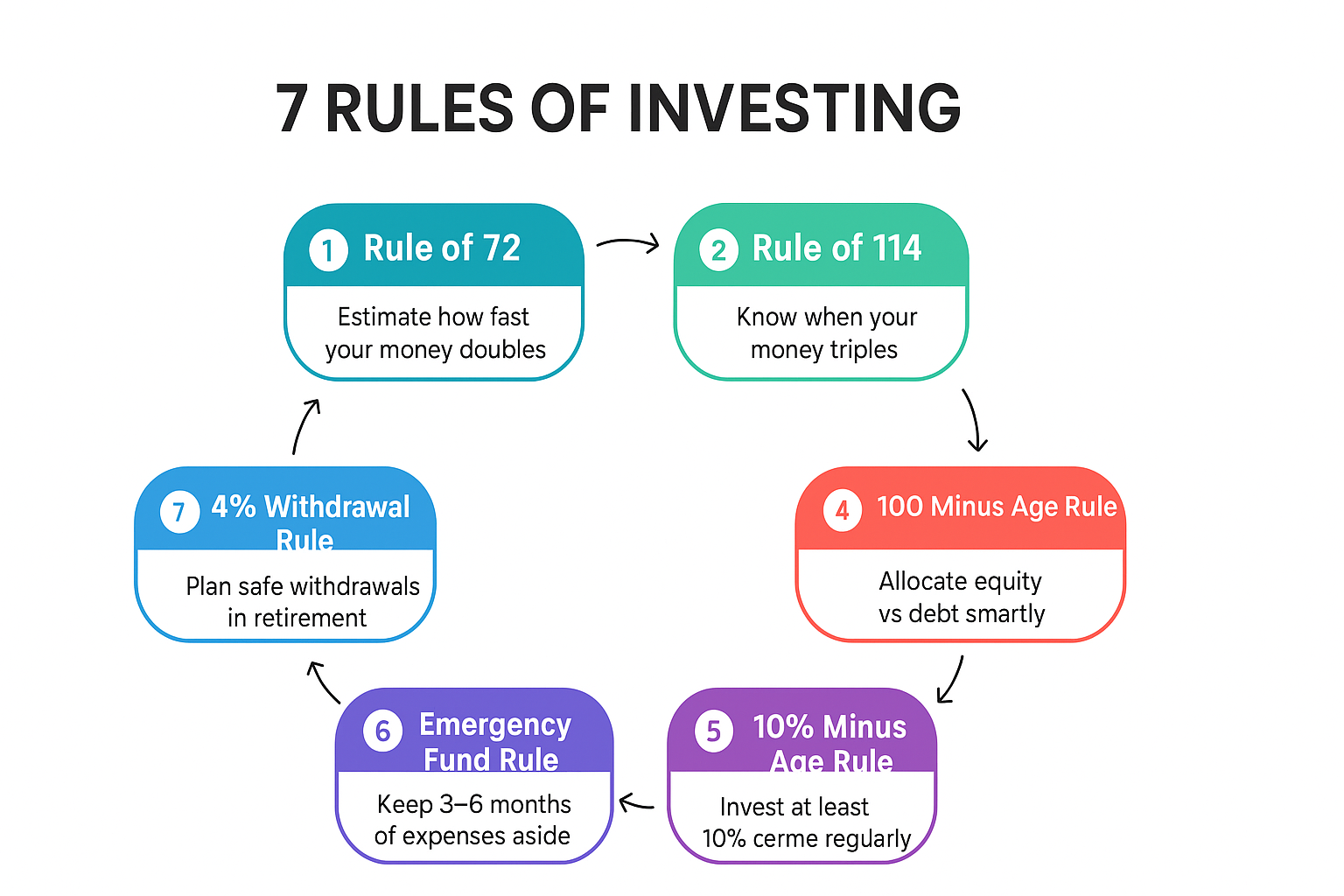

7 Rules of Investing in Mutual Funds Every Investor Should Know

When it comes to money, we all want simple answers. But financial markets are complex, and it’s easy to feel lost in numbers, products, and jargon. This is where rules of investing come in handy. A thumb rule is not a strict law, but a guiding principle, a simple formula or idea that helps you make smarter decisions. From cricket to cooking, thumb rules exist everywhere. And when it comes to investing in mutual funds, these rules can provide clarity, discipline, and direction.

At Nemi Wealth, we believe investing doesn’t have to be complicated. With the right framework, even beginners can build strong, long-term portfolios. In this article, we’ll break down the 7 most powerful thumb rules of investing – with examples, scenarios, and practical tips.

Why Do We Need Thumb Rules in Investing?

- Clarity: They simplify financial decisions.

- Direction: They provide benchmarks for savings, asset allocation, and withdrawals.

- Discipline: They stop you from acting on impulse and bring structure to your financial plan.

- Awareness: They remind you of risks, timelines, and realistic returns.

Remember, thumb rules are guidelines, not guarantees. They should be adapted to your age, income, risk appetite, and financial goals.

Now, let’s explore the seven thumb rules every investor should know.

