Quant Mutual Fund QSIF: India’s First Specialised Investment Fund 2025

India’s investment space has entered a new era. Quant Mutual Fund QSIF has made history as the first Specialised Investment Fund in India to launch a Long-Short Fund strategy. This launch, which took place in August 2025, is a milestone for high-net-worth investors seeking more sophisticated, flexible, and tax-efficient investment options.

By introducing the QSIF Equity Long-Short Fund, Quant Mutual Fund QSIF has brought advanced, globally recognised portfolio strategies into the regulated Indian mutual fund space something investors had long been waiting for.

What is a Specialised Investment Fund in India?

A Specialised Investment Fund in India is a new investment product introduced by SEBI in April 2025. It sits between traditional mutual funds and Portfolio Management Services (PMS), giving investors the benefits of professional management, tax efficiency, and advanced strategies.

Key features of a Specialised Investment Fund in India:

- Minimum Investment: ₹10 lakh

- Advanced Strategies Allowed: Including the Long-Short Fund strategy, thematic investing, and structured credit

- Tax Benefits: Long-term capital gains taxed at 12.5%, lower than similar Alternative Investment Funds (AIFs)

- SEBI-Regulated: Offering investor safety and transparency

This category allows AMCs like Quant Mutual Fund QSIF to operate with greater flexibility than regular mutual funds while keeping regulatory safeguards in place.

The QSIF Equity Long-Short Fund Strategy Explained

At the heart of the Quant Mutual Fund QSIF offering is the Long-Short Fund strategy an approach that can work in rising, falling, or sideways markets.

- Long Positions: Buying stocks expected to rise in value

- Short Positions: Selling or betting against stocks likely to decline

By combining both, the Long-Short Fund strategy helps:

- Reduce risk by offsetting losses in one position with gains in another

- Profit in all market conditions – bullish, bearish, or neutral

- Stabilise returns during volatility

The Quant Mutual Fund QSIF can also invest in debt instruments and hybrid strategies, making it even more adaptable.

Why Quant Mutual Fund QSIF Stands Out

The QSIF Equity Long-Short Fund strategy is a game-changer because:

- It’s the first Specialised Investment Fund in India to run a regulated Long-Short Fund strategy

- It gives investors hedge fund-like exposure without going offshore

- It offers tax efficiency with a 12.5% LTCG rate

- It can adapt to different market cycles — protecting capital in downturns while capturing upside in rallies

With its flexibility and SEBI oversight, Quant Mutual Fund QSIF sets a new benchmark for sophisticated investing in India.

Who Can Invest in a Specialised Investment Fund in India?

The Quant Mutual Fund QSIF is not a starter product it’s built for seasoned investors who:

- Can meet the ₹10 lakh minimum investment requirement

- Have a demat account to hold units digitally

- Understand the higher risk and complexity of a Long-Short Fund strategy

If you’re looking for diversification beyond regular mutual funds, the Specialised Investment Fund in India model is worth considering.

