Experts suggest that the short-term dip around ₹1,00,100 could be a potential buying opportunity for medium-to-long-term investors. Strategic entry via staggered investments can help capture long-term gains while managing market volatility.