1. The Rule of 72 – Doubling Your Money

We all want to know: How long will it take for my investment to double? The Rule of 72 gives a quick answer.

Formula:Years to double = 72 ÷ Rate of Return

Example:

If you invest ₹1,00,000 at 6% annual return,72 ÷ 6 = 12 years

So, your money will double in 12 years.

If you increase the return to 12%,72 ÷ 12 = 6 years

Now your money doubles in just 6 years.

Key takeaway: The higher the return, the faster your money doubles – but higher returns usually come with higher risk.

2. The Rule of 114 – Tripling Your Money

Once you understand doubling, the next logical step is tripling.

Formula:Years to triple = 114 ÷ Rate of Return

Example:

If you invest ₹1,00,000 at 6% annual return,114 ÷ 6 = 19 years

Your investment will become ₹3,00,000 in 19 years.

At 12% return,114 ÷ 12 = 9.5 years

Key takeaway: Patience plays a huge role in wealth creation. Even modest returns, when compounded, grow meaningfully over time.

3. The Rule of 144 – Quadrupling Your Money

If you want to know when your investment will become 4 times, the Rule of 144 is your friend.

Formula:Years to quadruple = 144 ÷ Rate of Return

Example:

At 6% return:144 ÷ 6 = 24 years – ₹1,00,000 grows to ₹4,00,000 in 24 years.

At 12% return:144 ÷ 12 = 12 years

Key takeaway: The power of compounding is exponential. The earlier you start, the greater your long-term wealth.

4. The 100 Minus Age Rule – Asset Allocation

How much of your money should go into equities (mutual funds, stocks) and how much into debt (FDs, bonds)? The 100 minus age rule gives a quick allocation formula.

Formula:Equity Allocation (%) = 100 – Your Age

Example:

- If you are 25 years old – 100 – 25 = 75% in equity, 25% in debt.

- If you are 40 years old – 100 – 40 = 60% in equity, 40% in debt.

Key takeaway: Younger investors should take more equity exposure because they have time to recover from market volatility. Older investors should shift to safer assets.

5. The 10% Investment Rule – Start Small, Grow Big

The most common excuse for not investing is “I don’t have enough money.” But the 10% rule says: Start by investing at least 10% of your income every month.

Example:

If your salary is ₹50,000, invest ₹5,000 monthly. As your income rises, increase your SIPs by 10% each year.

Over time, this disciplined approach creates wealth without feeling like a burden.

Key takeaway: Don’t wait to earn more before investing. Start small, start now.

6. The Emergency Fund Rule – Always Be Prepared

Before you invest aggressively, you need a safety net. The Emergency Fund Rule suggests keeping 3–6 months of expenses in liquid form (savings account, liquid mutual funds, etc.).

Example:

If your monthly expenses are ₹40,000,

You should keep between ₹1,20,000 – ₹2,40,000 as emergency funds.

Key takeaway: An emergency fund protects you from dipping into your investments during a crisis.

7. The 4% Withdrawal Rule – Retirement Planning

How much can you safely withdraw from your retirement fund without running out of money? The 4% rule suggests withdrawing only 4% of your retirement corpus each year.

Example:

If your retirement corpus is ₹1 crore,

You can withdraw ₹4 lakh per year (₹33,000/month).

This helps your money last through retirement while adjusting for inflation.

Key takeaway: A disciplined withdrawal strategy ensures financial independence in retirement.

Bonus: The 50-30-20 Rule of Money Management

While not directly about mutual funds, this is a universal budgeting thumb rule.

- 50% of income – Needs (rent, bills, groceries)

- 30% – Wants (lifestyle, leisure)

- 20% – Savings & Investments

This rule ensures you live comfortably today while saving enough for tomorrow.

Putting It All Together

Imagine a 25-year-old earning ₹50,000 per month who applies these rules:

- Saves 10% = ₹5,000 in SIPs.

- Keeps ₹1.5 lakh as emergency fund.

- Allocates 75% in equity mutual funds, 25% in debt.

- Understands money will double in ~6 years at 12% return.

- Plans for retirement with the 4% rule in mind.

By following these simple thumb rules, this investor is already on track to build long-term wealth.

Frequently Asked Questions (FAQs)

Q1: What is the 5% rule in investing?

It means you shouldn’t put more than 5% of your portfolio in a single stock or fund. This ensures diversification.

Q2: How much should I invest in mutual funds every month?

At least 20% of your income should go into investments. Start with SIPs and increase yearly as your salary grows.

Q3: What are the 3 golden rules of investing?

- Start early

- Be consistent

- Seek professional advice

Final Thoughts

Thumb rules are not perfect formulas but they are practical tools to simplify decision-making. They help you stay disciplined, avoid mistakes, and stick to long-term goals.

At Nemi Wealth, we always remind investors:

- Start early, even if the amount is small.

- Stay consistent, even when markets fluctuate.

- Seek guidance, because every investor’s journey is unique.

The best investment you can make is in your financial discipline. Thumb rules are just the starting point the real success comes from planning, patience, and persistence.