FII and FPI Explained: Know Their Impact & Why It Matters to You in 2025

As India continues to stand out as one of the world’s fastest-growing economies, the role of foreign investments has become increasingly significant. Among the various types of foreign investments, two major categories dominate the Indian financial landscape Foreign Institutional Investors (FIIs) and Foreign Portfolio Investments (FPIs). These investments play a crucial role in shaping stock market dynamics, influencing economic growth, and providing strategic investment opportunities for individuals and institutional investors alike.

In this detailed blog, we’ll cover everything you need to know about FIIs and FPIs in India in 2025 what they are, how they work, their impact on markets and the economy, their benefits and risks, and why understanding their movement is vital for individual investors.

What is a Foreign Institutional Investor?

A Foreign Institutional Investor (FII) refers to an investment fund or organization that is based outside India and invests in Indian financial markets. These entities include mutual funds, hedge funds, insurance companies, pension funds, and investment banks. The term is commonly used in India and is regulated by the Securities and Exchange Board of India (SEBI).

Key Characteristics of Foreign Institutional Investor:

- Institutional investors, not individuals

- Invest in equity, debt, and hybrid securities

- Need to be registered with SEBI

- Follow investment limits and compliance norms

FIIs are a subset of Foreign Portfolio Investments and are known for their active and influential participation in stock markets. Their buying and selling decisions often trigger large market movements.

What is Foreign Portfolio Investment (FPI)?

Foreign Portfolio Investment (FPI) is a broader term that encompasses all investments made by foreign entities in India’s securities market. This includes shares, bonds, debentures, derivatives, and other financial instruments. FPI allows for easier and faster entry and exit compared to Foreign Direct Investment (FDI), making it a preferred choice for short- to medium-term investors.

Key Features of FPI:

- Passive form of investment

- Includes both institutional and individual investors

- Flexible and liquid

- Short- to medium-term outlook

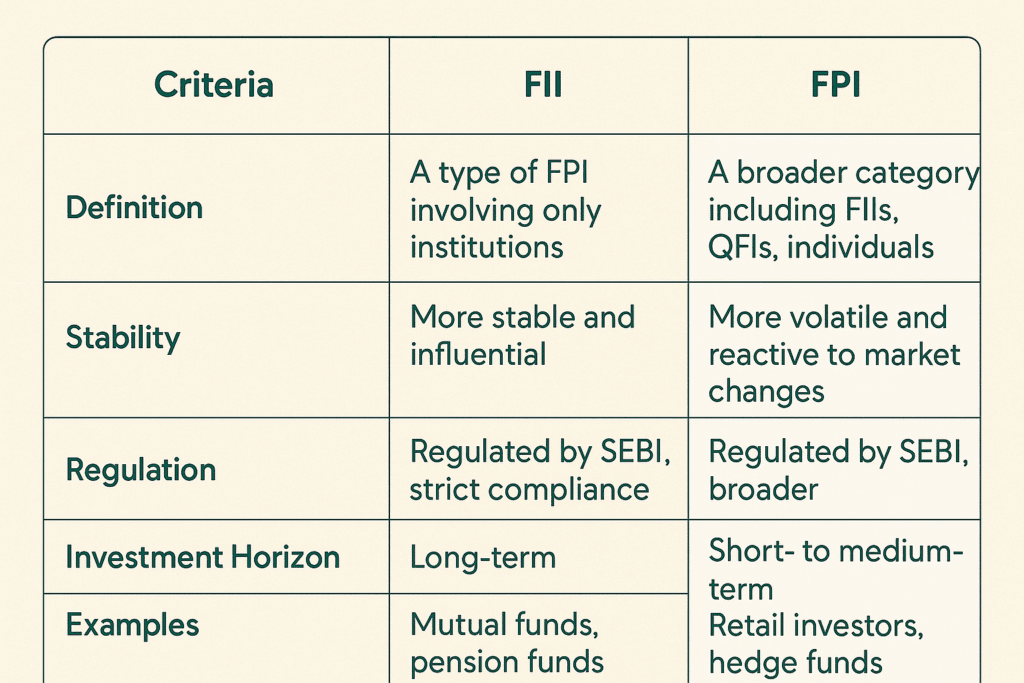

Foreign Institutional Investor vs Foreign Portfolio Investment: What’s the Difference?

Why Do Foreign Institutional Investors Invest in India?

India has consistently attracted FIIs due to several favorable macroeconomic and policy-related factors:

- Growth Potential: India’s economy continues to grow at a strong pace, supported by a robust services sector, a vibrant manufacturing base, and an expanding digital economy.

- Sectoral Opportunities: Promising sectors like technology, finance, pharmaceuticals, and infrastructure offer lucrative returns.

- Reform-Oriented Government: Investor-friendly policies, tax reforms, and liberalized FDI norms create a stable investment environment.

- Currency and Legal Framework: India’s relatively stable currency and well-defined legal system provide assurance to foreign investors.

- Diversification: Investing in India allows global investors to diversify their portfolios into emerging markets.

