Debt Consolidation in India: 3 Reasons It’s Smart and 3 Signs It’s a Dangerous Debt Trap

Managing three, four, or even five different EMIs every month can feel overwhelming—especially when each loan carries its own interest rate, due date, and penalty rules.

This is exactly why many Indians consider a Debt Consolidation Loan, a financial tool that lets you combine all your existing loans into one single EMI.

But here’s the truth:

Consolidation can save you money… or silently cost you more than you expect.

Let’s break it down with complete clarity.

What Is a Debt Consolidation Loan?

A debt consolidation loan is essentially a fresh personal loan taken to close all your existing loans such as:

- Credit card rollover balances

- NBFC personal loans

- Older high-interest personal loans

- Consumer durable loans (sometimes)

Once these are shut, you’re left with only one EMI—ideally at a lower interest rate.

Why Do People Choose Debt Consolidation?

The main reasons include:

- Too many EMIs to manage

- High interest on credit cards (30–42% p.a.)

- NBFC loans at 18–32%

- Need for better cash flow

- Desire to simplify finances

- Improving credit score with a cleaner structure

But benefits appear only when certain conditions are met.

Positives: When Debt Consolidation Actually Helps

1. Lower Interest Rate (if your profile is strong)

This is the biggest advantage.

People with high-interest debt can reduce their burden significantly if they manage to secure:

- A new loan rate of 10–13%

- Replacing credit card debts of 30–42%

- Replacing NBFC loans of 18–32%

A drop of 3–6 percentage points is where consolidation becomes meaningful.

2. One EMI Instead of Many

One date, one amount, one lender.

This reduces mental stress and the risk of late payments.

3. Improved CIBIL Score Over Time

Consolidation often reduces your credit utilization and creates a stable repayment pattern, helping your CIBIL score recover within 3–6 months.

4. Lower EMI by Extending Tenure

If cash flow is tight, a longer tenure can reduce EMI. It’s not always financially optimal, but it brings short-term breathing room.

