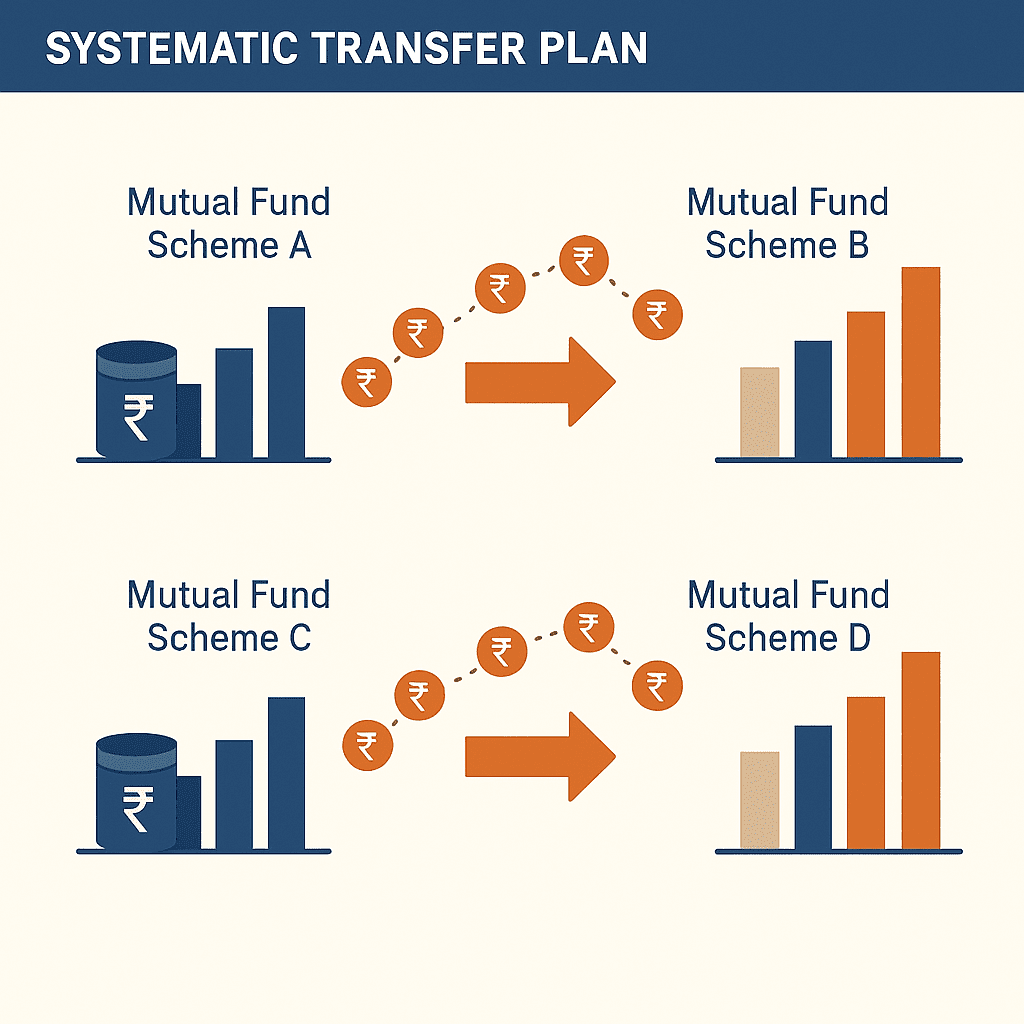

Secure Wealth with Systematic Transfer Plan

Investing in the stock request is an excellent way to grow your wealth. Still, request oscillations can be stressful, especially for newcomers. That is where a Systematic Transfer Plan(STP) comes in.

Think of an STP as autopilot for your investments. It automatically transfers a fixed amount from one mutual fund scheme to another at regular intervals. As a result, it helps manage risk, benefit from market movements, and achieve your financial goals.

How Does an STP Work?

Imagine you have two pails- a source pail and a destination pail. Then is how an STP works

- An STP works like this: imagine two pails — one for the source fund and one for the destination fund.

- Choose Your finances First, elect two collective fund schemes within the same fund house. The source fund provides the plutocrat, and the destination fund receives it.

- Set Up the Transfer: Decide how important Plutocrat you want to transfer and how frequently — weekly, yearly, or daily.

- Automatic Transfers On the listed dates, the specified quantum is redeemed from your source fund. Investment in Destination Fund The redeemed plutocrat is used to buy units in your destination fund. To know the in depth detailed about STP click here

Benefits of Using a Systematic Transfer Plan (STP)

An STP offers several advantages for investors, especially newcomers:

- Rupee-Cost Averaging By regularly investing a fixed quantum, you buy further units when the request is low and smaller units when it is high. Over time, this strategy pars out your cost per unit and can ameliorate returns.

- Chastened Investing An STP runs automatically, removing feelings from your investment opinions. Once you set it up, you continue investing constantly, regardless of requests and campaigns.

- Threat operation. An STP helps you gradationally shift finances. For illustration, you can move Plutocrat from unsafe investments like equity finances to safer bones like debt finances as you approach your fiscal pretensions.

- Inflexibility STPs offer great inflexibility. You can adapt the transfer quantum and frequency to fit your budget and threat appetite.

Examples of Using Systematic Transfer Plan (STP) in India

Then are some common ways STPs are used in India:

- Equity to Debt STP Some finances may charge an exit cargo if you redeem units too soon. Always check this before setting up your STP.

- Debt to Equity STP Start by parking your finances in a low-riskt debt fund. Also, transfer them gradationally into an equity fund to make wealth over the long term.

- Balanced Approach Maintain a balanced portfolio by transferring finances from a debt fund to an equity fund yearly. This ensures a steady blend of threat and return.

Things to Consider Before Starting an Systematic Transfer Plan (STP)

While an STP offers multitudinous benefits, there are some effects to keep in mind:

- When using a Systematic Transfer Plan(STP), there are many important points to keep in mind. To begin with, check for any exit cargo. Some source finances may charge a figure if you redeem your units within a certain period. Thus, it is important to factor this cost into your decision before starting an STP.

- Next, consider your investment horizon. STPs generally work well for long-term ambitions.. This is because the benefit of rupee-cost averaging becomes more effective over longer ages.

- Incipiently, make it a habit to review your STP regularly. This helps ensure that it still matches your fiscal pretensions and threat tolerance. However, you can make adaptations to stay on track if demanded.

Conclusion

A Systematic Transfer Plan(STP) is a useful tool for both newcomers and educated investors. Firstly, it helps you invest in a more disciplined way. Rather of putting a large quantum of plutocrat into the request each at once, you transfer a fixed quantum regularly from one fund to another. As a result, you can manage threats more effectively. Also, STPs can help you take advantage of request ups and camp. Over time, this strategy may lead to better returns. By understanding how STPs work and knowing their benefits, you can make smarter investment choices. In the end, this can help you feel more confident and reach your fiscal goals more fluently.