Impact of Foreign Institutional Investor on Stock Markets

FIIs are known to influence stock market trends in both bullish and bearish phases. Here’s how their participation affects Indian equity markets:

- Price Movements: When Foreign Institutional Investor invest in large volumes, stock prices tend to rise due to increased demand. Conversely, large withdrawals can lead to market corrections.

- Liquidity: FII activity increases liquidity in markets, making it easier for other investors to buy and sell.

- Sector Rotation: Foreign Institutional Investor often target specific sectors. A surge in Foreign Institutional Investor interest in banking or IT stocks can result in rallies in those sectors.

- Market Sentiment: Foreign Institutional Investor flows are closely watched by domestic investors. Positive inflows often boost market confidence, while outflows trigger caution.

Types of Foreign Institutional Investor

- Mutual Funds: Pool money from global investors to invest across a diversified portfolio. Some mutual funds specifically focus on emerging markets like India.

- Pension Funds: Seek long-term, steady returns. Invest in stable sectors with predictable earnings.

- Insurance Companies: Prefer secure, high-return investments to cover future claims.

- Hedge Funds: Invest in high-risk, high-reward opportunities, often with complex strategies.

- Investment Banks: Engage in direct equity and bond investments, often through proprietary trading desks.

Risks Posed by Foreign Institutional Investor

While FIIs bring substantial benefits, they also introduce certain risks:

- Market Volatility: Their exit can lead to sharp corrections.

- Currency Risk: Mass withdrawal can weaken the rupee, increasing inflation and import costs.

- Sector Imbalances: Heavy investment in one sector can inflate valuations beyond fundamentals.

- Regulatory Dependence: Over-reliance on foreign money may reduce policy independence.

Benefits of FPI & FII to the Indian Economy

- Capital Inflows: Strengthens forex reserves and bridges the investment gap.

- Improved Liquidity: Makes the Indian stock market more vibrant and accessible.

- Technology & Expertise: Promotes corporate governance and international best practices.

- Increased Market Depth: Enhances the variety of instruments and investment avenues.

How Can Individual Investors Benefit from FII Trends?

- Track Sector Rotation: Observing Foreign Institutional Investor interest in sectors like FMCG or IT helps identify emerging trends.

- Data Monitoring Tools: Use trading platforms or financial news portals to stay informed about Foreign Institutional Investor flows.

- Informed Decision-Making: Align your portfolio with Foreign Institutional Investor activity for better entry/exit strategies.

Key Regulatory Developments

- SEBI’s FPI Framework (2021): Simplified registration, enhanced transparency, and monitoring.

- Beneficial Ownership Rules: Mandate disclosures of ownership to prevent misuse of investment routes.

- OFI & Unlisted Securities: FPIs now allowed to invest in unlisted debt securities and participate in Offer for Sale (OFS) mechanisms.

Foreign Direct Investment (FDI) vs FPI

| Criteria | FDI | FPI |

|---|---|---|

| Control | Active control over business | No management control |

| Tenure | Long-term | Short- to medium-term |

| Entry Barriers | Higher | Lower |

| Risk | Lower due to ownership | Higher due to market volatility |

Example of FII Activity in India

A U.S.-based mutual fund identifies India’s renewable energy sector as a high-growth opportunity. The fund buys large stakes in listed companies like Adani Green or Tata Power. This Foreign Institutional Investor activity not only boosts these stocks but also encourages other investors to follow suit, leading to sectoral growth.

Future Outlook: 2025 and Beyond

- Tech-driven Investing: Expect more algorithm-based and ESG-aligned investments from Foreign Institutional Investor.

- India’s Inclusion in Global Indices: Will attract more passive funds.

- Rising Retail Participation: May offset volatility caused by Foreign Institutional Investor exits.

- De-dollarisation Trend: Could influence Foreign Institutional Investor behavior based on geopolitical shifts.

FPI and FII: Why They Matter to You

Understanding Foreign Portfolio Investments and Foreign Institutional Investor flows is not just for economists or fund managers it’s relevant to every retail investor. These foreign funds shape trends, move markets, and influence everything from the Sensex to your SIP. By monitoring Foreign Portfolio Investments/Foreign Institutional Investor data, staying updated on regulatory changes, and aligning your strategy accordingly, you position yourself to make informed and confident investment decisions.

Conclusion: Invest Wisely with Nemi Wealth

At Nemi Wealth, we believe knowledge is power. Knowing how Foreign Institutional Investor and Foreign Portfolio Investments movements affect the Indian markets can help you craft a more responsive and resilient investment strategy. We guide investors in:

- Portfolio diversification aligned with global capital flows

- Sectoral strategy based on Foreign Institutional Investor insights

- Monitoring FPI regulatory changes and trends

Whether you’re a seasoned investor or just starting, our expert insights and tools help you stay ahead. Get Started with Nemi Wealth Take control of your financial journey today.

Disclaimer: This blog is for educational purposes only and does not constitute financial advice. Please consult with certified professionals before making investment decisions.