Aggressive Hybrid Mutual Fund: The Balanced Way to Grow Wealth

If you want to grow your wealth but don’t feel ready to take on the full risk of stock investing, Aggressive Hybrid Mutual Fund offer a smart middle ground. These funds mainly invest in equity (stocks) while keeping a part of your money in debt instruments like bonds. As a result, you get the chance to earn strong returns while having a safety net during market dips.

Unlike pure equity funds that can rise or fall sharply, aggressive hybrid funds give you a mix of growth and stability. They work well if you want to build wealth over time but still feel safe when markets become unpredictable.

In this blog, we’ll explain how these funds work, who should invest in them, and why they’re becoming a popular choice for long-term investors in India.

What is an Aggressive Hybrid Mutual Fund?

Aggressive Hybrid Funds are a category of open-ended mutual funds that invest between 65% to 80% in equities and the remaining 20% to 35% in debt instruments. This mix gives you a taste of high-growth potential from equities while still maintaining a layer of stability through debt investments.

At Nemi Wealth, we believe that Aggressive Hybrid Funds offer a balanced route for investors seeking better returns than debt funds but with less risk than pure equity schemes.

How Do Aggressive Hybrid Mutual Fund Work?

Aggressive Hybrid Funds work by combining two major asset classes:

- Equity – Offers long-term growth potential

- Debt – Provides stability and acts as a buffer against market volatility

Let’s say Fund A invests 80% in equities and 20% in debt, while Fund B maintains 65% in equities and 35% in debt. Fund A would be considered more aggressive, targeting higher returns but also carrying higher risk.

When equity markets rise, the fund’s equity portion fuels capital appreciation. Conversely, in market downturns, the debt component cushions your portfolio against severe losses. This balanced approach makes it an ideal product for moderate to high-risk investors.

Curious about how much your investment might grow? Try this Mutual Fund SIP Calculator to estimate potential returns.

Why Consider Investing in Aggressive Hybrid Mutual Fund?

Automatic Portfolio Rebalancing

To stay within SEBI’s mandated asset allocation range, fund managers continuously rebalance the portfolio. When equities rise too much, they may shift gains into debt maintaining optimal exposure.

Diversified Exposure

Aggressive Hybrid Funds invest across sectors, market capitalizations, and fixed-income instruments, providing you with a well-rounded investment option.

Reduced Volatility

Compared to pure equity funds, these funds are relatively less volatile. The debt component acts as a shock absorber, helping you stay invested even in uncertain markets.

Suits Multiple Financial Goals

Whether it’s a mid-term goal like buying a car or saving for a child’s education, these funds are designed to align with 5–7 year investment horizons.

Taxation on Aggressive Hybrid Mutual Fund in India

Since these funds maintain equity exposure above 65%, they are taxed like equity funds:

- Short-Term Capital Gains (STCG) – 20% if redeemed within one year

- Long-Term Capital Gains (LTCG) – Tax-free up to ₹1 lakh annually; 12.5% tax beyond that

Dividends are taxed as per your income tax slab, and TDS applies if your dividends exceed ₹5,000 in a financial year.

