Mutual Fund Revolution: Changing the Game in 2025

India’s mutual fund (MF) industry is entering an exciting phase. Once dominated by a handful of large players, the ₹74 lakh crore sector is now seeing a fresh wave of entrants bringing new ideas, deeper niche strategies, and innovation in investment styles.

Two firms Abakkus Asset Management and Choice International have recently received in-principle approval from SEBI to launch their mutual fund businesses. In addition, five more applicants are awaiting approval, many of whom are already known for their performance in the PMS (Portfolio Management Services) and AIF (Alternative Investment Fund) space. So, why is the MF industry suddenly attracting new players? What do these entrants bring to the table? And more importantly, what does this mean for you as an investor? Let’s break it all down.

The Big Picture: A Booming Mutual Fund Industry

Before diving into the new players, it’s important to understand the current state of India’s mutual fund industry. As of mid-2025, India’s MF industry has:

- Assets under management (AUM) crossing ₹74 lakh crore

- Over 16 crore folios and growing rapidly

- Strong SIP inflows, with over ₹20,000 crore monthly contributions

- Participation from Tier-2 and Tier-3 cities increasing steadily

Thanks to rising financial awareness, improved digital infrastructure, and trust in regulated products, mutual funds have gone mainstream. What was once considered complex is now being adopted by young investors, working professionals, and even retirees. Naturally, such explosive growth is drawing interest from newer financial institutions, wealth managers, and asset managers all wanting a piece of the growing pie.

Two New Entrants: Abakkus AMC and Choice International

SEBI’s recent update confirms that Abakkus Asset Management and Choice International have received in-principle approval to launch their mutual fund businesses.

What Does “In-Principle” Approval Mean?

It means SEBI has agreed to the proposal in principle, but final approval depends on:

- Submitting final documents and clarifications (done in June 2025)

- Clearing on-site inspections by SEBI officials (expected in Aug–Sept 2025)

- Once cleared, AMCs can file schemes and launch products within 1–2 months

Let’s understand these two firms in more detail.

Abakkus Asset Management – Led by Sunil Singhania

Abakkus AMC is not an unknown name in the investment space. Founded by Sunil Singhania, former CIO of Reliance Mutual Fund (now Nippon India MF), Abakkus has built a solid reputation in the PMS and AIF space.

What They Bring:

- Proven stock-picking expertise, especially in mid and small caps

- A contrarian investment style, backed by deep fundamental research

- Strong HNI and institutional client base in PMS and AIF formats

What to Expect:

With MF approval, Abakkus can now offer retail investors access to strategies that were earlier limited to wealthy clients. Expect differentiated equity schemes, unique thematic funds, and perhaps a strong smallcap/midcap focus.

Choice International – A Full-Stack Financial Services Firm

Choice International, led by Arun Poddar, is a diversified financial group offering:

- Stockbroking

- Investment banking

- Wealth management

- Lending

- Insurance advisory

With its massive retail reach and tech infrastructure, Choice is well-positioned to launch mutual funds aimed at India’s mass affluent and digital-savvy audience.

What They Bring:

- A strong distribution network across India

- Experience in serving retail investors

- Tech-driven solutions for advisory and onboarding

What to Expect:

Expect Choice MF to launch hybrid funds, multi-asset funds, and SIP-friendly products that resonate with young savers and first-time investors.

Five More Applicants in the Pipeline

Besides Abakkus and Choice, five more companies have applied for MF licenses, as per SEBI’s latest update. Let’s look at each:

1. Alpha Alternatives

- Founder: Naresh Kothari

- Current Business: AIFs and structured investment solutions

Alpha Alternatives is known for innovative strategies in the alternative investment space. Their focus has been on bespoke products for HNIs and institutions.

What to Watch:

If approved, Alpha’s mutual fund arm could introduce structured and multi-asset strategies that go beyond traditional large-cap equity and debt funds.

2. Carnelian Asset Management

- Founders: Vikas Khemani (ex-Edelweiss), Manoj Bahety, Swati Khemani

- Current Business: PMS and AIF

Carnelian has quickly gained a reputation for its “good businesses run by great people” investment philosophy. Their PMS strategies have delivered competitive returns, with a disciplined focus on governance and capital allocation.

What to Watch:

Expect investor-focused equity MFs that mirror their PMS themes. Their strong research culture might reflect in a unique approach to portfolio construction.

3. Estee Advisors

- Founder: Sandeep Tyagi

- USP: Quant-based investment firm

Estee is one of India’s few quant-focused PMS firms, using data science and algorithms to make investment decisions.

What to Watch:

Estee could pioneer the rise of quant mutual funds a global trend yet to fully take off in India. If they bring true factor-based or machine-learning-driven products to retail investors, it could be a game-changer.

4. Oaklane Capital

- Founder: Kuntal Shah

- Background: Value investor and market veteran

Oaklane Capital is rooted in long-term value investing. With Kuntal Shah’s market experience and deep networks, Oaklane’s PMS has been well-received among seasoned investors.

What to Watch:

Value-style equity mutual funds could make a comeback, especially in volatile markets. Oaklane may offer a Buffett-style, concentrated equity approach to retail investors.

5. Ashika Credit Capital

- Leadership: Pawan Jain (Chairman), Daulat Jain (MD)

- Current Business: Stockbroking, lending, family office services, and AIFs

Ashika Group has been serving retail clients for decades. With deep distribution across Tier-2 and Tier-3 cities, they’re well-positioned to democratize access to mutual funds.

