Start Smart: Early Retirement Planning in Your 20s

Early retirement planning might not be a priority when you’re in your 20s, but it can make all the difference in your financial future. Starting early allows you to take advantage of compounding, reduce future stress, and build wealth at a steady pace. Plus, the earlier you start, the less financial pressure you’ll feel later in life.

In this guide, we’ll break down why starting in your 20s is crucial, and walk you through simple, practical steps to build a strong retirement plan, even with a modest income. Let’s future-proof your finances, one smart move at a time.

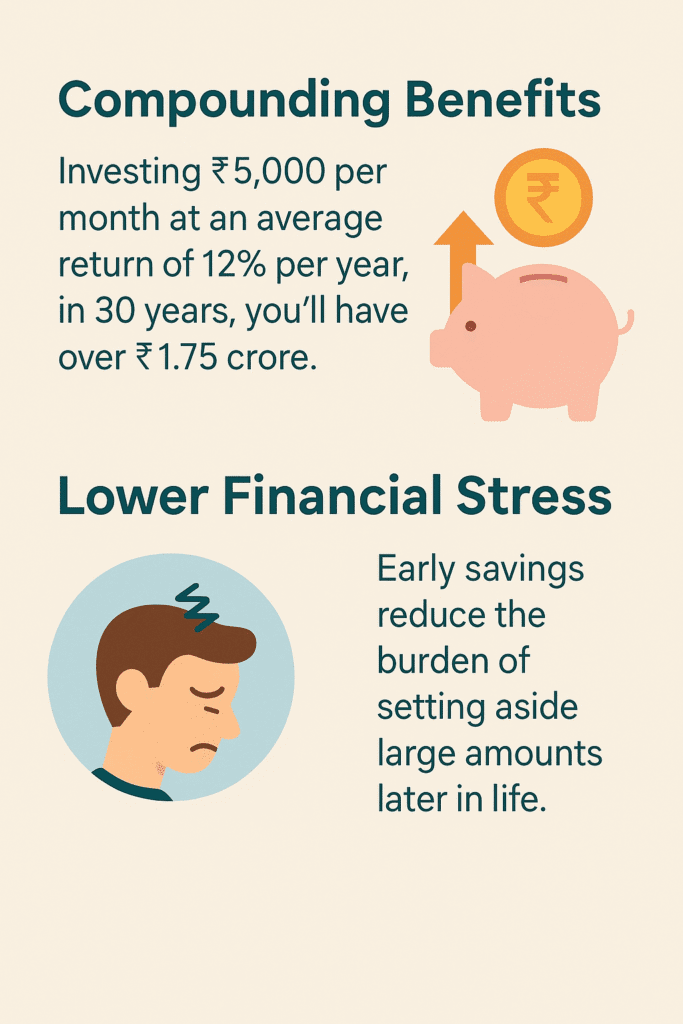

Many people delay retirement planning, thinking they have plenty of time. However, starting early can help in two major ways.

Here’s a Steps to Start Early Retirement Planning in your 20s

Step 1: Set Your Early Retirement planning Goals

Before you start investing, define your early retirement planning goals:

- At what age do you want to retire?

- How much will you need per month?

- Will you have other income sources like rent or a pension?

For example, if you plan to retire at 60 and need ₹50,000 per month, you’ll need at least ₹3 crore in savings (adjusted for inflation). Check out more calculators to plan your savings, investments with ease.

Step 2: Build an Emergency Fund

Before focusing on early retirement planning and investments, ensure you have an emergency fund.

- Save 6 months’ worth of expenses in a liquid fund or savings account.

- This ensures you won’t withdraw retirement savings for unexpected expenses.

Step 3: Choose the Right Investments

Your early retirement planning should be in high-growth investments. Some good options are:

- Equity Mutual Funds (SIP) : A Systematic Investment Plan (SIPs) helps you invest a fixed amount regularly, bringing discipline to your savings. It also benefits from rupee cost averaging, meaning you buy more units which prices are low and fewer when prices are high.

- Stocks & ETFs : If you understand the stock market, investments can offer high returns. Since stock investing can be complex, it’s best to consult a financial advisor before starting.

- You could also consider investing a portion of your money in options like an Fixed Deposit or Public Provident Fund (PPF).

Step 4: Increase Contributions as Your Income Grows

As your income increases, increase your early retirement planning contributions

- As you earn more, whether from a job, business, or other sources, your savings and investments should grow too. A common mistake people make is increasing their expenses as their income rises, but a smarter approach is to boost your savings first.

- If you invest through SIPs, increase your contribution regularly. Even a 10% yearly increase can make a huge difference over time.

Step 5: Avoid Unnecessary Debt to Secure Early Retirement Planning

- Debt can be a major obstacle to financial freedom. While some loans, like home loans or education loans are necessary, avoid high-interest debt.

- Avoid high-interest debt like personal loans and credit card debt. If you have a student loan, aim to repay it early to free up savings.

Step 6: Review Your Early Retirement Planning Strategy Regularly

- Assess Investment Performance: Check if your investments are delivering expected returns. If certain assets underperform consistently, consider rebalancing or switching to better options.

- Get Expert Advice: An investment advisor can help you review your portfolio and suggest better opportunities.

- Check your investments yearly to ensure they align with your goals. Regular reviews help you stay in control of your finances and make necessary adjustments for long-term success.

Step 7: Secure Early Retirement Planning with Insurance

- Medical emergencies can be unpredictable and expensive. Select a health insurance plan that covers hospitalization, critical illnesses, and rising medical costs. Consider family floater plans if you have dependents to ensure everyone is protected. Buying early helps you get lower premiums and avoid exclusions for pre-existing conditions.

- Term Insurance: Life is uncertain, and term insurance provides financial security for your family in case of an untimely event. It offers a large cover at an affordable premium, ensuring your loved ones are financially protected even in your absence.

Conclusion: Start your Early Retirement Planning Today

Starting retirement planning early is one of the best financial decisions you can make. The earlier you begin, the more time your money has to grow through compounding and smart investments. By choosing the right investment options, increasing your contributions over time, and regularly reviewing your plan, you can build a secure financial future.

Additionally, having health and term insurance ensures that unexpected medical expenses or life uncertainties don’t derail your financial goals. A well-structured plan not only provides peace of mind but also allows you to enjoy your later years without financial stress.

The key to a comfortable retirement is starting early, staying consistent, and making informed financial choices.

FAQs

Why should I start early retirement planning in my 20s?

Starting early gives your money more time to grow through compounding. Even small monthly investments can grow into a large corpus over decades. Plus, early planning reduces future financial stress and allows you to build wealth steadily.

How much should I invest for retirement in my 20s?

Start with whatever amount you can comfortably afford. Even investing ₹3,000–₹5,000 per month can make a significant difference. As your income grows, gradually increase the amount you invest.

What is compounding and how does it help?

Compounding is the process where your returns start generating additional returns over time. For example, investing ₹5,000/month at 12% annual returns for 30 years can grow to over ₹1.75 crore that’s the power of compounding.

What are the best investment options for retirement in my 20s?

Some of the best options include:

- Public Provident Fund (PPF) for stable, tax-free returns

- Equity Mutual Funds via SIPs

- Stocks and ETFs (if you understand the market)

Balancing risk and growth is key, a mix of equity and debt investments works well.

Should I still plan for retirement if I have student loans or other debts?

Yes, you can do both. Prioritize high-interest debt (like credit cards), but don’t completely pause retirement savings. Even small SIPs alongside debt repayments can keep your financial plan on track.