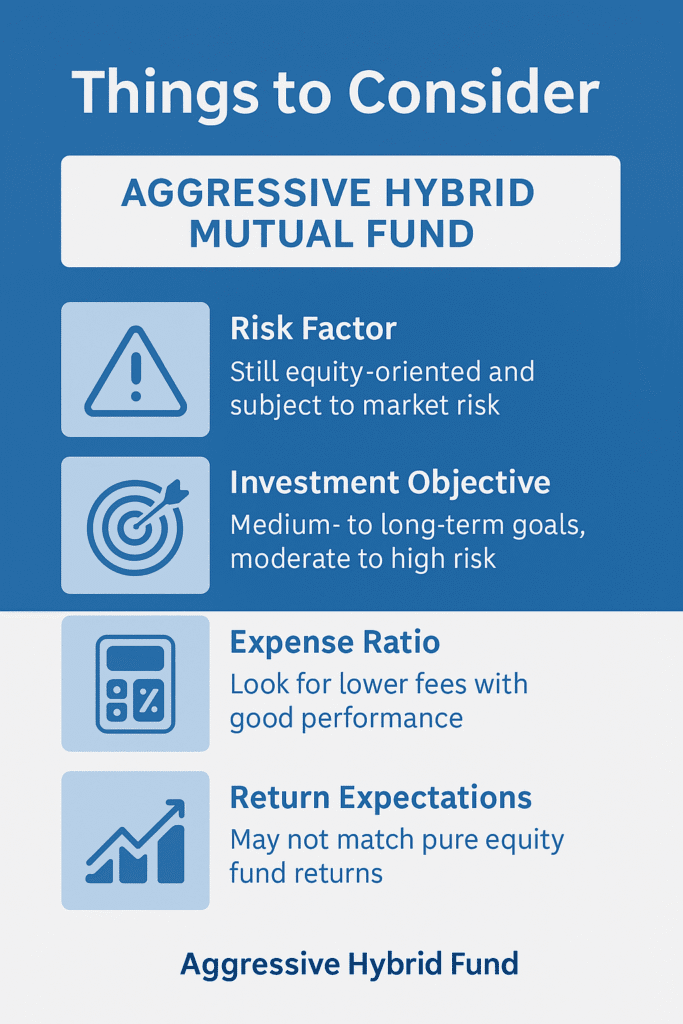

Things to Consider Before Investing in Aggressive Hybrid Fund

- Risk Factor: While less risky than pure equity funds, these are still equity-oriented and hence not suitable for conservative investors. Debt exposure is also subject to interest rate and credit risk.

- Investment Objective: Ideal for those with medium- to long-term goals and a moderate to high risk appetite. A minimum horizon of 5 years is advisable to unlock the true potential of this category.

- Expense Ratio: Every mutual fund comes with an expense ratio, which is the annual fee charged for managing your investment. Look for funds that maintain low fees with consistent performance.

- Return Expectations: While they aim to deliver better returns than debt funds, Aggressive Hybrid Funds may not match the upside of pure equity funds during a strong bull run.

Who Should Invest in Aggressive Hybrid Fund?

- First-time equity investors

- Individuals planning for goals in 5–7 years

- Investors seeking less volatility than pure equity funds

- Those comfortable with moderate to high risk

Final Thoughts by Nemi Wealth

Aggressive Hybrid Mutual Funds are a great way to dip into equities without diving all in. They offer a good mix of growth and protection, making them a strong choice for medium-term investors who can stomach some market fluctuations.

At Nemi Wealth, we help you:

- Select the right aggressive hybrid fund

- Align it with your financial goals

- Monitor your investments proactively

Visit Nemi Wealth to explore handpicked fund options that match your risk appetite.

FAQs

How much do aggressive hybrid funds invest in equity and debt?

Aggressive hybrid funds invest 65% to 80% in equities and 20% to 35% in debt instruments. This mix gives your portfolio growth potential while maintaining a cushion against market volatility.

Can beginners invest in aggressive hybrid mutual funds?

Yes, beginners can start with aggressive hybrid funds. These funds let you experience stock market growth while reducing risk through debt exposure, making them a smart starting point.

How do tax rules apply to aggressive hybrid funds in India?

The government taxes them like equity funds:

- Dividends: Your dividends are taxed based on your income slab, and TDS applies if they exceed ₹5,000 in a financial year.

- Short-Term Capital Gains (STCG): You pay 15% if you redeem within one year.

- Long-Term Capital Gains (LTCG): You pay 10% on profits exceeding ₹1 lakh annually.

How long should I stay invested in aggressive hybrid funds?

Aim to stay invested for at least 5 to 7 years. A longer horizon helps you manage market ups and downs while benefiting from compounding returns.

Can I invest in aggressive hybrid funds through SIPs?

Yes, you can start a Systematic Investment Plan (SIP) in aggressive hybrid funds. SIPs let you invest regularly and reduce risk by averaging your cost over time.