Top 5 Brokerage Firms in India (Discount brokers vs Full-Service Brokers)

Introduction to Brokerage Firms in India

Brokerage firms play a vital role in the Indian financial markets, acting as intermediaries between investors and the stock exchanges. They facilitate buying and selling of securities, such as stocks, bonds, and mutual funds, enabling investors to engage in various financial activities. The landscape of brokerage services in India can be primarily categorized into two types: discount brokers and full-service brokers.

Discount brokers provide a streamlined approach, offering minimal services at reduced commissions. These firms are ideal for self-directed investors who prefer to make their own trading decisions without the guidance of a financial advisor. Their technological-driven platforms often provide advanced trading tools, making them suitable for experienced traders who are comfortable navigating the complexities of the market. However, the limitation of having less personalized service can be a drawback for those who require more guidance.

On the other hand, full-service brokers offer a comprehensive range of services, including personalized investment advice, research reports, and portfolio management. This model appeals to investors who value a higher level of support and are willing to pay for it. Full-service brokers tend to charge higher fees, which can be a disadvantage for cost-conscious investors. They are better suited for novice traders or those with specific investment goals that require expert guidance.

When selecting a broker, it is essential to consider individual trading needs and investment objectives. One can invest in various assets like stocks, IPOs, ETFs, commodities, algo trading, and Futures & Options. Factors such as trading frequency, market knowledge, and the level of support desired should guide the decision-making process. Understanding the differences between discount and full-service brokers ensures that investors can make informed choices that align with their personal financial strategies.

Top 5 Discount Brokers in India

In the evolving financial landscape of India, discount brokers have gained immense popularity due to their cost-effective solutions for retail traders and investors. The following is a detailed look at the top five discount brokers in India, each distinguished by their unique features and offerings.

1. Zerodha: A pioneer in the discount brokerage industry, Zerodha offers a user-friendly trading platform known as Kite. Their fee structure is straightforward with zero brokerage on equity investments and a nominal fee for intraday and futures trades. The broker also provides a robust educational platform, making it an excellent choice for beginners.

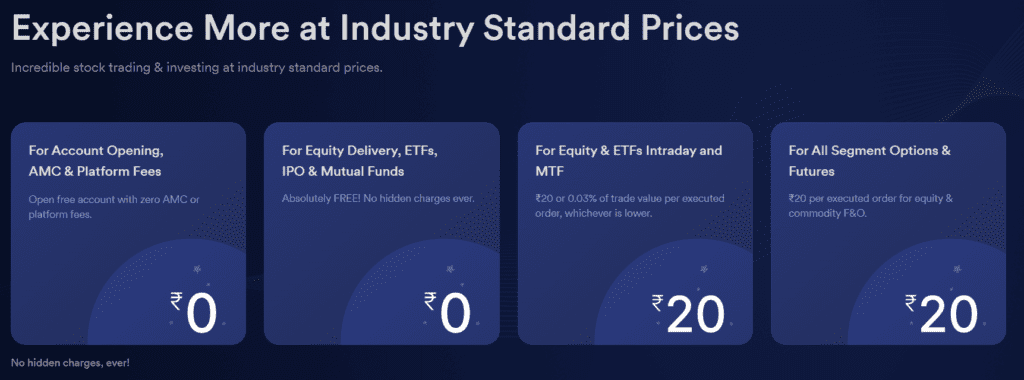

2. Upstox: Upstox combines advanced trading tools with low-cost services, charging a flat fee of ₹20 per trade across various segments. The broker’s trading platform provides comprehensive technical analysis, making it suitable for both novice and experienced traders. Their customer service is responsive and well-rated by users.

3. Angel One: Previously known as Angel Broking, Angel One has transitioned to a discount broker while retaining its strong brand presence. With zero brokerage on equity delivery and an intuitive mobile application, they are a compelling choice for tech-savvy investors. Their research reports and insights can help clients make informed trading decisions.

4. 5Paisa: 5Paisa stands out with its low flat fee per trade, alongside comprehensive financial products ranging from stockbroking to mutual funds. Their research and advisory services cater to diverse investment needs. The platform provides a seamless user experience, allowing easy navigation for users.

5. Dhan: Dhan is gaining traction rapidly due to its innovative features like multiple trading tools and performance analytics. The platform offers a simplified fee structure, with a special focus on delivering value to its users. For those looking to start their trading journey, opening a free demat account with Dhan can be a valuable first step towards smart investing.

Each of these discount brokers plays a significant role in India’s trading ecosystem, offering unique services and competitive pricing that caters to a wide range of investors. By understanding their distinct features, traders can make informed choices in aligning their investment strategy with the right broker.

Top 5 Full-Service Brokers in India

Full-service brokers in India offer a comprehensive array of services, distinguishing themselves from discount brokers by providing personalized financial guidance, research capabilities, and a robust suite of investment products. Here, we examine the top five full-service brokers that cater to diverse investor needs.

1. ICICI Direct: A leading name in the Indian brokerage industry, ICICI Direct provides an extensive range of services including equity trading, mutual funds, and insurance. They are renowned for their strong research capabilities and user-friendly trading platforms. Their personalized customer support ensures that clients receive the requisite assistance to navigate the complexities of investing.

2. HDFC Securities: As part of the HDFC group, HDFC Securities offers clients a seamless trading experience coupled with robust research services. They have a strong online presence, allowing clients to access a wealth of information and trading tools. Their personalized advisory services cater particularly well to new investors seeking guidance.

3. Kotak Securities: Kotak Securities stands out for its diverse financial services, including derivatives, commodities, and portfolio management. Their insights and research reports are instrumental in helping clients make informed investment decisions. With a focus on customer satisfaction, they provide dedicated support to all their clients.

4. Sharekhan: With a historical presence in the Indian market, Sharekhan offers extensive educational resources, ensuring that clients are well-informed about investment opportunities. Their research capabilities are commendable, and they provide detailed market analysis and trading recommendations. Their strong customer service sets them apart from many competitors.

5. Motilal Oswal: Known for its vast investment experience and robust research, Motilal Oswal offers a variety of services that cater to both novice and experienced investors. Their advisory services are tailored to meet individual needs, making it easier for clients to achieve their financial goals. For those interested in exploring full-service brokerage options, consider opening a free demat account with Motilal Oswal to embark on your investment journey today.

Conclusion and Final Thoughts

In summary, the choice of a brokerage firm is a pivotal decision that significantly impacts an investor’s financial journey. This blog post has explored the nuances of both discount brokers and full-service brokers in India, highlighting the strengths and weaknesses of each type. Discount brokers are increasingly appealing to self-directed investors due to their cost-effective trading options, low commissions, and the flexibility they offer. Their platforms can enable investors to execute trades quickly and efficiently, appealing primarily to those who prefer a hands-on approach to their investments.

On the other hand, full-service brokers offer a range of personalized services, including comprehensive investment advice, portfolio management, and research assistance, which may be more suitable for investors seeking guidance and expertise. These brokers typically charge higher fees, but their seasoned professionals can provide insights that may lead to better investment outcomes for those who are less experienced or prefer a more passive investment strategy.

As you contemplate your brokerage options, consider your trading style, financial goals, and the level of support you desire. Each investor has unique needs, and understanding them will help you choose the right brokerage firm aligned with your investment strategy. It is essential to thoroughly evaluate the features, fees, and services offered by various brokers, as these elements can dramatically influence your trading experience and overall satisfaction.

Ultimately, whether you lean towards an affordable discount broker or a more comprehensive full-service broker, both options cater to diverse investor needs in India. Carefully weighing the pros and cons of each will empower you to make an informed decision that aligns with your financial aspirations.