Five Timeless Warren Buffett Money Lessons to Build Wealth

Warren Buffett, often called the Oracle of Omaha, is one of the greatest investors in history. He built a fortune by staying calm, thinking long term, and sticking to simple principles. Now, at 94, as he prepares to step down as CEO of Berkshire Hathaway, we take a moment to reflect on the most powerful money lessons he’s taught the world. At Nemi Wealth, we believe that good investing is all about clarity, patience, and smart decisions. And no one teaches that better than Buffett. Here are 5 Warren Buffett money lessons that every investor beginner or expert should know.

1. Your Temperament Matters More Than Your IQ

Warren Buffett once said,

“The most important quality for an investor is temperament, not intellect.”

Most people buy when markets are booming and panic-sell when prices fall. This emotional investing hurts your long-term returns. Buffett’s secret? He stays calm when others are panicking and takes action when others are afraid.

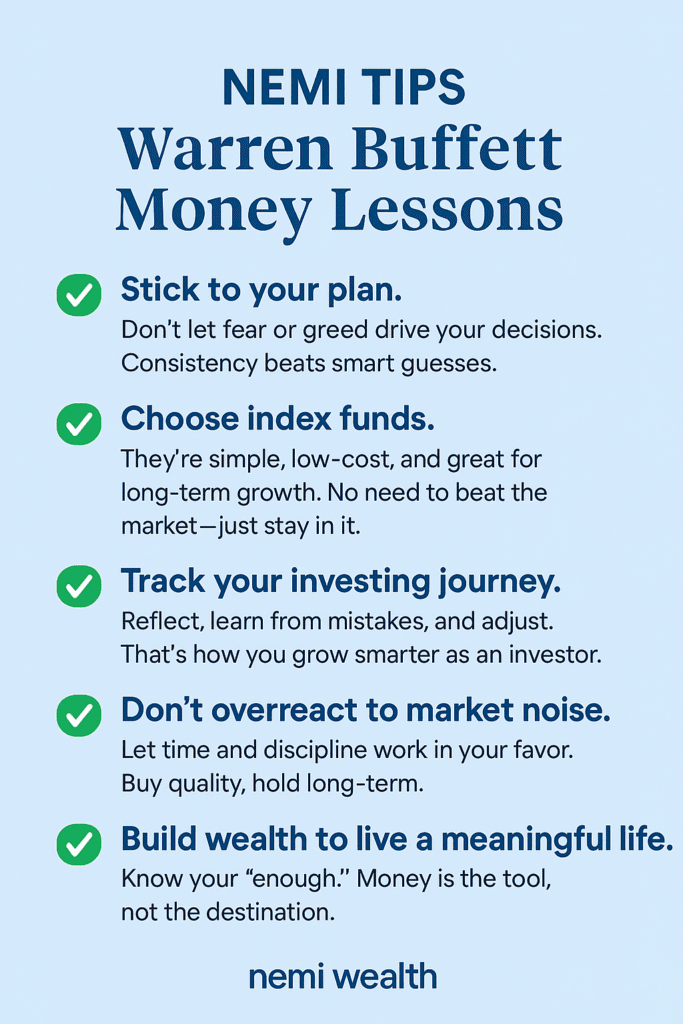

Nemi Tip: Stick to your plan. Don’t let fear or greed drive your decisions. Consistency beats smart guesses.

2. Trust Index Funds

Despite being the world’s best stock picker, Buffett recommends index funds for most people. Why? Because actively managed funds often charge high fees and still fail to beat the market. Index funds are low-cost, diversified, and have strong long-term results.

“Both large and small investors should stick with low-cost index funds.” – Warren Buffett

Nemi Tip: Want a simple, smart way to invest? Choose index funds and focus on long-term growth.

3. Learn from Your Mistakes

Buffett isn’t afraid to talk about his failures. Once, he bought a furniture company and didn’t include a non-compete clause. The founder later opened a rival shop nearby. He admitted the mistake and learned from it. We all make investing mistakes. What matters is how we respond.

Nemi Tip: Track your investing journey. Reflect, learn, and adjust. That’s how you grow.

4. Avoid Frequent Trading

Buffett says his favorite holding period is “forever.”

That’s because short-term trading often leads to poor timing, taxes, and lower returns.

At Nemi Wealth, we believe in buying quality investments and holding them for the long run. That’s how wealth is built, not by chasing every new trend.

Nemi Tip: Don’t overreact to market noise. Let time work for you.

5. Money Is a Tool, Not the Goal

Buffett still lives in the house he bought in 1958. He prefers simple food and modest living. His focus has always been financial freedom, not showing off.

He once said,

“I don’t equate the amount I spend with the enjoyment I’m going to get.”

Nemi Tip: Build wealth to live a meaningful life, not just to spend more. Know your “enough.”

Final Thoughts

Warren Buffett’s investing lessons are simple, timeless, and practical. You don’t need to be a genius to grow your money. You just need the right mindset and a clear plan. At Nemi Wealth, we help you do exactly that.

- Simple SIPs

- Expert-selected mutual funds

- Long-term wealth strategies that work

Start building wealth the Warren Buffett way.

Visit Nemi Wealth and begin your smart money journey today.

FAQs

Why does Warren Buffett prefer index funds over actively managed funds?

To begin with, index funds are low-cost and diversified. Unlike actively managed funds, they don’t try to beat the market but aim to match it. As a result, they often perform better over the long term, especially after accounting for fees.

Can I really avoid losses by staying invested long term?

Yes, because markets tend to grow over time despite short-term ups and downs. Therefore, by holding quality investments instead of panic-selling, you give your money the chance to recover and grow.

Is it okay to make mistakes while investing?

Absolutely. Even Buffett admits to making mistakes. However, what sets successful investors apart is that they learn from errors and adjust their strategy accordingly. So, take each mistake as a lesson for smarter decisions in the future.

Why should I avoid frequent trading?

Frequent trading often leads to higher taxes, unnecessary costs, and emotional decisions. On the other hand, holding investments long term allows compounding to work in your favor, which is Buffett’s favorite strategy.

How do I know when I’ve saved “enough”?

That depends on your financial goals. Instead of chasing endless wealth, Buffett focuses on financial freedom and meaningful living. So, identify your “enough” and let your investments support that vision.