Arbitrage Mutual Funds: A Smart Route to Profiting from Market Inefficiencies

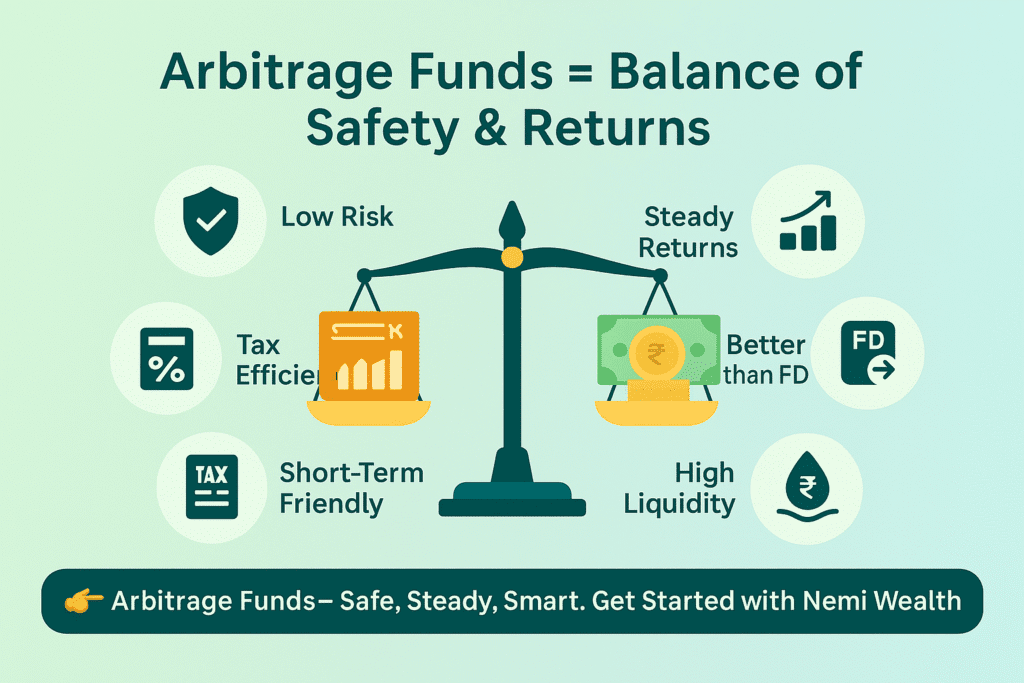

Arbitrage Mutual Funds have steadily gained attention among investors who wish to strike a balance between growth and safety. In a world where market movements often appear unpredictable, arbitrage funds stand out by relying on price differences between markets rather than on market direction. For investors who are cautious yet want equity exposure with limited risks, these funds offer an effective low risk investment strategy.

In this blog by Nemi Wealth, we’ll explore what arbitrage funds are, how they work, their benefits, risks, taxation rules, and why they can be a useful addition to a diversified portfolio.

What Are Arbitrage Mutual Funds?

Arbitrage Mutual Funds are equity-oriented schemes that earn by exploiting price mismatches of the same asset in two different markets. Instead of betting on whether the stock market will rise or fall, these funds identify and capitalize on pricing differences between:

- The cash market (where shares are traded immediately), and

- The futures market (where shares are bought or sold for a future date at a set price).

Example:

If a stock trades at ₹100 in the cash market and ₹102 in the futures market, the fund buys it at ₹100 and simultaneously sells it at ₹102. This locks in a profit of ₹2 per share, irrespective of what happens later.

This method makes arbitrage funds an attractive low risk investment choice, especially for conservative investors who want steady returns without heavy exposure to equity volatility.

How Do Arbitrage Mutual Funds Work?

The working can be broken down into simple steps:

- Identifying Price Gaps – The fund manager scans the market for securities showing mismatched prices in cash and futures.

- Simultaneous Transactions – Buys the stock in the cash market and sells in the futures market, locking the spread as profit.

- Cash price of Stock A = ₹1000

- Futures price of Stock A = ₹1025

- Profit secured = ₹25 per share.

- Utilizing Volatility – The higher the market volatility, the greater the chances of finding profitable arbitrage spreads.

- Parking in Debt Instruments – When arbitrage opportunities are scarce, funds temporarily invest in short-term debt securities like treasury bills or bonds, while still maintaining SEBI’s 65% equity allocation rule.

This structure ensures arbitrage funds consistently behave like a low-risk investment, even during unpredictable markets.

Key Benefits of Arbitrage Mutual Funds

Arbitrage funds bring together the best of both equity and debt, creating a unique value proposition. Here are the major benefits:

- Relatively Low Risk

Since the profit is locked in through simultaneous buy-sell transactions, the market direction does not significantly affect returns. This makes them behave like a low-risk investment option, particularly in uncertain markets.

- Tax Efficiency

Arbitrage funds are classified as equity schemes for taxation purposes. This means:

Short-Term Capital Gains (STCG) are taxed at 20% if units are sold within 12 months.

Long-Term Capital Gains (LTCG) above ₹1.25 lakh are taxed at 12.5% if units are sold after 12 months.

This treatment is more favorable compared to debt funds, making them a tax-efficient low-risk investment.

For example, in debt funds, the capital gain is taxed at income slab rate. So, if you fall under 30% slab rate, then all capital gain from debt funds will be taxed at 30%, while it will be taxed at 20% if sold before 365 days.

- Suitable for Volatile Markets

While volatility may worry equity investors, it actually benefits arbitrage funds. Larger price gaps between cash and futures markets increase profit potential.

