Avalanche Method Explained: The Fastest Way to Become Debt-Free in India (2025 Guide)

If you’ve ever wondered why your loans never seem to reduce even after paying EMIs month after month, the answer is simple—

You’re paying them in the wrong order.

Most Indians follow a very emotional approach:

“Chota loan pehle finish kar dete hain… easy lagta hai.”

But financially, this is the slowest method to get out of debt.

Enter the Avalanche Method — a mathematically proven strategy that helps you close your loans much faster, reduce total interest paid, and free up monthly cash flow.

Let’s understand this powerful method in detail.

What Is the Avalanche Method?

The Avalanche Method is a debt repayment strategy where you:

List down all your loans

This includes:

- Credit cards

- Personal loans

- Car loan

- Education loan

- BNPL / Consumer loans

Identify the loan with the highest interest rate

This is usually the biggest villain:

- Credit card interest (36–42% APR)

- Personal loan (14–18%)

- Consumer durable loans (20–30%)

Pay the highest-interest loan first

This is your target loan.

Pay only the minimum due on all other loans

Don’t close anything else first.

Once the highest-interest loan is cleared…

You roll all the freed EMI + extra money into the next highest-interest loan.

This creates an Avalanche effect —

the repayments become faster and faster with every loan closure.

Why the Avalanche Method Works So Fast

You attack the costliest loan first

High interest loans grow aggressively due to compounding.

Closing them first = maximum savings on interest.

Your EMI burden keeps reducing

When your highest-interest EMI ends, your monthly stress reduces instantly.

Cashflow frees up at each stage

This extra money accelerates the repayment of all remaining loans.

Emotionally rewarding after the first closure

Your loan timeline starts shrinking faster than expected.

Example: Snowball vs Avalanche — Interest Savings

Let’s compare two common loans:

| Loan Type | Amount | Interest Rate | EMI |

|---|---|---|---|

| Credit Card | ₹50,000 | 40% | Variable |

| Personal Loan | ₹1,00,000 | 15% | ₹2,850 |

❌ If you close the smaller loan first

You lose heavily on interest.

✔ If you clear the highest-interest loan first

You save thousands in the long run.

The Avalanche Method always results in the least total interest paid.

When Should You Use the Avalanche Method?

Use this method if:

✔ You have multiple loans

✔ You pay high credit card interest

✔ You want to save maximum interest

✔ You want to become debt-free as fast as possible

✔ You prefer logic + numbers over emotion

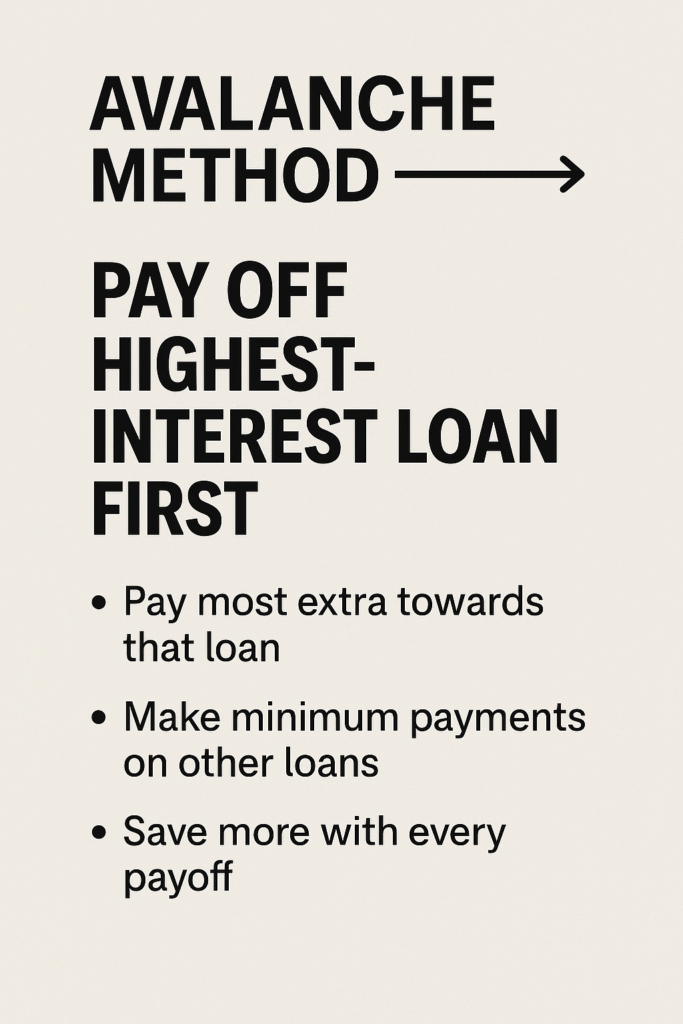

Steps to Implement the Avalanche Method Today

Step 1: Write down all your loans

Include EMI amount, pending principal, and interest rate.

Step 2: Sort them from highest to lowest interest rate

Example:

- Credit Card – 40%

- Consumer Loan – 28%

- Personal Loan – 16%

- Car Loan – 9%

Step 3: Pay maximum money to Loan #1

Even ₹2,000 extra per month makes a huge difference.

Step 4: After Loan #1 closes

Shift all money + EMI to Loan #2.

Step 5: Repeat until all loans are cleared

Within months, you’ll feel your financial oxygen returning.

Real-Life Impact: What Most People Experience

After using the Avalanche Method, people report:

✔ Faster loan closure

✔ Lower financial stress

✔ Higher savings

✔ Better credit score

✔ More monthly cashflow

✔ Improved long-term wealth creation

This is one of the most effective debt exit strategies recommended by finance experts globally.

Frequently Asked Questions

1. Is Avalanche Method better than Snowball Method?

Yes—if your goal is minimum time + maximum savings.

2. Which loans should I avoid closing first?

- Home loans (usually tax-efficient)

- Low-interest car loans

- Education loans

Always close high-interest loans first.

3. Can I use this even if I have only two loans?

Absolutely. The benefit is still huge.

4. Does this improve my credit score?

Yes. Timely payments + reducing total debt improves your CIBIL score.

Final Thoughts: The Smartest Way to Exit Your Debt Trap

The Avalanche Method changes how you think about loans.

It focuses on the cost of debt, not the size of debt.

If you follow this strategy consistently,

your debt-free date will arrive much sooner than you expect.

Want a customized debt repayment plan based on your loans, EMI, income, and goals?

Click Here — we’ll help you exit the debt trap faster.