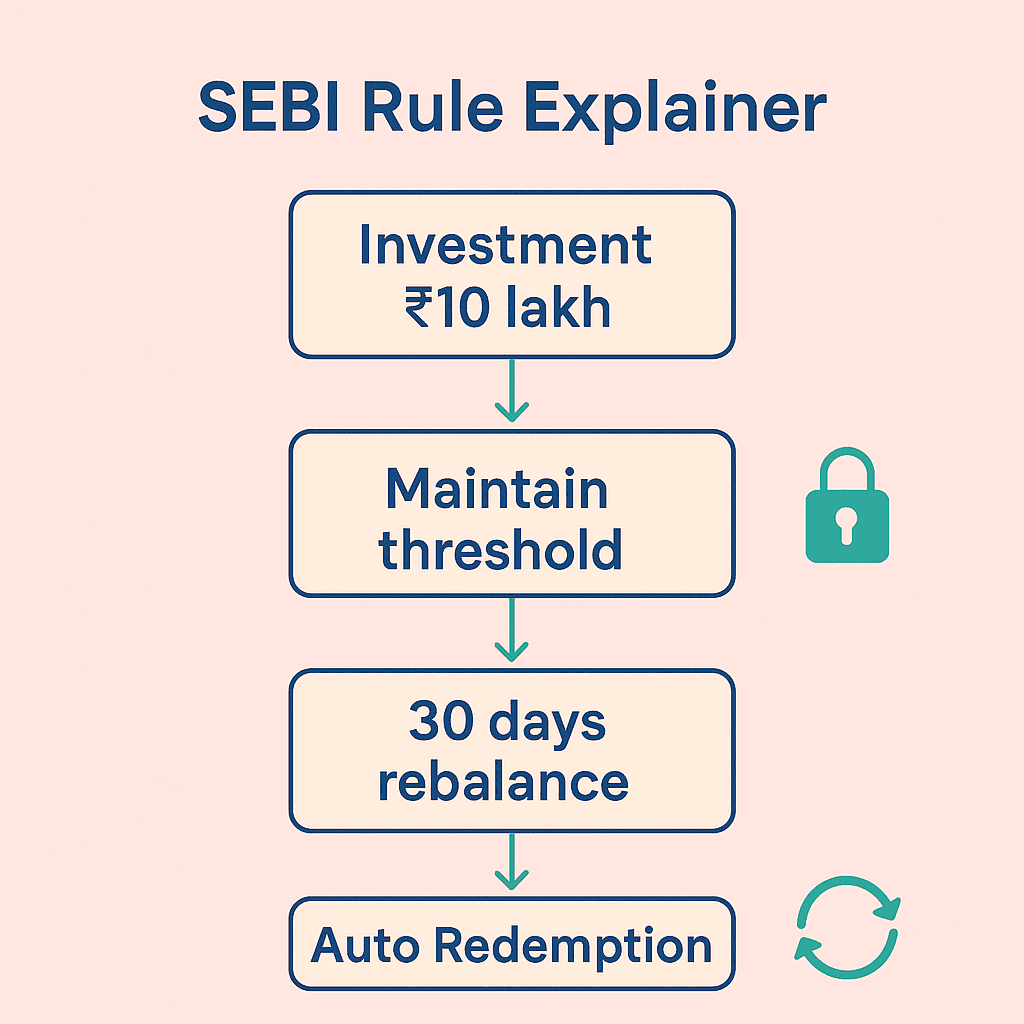

SEBI’s Rules for Specialised Investment Fund in India

To ensure SIFs remain true to their investor profile, SEBI has set clear rules:

- Investors must maintain a ₹10 lakh minimum at all times

- If holdings fall below this threshold, units in the Quant Mutual Fund QSIF (or any other SIF) will be frozen for debit

- Investors get 30 days to rebalance

- If not rebalanced, the AMC will automatically redeem the units at the applicable NAV

These safeguards keep the Specialised Investment Fund in India category exclusive to eligible participants.

Market Impact and What’s Next

With the launch of the Quant Mutual Fund QSIF, the Indian market now has its first regulated Long-Short Fund strategy accessible through a mutual fund-like platform.

Other AMCs like SBI Mutual Fund, Mirae Asset, Edelweiss AMC, and ICICI Prudential AMC are reportedly working on their own Specialised Investment Fund in India products, but Quant Mutual Fund QSIF has taken the first mover’s advantage.

Final Word – Should You Consider Quant Mutual Fund QSIF?

If you’re a high-net-worth investor seeking:

- Advanced strategies like the Long-Short Fund strategy

- Exposure to equities, debt, and hybrid assets

- Risk-managed returns in volatile markets

- Better tax efficiency than AIFs

…then the Quant Mutual Fund QSIF might deserve a place in your portfolio.

As always, ensure your investment decisions align with your risk tolerance and financial goals. A Specialised Investment Fund in India offers exciting possibilities but with complexity comes the need for careful understanding.

Ready to explore advanced strategies like the Quant Mutual Fund QSIF?

Get started with Nemi Wealth today and build a portfolio that’s as ambitious as your goals. Our experts help you navigate opportunities in the Specialised Investment Fund in India space and beyond.

Start Your Investment Journey Get Started Now

Disclaimer

This blog is for educational purposes only and does not constitute investment advice. Investments in securities are subject to market risks. Please read all scheme-related documents carefully before investing.

FAQs

What is a Specialised Investment Fund (SIF) in India?

A Specialised Investment Fund is a new SEBI-regulated category introduced in April 2025, designed to bridge the gap between mutual funds and PMS (Portfolio Management Services). It allows advanced strategies like Long-Short, thematic investing, and structured credit, while offering professional management, tax efficiency, and investor protection.

What makes the QSIF Equity Long-Short Fund unique?

The QSIF Equity Long-Short Fund is the first SIF in India to launch a regulated Long-Short strategy. This gives investors hedge-fund-like exposure within a mutual fund-like structure, with the ability to profit in rising, falling, or sideways markets, and enjoy 12.5% LTCG tax benefits.

Who can invest in a Specialised Investment Fund in India?

SIFs are meant for seasoned investors who:

- Understand higher-risk, more complex strategies like Long-Short

- This is not an entry-level product for beginners.

- Can invest a minimum of ₹10 lakh

- Have a demat account for holding units

How does the Long-Short Fund strategy work?

The strategy takes long positions in stocks expected to rise and short positions in stocks expected to fall. This dual approach helps reduce risk, generate returns in all market conditions, and stabilise performance during volatility.

What happens if my SIF investment falls below ₹10 lakh?

If your holding drops below ₹10 lakh, SEBI rules require the AMC to freeze debit transactions for your units. You’ll have 30 days to top up the amount; if not, the AMC will automatically redeem your investment at the applicable NAV.