What to Watch:

Ashika may launch goal-based mutual funds catering to first-time investors think retirement funds, child education funds, tax-saving plans.

Why Are PMS and AIF Players Eyeing Mutual Funds?

Most new applicants are already successful in the PMS and AIF segments. So why enter the regulated mutual fund space? Here are a few reasons:

Wider Reach:

MFs allow firms to access lakhs of retail investors with ticket sizes as low as ₹500 via SIPs. PMS/AIFs need minimum investments of ₹50 lakh–₹1 crore.

Regulatory Trust:

Mutual funds are SEBI-regulated, widely accepted, and tax-efficient ideal for long-term wealth creation.

Cross-sell Opportunities:

Firms can offer goal-based investing and use MF products to build long-term client stickiness across financial products.

Product Flexibility:

With Specialised Investment Funds (SIFs) expected to gain traction, mutual funds are no longer limited to plain-vanilla equity and debt. Firms can now offer hedge-fund-like strategies in a regulated wrapper.

The Rise of Specialised Investment Funds (SIFs)

SEBI recently introduced a new MF category Specialised Investment Funds to bridge the gap between traditional mutual funds and alternative products.

Key Features of SIFs:

- Higher ticket sizes (likely ₹10 lakh+)

- Broader investment flexibility (including derivatives, unlisted assets)

- Caters to HNIs and sophisticated investors

- Still regulated under MF structure, offering transparency

Many new AMCs are expected to launch SIFs before standard retail mutual funds. Think of SIFs as a hybrid of mutual funds + hedge funds accessible to India’s growing base of wealthy investors.

What This Means for Existing AMCs

The rise of new entrants signals that the bar is rising for established players. Here’s why:

- New firms are nimble, tech-savvy, and differentiated

- They offer curated strategies vs. cookie-cutter products

- Many are led by respected fund managers with loyal followers

- Distribution models are moving digital-first

Established AMCs will need to:

- Refresh their product lineup

- Embrace performance-linked fees

- Enhance transparency and communication

- Rebuild investor trust, especially post underperformance in some flagship schemes

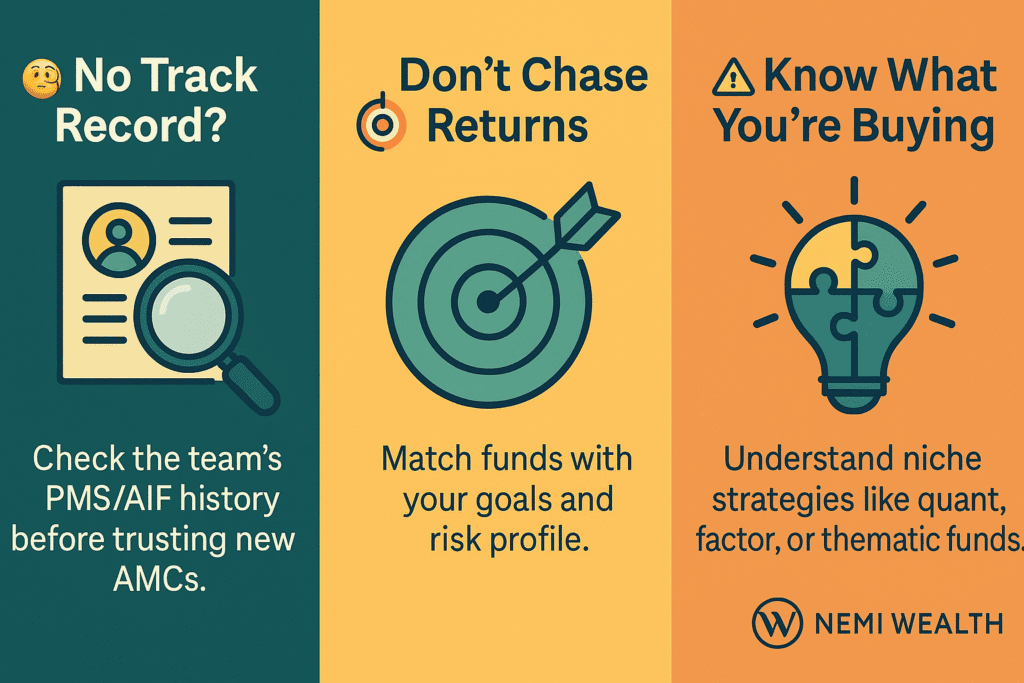

What Should Investors Do?

If you’re a mutual fund investor, here’s what this shift means for you:

- More choice: From quant funds to value-focused and thematic strategies

- Better performance: New AMCs will be hungry to prove themselves

- Access to niche products: Through SIFs and hybrid models

- Lower costs in some cases: Thanks to competition

- Diversification: Beyond the 4-5 top AMCs you may already be investing with

Final Thoughts: A New Era for Indian Mutual Funds

The mutual fund industry is no longer just a battleground of big banks and insurance-owned AMCs. The next wave belongs to boutique, strategy-driven, founder-led firms who are here to challenge the status quo. Whether it’s Abakkus AMC’s stock-picking DNA, Estee’s quant-tech model, or Ashika’s mass outreach investors now have more options than ever.

At Nemi Wealth, we believe this evolution is great for you, the investor. As long as you stay informed, invest with discipline, and align your choices with your long-term goals, this is the best time to participate in India’s financial revolution.