- Diversification

Arbitrage funds add another layer of diversification to an investor’s portfolio. By combining equity trades with fixed income instruments, they deliver stability and reduce overall portfolio risk.

Risks of Arbitrage Mutual Funds

While safer than equities, arbitrage funds aren’t risk-free:

- Shrinking Opportunities – In calm or flat markets, spreads narrow and returns dip.

- Transaction Costs – Frequent trades can eat into profits.

- Short-Term Volatility – Sudden spread changes may affect near-term performance.

- Lower Returns vs Equities – Ideal for stability, not aggressive wealth creation.

They are best suited for low-risk investment seekers, not high-return chasers. Ready to make smarter low-risk investments? Get started today with Nemi Wealth and let your money grow safely.

Who Should Invest?

Arbitrage funds are not meant for everyone. They are ideal for:

Conservative Investors: Those who want stability and limited downside risk.

Short to Medium-Term Investors: Suitable for time horizons ranging from a few months to three years.

Tax-Sensitive Investors: People who want equity-style taxation while opting for a low-risk investment.

Diversifiers: Investors looking to balance their equity and debt exposure.

Corporates and Businesses: Companies with surplus cash can park their short-term funds in arbitrage schemes. They provide better post-tax returns than liquid funds, along with low risk and high liquidity making them an effective treasury management tool.

For investors who have surplus cash and want to park it without taking on excessive market risk, arbitrage funds are an appealing choice.

Arbitrage Funds vs Other Options

- Vs Debt Funds – Safer from credit/default risks, plus equity taxation benefits.

- Vs Equity Funds – Lower risk, but also lower returns; suited for stability seekers.

- Vs Liquid Funds – Slightly higher returns with tax advantages.

Clearly, they stand out as a practical low-risk investment alternative.

Arbitrage Funds vs Debt Funds

Both are considered relatively safe.

Debt funds carry risks like interest rate movements and credit defaults.

Arbitrage funds, while technically equity funds, behave similarly to a low-risk investment but enjoy tax benefits of equity classification.

Arbitrage Funds vs Equity Funds

Equity funds depend on market performance.

Arbitrage funds profit from price gaps, not market direction.

They are safer but offer lower returns, aligning better with low-risk investment goals.

Arbitrage Funds vs Liquid Funds

Liquid funds are purely debt-oriented.

Arbitrage funds can sometimes offer slightly higher returns due to equity-linked arbitrage strategies.

Both are useful for short-term parking of funds, but arbitrage enjoys tax efficiency.

What to Check Before Investing in Arbitrage Funds

Before committing, investors should consider:

- Investment Horizon: Ideally stay invested for at least 6 months to a year, as very short periods may not justify transaction costs.

- Expense Ratio: Active trading leads to higher costs, which should be checked carefully.

- Exit Loads: Many funds impose exit loads if redeemed within 30–60 days.

- Risk Tolerance: Ensure that expectations align with the reality of a low-risk investment, which is stability, not high returns.

Taxation Rules

Arbitrage funds are taxed like equity schemes, which generally results in better post-tax returns than debt funds, especially for high-income investors. In Taxation Rules: Arbitrage mutual funds enjoy equity taxation benefits even though their risk-return profile is closer to debt.Short-Term Capital Gains (STCG): 20% if units are sold within 12 months. Long-Term Capital Gains (LTCG): 12.5% on gains above ₹1.25 lakh if held for more than 12 months.This treatment often results in better post-tax outcomes compared to debt funds, where gains are taxed at the investor’s slab rate (up to 30%).

Example:If you are in the 30% tax bracket, short-term gains from debt funds will be taxed at 30%, while arbitrage funds will be taxed at only 20%. That way, taxation appears once in detail, and once briefly as a highlight under benefits.

When Do They Perform Best?

- Volatile Markets – More opportunities, better returns.

- Short-Term Cash Management – Ideal for parking funds temporarily.

- High Liquidity Needs – Since they are open-ended, units can be redeemed anytime.

Even when opportunities shrink, debt exposure ensures stable income.

Why Consider Arbitrage Funds in Your Portfolio?

Adding arbitrage funds provides:

Safety Net: Reduces overall portfolio volatility.

Flexibility: Can be used for systematic transfer plans (STPs) when moving from equity to safer funds.

Better Tax Outcomes: Equity taxation boosts post-tax yield versus other short-term instruments.

For investors who value stability and want tax efficiency, these funds act as an effective low-risk investment choice.

Conclusion

Arbitrage Mutual Funds are a unique category of mutual funds that blend equity and debt while exploiting price mismatches to deliver returns. They stand apart because their performance is not dependent on whether the stock market rises or falls. Instead, they benefit from inefficiencies and volatility in the markets.

For investors seeking a low-risk investment option with better tax efficiency than debt funds, arbitrage funds are worth serious consideration. They can serve as a safe parking ground for short-term money, provide diversification benefits, allow low risk investments, and cushion portfolios during volatile times.

However, it is important to remember that arbitrage funds are not designed for high returns. They are best suited for conservative investors, short- to medium-term horizons, and those who want to balance risk with stability. By including arbitrage funds in a well-structured portfolio, investors can achieve a healthier mix of growth, safety, and accessibility.

Ready to make smarter low-risk investments? Get started today with Nemi Wealth and let your money grow safely. At Nemi Wealth, we believe that the right knowledge empowers better financial decisions. Arbitrage Mutual Funds may not be glamorous, but they can be a quiet performer in your investment journey a practical, efficient, and tax-friendly way to grow your wealth while staying aligned with your comfort level of risk.