Couples Budgeting: 9 Steps to Avoid Money Fights in Relationships

Couples budgeting is one of the most powerful tools for creating clarity, fairness, and long-term financial harmony in a relationship. Most money fights in India don’t begin because couples lack money—but because they lack a shared budgeting system.

This guide teaches you why couples argue about finances, and shows a step-by-step couples budgeting system that reduces stress and turns money into teamwork.

Why Couples Budgeting Matters (The Real Reasons Couples Fight About Money)

1. Different Financial Upbringings

No two people grow up with the same financial environment.

Example from your original blog :

Rohan’s family tracked every rupee. Priya’s family never discussed money. Their first fight wasn’t about a ₹5,000 kurti—it was about unspoken expectations created by their upbringing.

Budgeting helps bridge these differences with shared systems.

2. Personality Clashes

Some partners are savers. Others are spenders.

Some seek security. Others value experiences.

Couples budgeting makes these differences complementary, not conflicting.

3. Assumptions & Unspoken Rules

Most couples never discuss:

- what counts as a big purchase,

- how much personal spending is acceptable,

- who pays for what,

- how much should be saved monthly.

Unspoken expectations = conflict.

Budgeting removes ambiguity.

4. Unequal Incomes, Equal Burdens

Fights commonly happen when:

- one partner earns more,

- but both split expenses 50–50.

Budgeting instead promotes income-ratio fairness.

The Root Cause Behind Most Fights: No System

When couples rely on assumptions instead of a structure, financial conversations feel emotional.

A couples budgeting system calms discussions and strengthens the relationship.

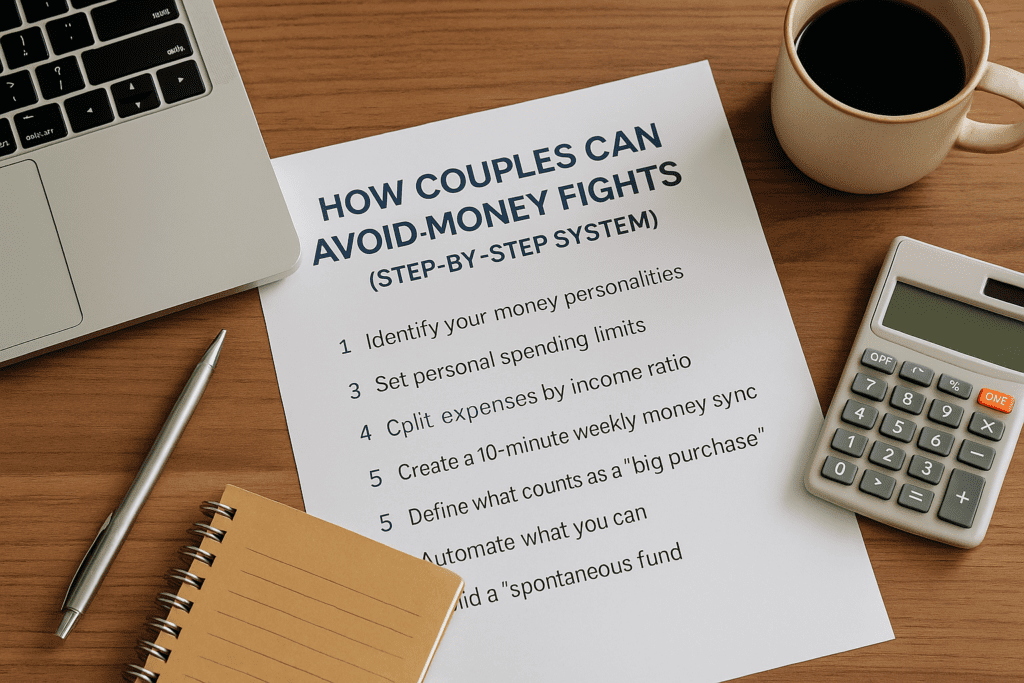

How Couples Can Avoid Money Fights

Step 1: Identify Your Money Personalities

Common money personalities:

- Saver

- Spender

- Security-oriented

- Freedom-driven

Use this couples budgeting prompt:

“Money in my home felt ____. I learned to think about money as ____.”

Understanding reduces judgement.

Step 2: Set Personal Spending Limits

Give each partner a no-questions-asked spending limit (₹3k–₹10k depending on income).

This alone reduces 50% of arguments.

Example from your file :

Neha (skincare lover) and Arjun (gadget lover) stopped arguing once they agreed on ₹5,000 each.

Step 3: Split Expenses by Income Ratio

Fair ≠ equal.

Example:

If total household expenses = ₹60,000

- Partner A earns 66% → pays 66%

- Partner B earns 34% → pays 34%

Couples budgeting must respect income realities.

Step 4: Do a Weekly 10-Minute Money Sync

This is the heartbeat of couples budgeting.

Every week, discuss:

- upcoming bills

- surprise expenses

- savings progress

- any planned purchases

It prevents the classic

“Why didn’t you tell me?”

Step 5: Define What Counts as a “Big Purchase”

Create a threshold:

- Above ₹2,000?

- Above ₹5,000?

- Above ₹10,000?

Couples budgeting thrives on clarity.

Step 6: Track Finances Together (Even with Separate Accounts)

You can maintain personal freedom and shared clarity.

Tracking = transparency, not control.

Step 7: Automate Everything You Can

Automation eliminates stress and emotional labour.

Automate:

- EMIs

- SIPs

- Rent

- Insurance

- Credit card payments

A smoother budgeting system → fewer fights.

Step 8: Build a Spontaneous Fund

A small monthly fund (₹1k–₹3k) for:

- date nights

- coffee outings

- surprise treats

Couples budgeting should allow fun—not just discipline.

Step 9: Celebrate Financial Wins Together

Celebrate:

- paying off a loan

- increasing SIPs

- meeting a savings goal

Celebration reinforces good financial behaviour.

A Plan can help you give direction to your Financial Health. Click here to build your customized financial plan.

Real Couple Example

Meera and Sandeep suffered due to:

- dining out costs

- subscription fees

- online orders

- credit card dues

After adopting couples budgeting tools (spend limits, weekly sync, ratio-based splitting), their fights dropped by 90%.

The system—not income—changed their relationship.

Mindset Shift Needed for Effective Couples Budgeting

Instead of asking:

❌ “How do we stop fighting about money?”

Ask:

✅ “How do we create a system that prevents fights?”

Couples budgeting builds:

- fairness

- teamwork

- trust

- clarity

- long-term stability

Final Thoughts

Couples budgeting isn’t about control—it’s about cooperation.

When couples use systems instead of assumptions, money becomes a tool for partnership, not conflict.

With couples budgeting, conversations shift from:

“Why did you spend this?”

to

“We’re building something strong together.”

A Plan can help you give direction to your Financial Health. Click here to build your customized financial plan.