Negatives: When Consolidation Can Backfire

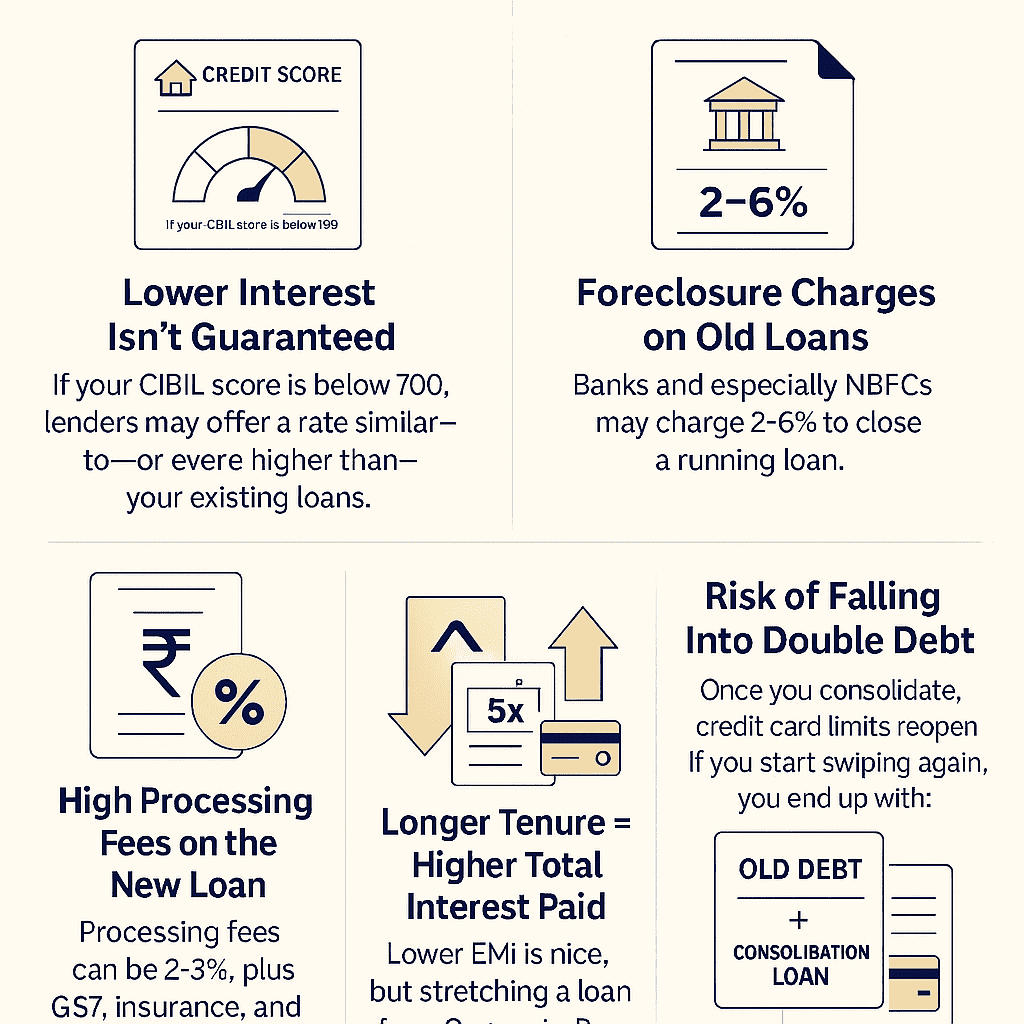

1. Lower Interest Isn’t Guaranteed

If your CIBIL score is below 700, lenders may offer a rate similar to—or even higher than—your existing loans.

Then consolidation becomes pointless.

2. Foreclosure Charges on Old Loans

Banks and especially NBFCs may charge 2–6% to close a running loan.

These charges can wipe out your savings.

3. High Processing Fees on the New Loan

Processing fees can be 2–3%, plus GST, insurance, and documentation charges.

4. Longer Tenure = Higher Total Interest Paid

Lower EMI is nice, but stretching a loan from 2 years to 5 years means paying more interest in total—even if the rate is lower.

5. Risk of Falling Into Double Debt

Once you consolidate, credit card limits reopen.

If you start swiping again, you end up with:

Old debt + New consolidation loan = Double debt trap

How to Know If Consolidation Is Actually Beneficial

Use these three filters:

1. Your new interest rate must be at least 3–6% lower

Example:

- Current weighted average interest = 22%

- New loan offer = 12–15% → Good

- New loan offer = 18–20% → Not worth it

2. Your CIBIL score should be 720+

A higher score gives you access to lower rates and better terms.

3. Fees and charges should not cancel out your savings

Calculate:

- Foreclosure charges

- Processing fee

- Insurance premium

- Stamp duty

If the net savings are positive, consolidation makes sense.

Conditions You Must Meet for a Lower Interest Rate

1. CIBIL 720+

Below 680 is a red flag for banks.

2. Low Credit Utilisation (Ideally under 30%)

Maxed-out cards = High-risk borrower.

3. Stable Income & Low FOIR

Your FOIR (Fixed Obligations to Income Ratio) should be under 40–45% after consolidation.

4. No recent missed EMIs

Lenders check repayment behaviour over the last 12 months.

Who Should Consider a Debt Consolidation Loan?

Consolidation is ideal for you if:

- Your current debts have very high interest

- You feel overwhelmed by multiple EMIs

- You’re confident you won’t take on new debt again

- Your credit score is strong

- You want a clean financial reset

Who Should Avoid It?

Avoid consolidation if:

- Your new loan interest is not significantly lower

- Foreclosure penalties are too high

- You have a habit of using credit cards impulsively

- Your income isn’t stable

- Your credit score is weak (you won’t get a good rate anyway)

A Simple Rule of Thumb

Consolidation is beneficial ONLY when:

(Interest Saved) – (Fees Paid) = Positive Savings

AND your EMI becomes easier to manage.

If the math doesn’t work, consolidation becomes just another loan—nothing more.

Check out The fastest way to become debt-free in India (2025 Guide): Avalanche Method

Final Thoughts: Calculate Before You Consolidate

Debt consolidation loans can be powerful tools for financial stability when you meet the right conditions and calculate total savings.

But don’t fall for the “one EMI = cheaper EMI” myth.

Sometimes a single EMI hides higher fees, a longer tenure, and more interest over time.

Make the choice with clarity, not convenience. Click Here if you need any help in Exiting Debt Trap.

FAQs (Frequently Asked Questions)

Is debt consolidation always a good idea?

No. Debt consolidation helps only when your new loan has a significantly lower interest rate (ideally 3–6% lower) and the total savings exceed the foreclosure and processing charges. If not, consolidation may offer convenience but no real financial benefit.

What CIBIL score is required for a debt consolidation loan in India?

Most lenders prefer a CIBIL score of 720+ for the best interest rates.

A score below 700 can lead to higher interest rates, making consolidation less effective.

What hidden charges should I watch out for before consolidating loans?

Key charges include:

1. Foreclosure penalty on existing loans (2–6%)

2. Processing fees on the new loan (2–3% + GST)

3. Insurance tied to the new loan

4. Stamp duty/documentation charges

These can reduce or eliminate your expected savings.

Can debt consolidation improve my credit score?

Yes—indirectly. By closing high-utilisation credit cards and maintaining consistent EMI payments on the new loan, your CIBIL score can improve within 3–6 months. But only if you avoid taking fresh debt during this period.

What is the biggest risk of taking a debt consolidation loan?

The biggest risk is falling into double debt.

Once your credit cards and old loan limits reopen, you may start borrowing again.

This leads to old debt + new consolidation loan, creating a deep debt trap.